How proper diversification benefits your portfolio?

What is diversification?

As per Harry Markowitz - The father of Modern Portfolio theory, diversification is the only "free lunch" in finance world. This notion that you’d get something for nothing is nearly unheard of in economics. He was the first to demonstrate that diversification can deliver improved performance and lessened risk relative to individual asset classes.

The key concept behind the “free lunch” is correlation—or rather, a lack of it. Typically, the performance of individual asset classes isn’t perfectly correlated. Asset classes which don’t typically move up or down in the same direction at the same time are said to be negatively correlated. Eg. Equity and Debt are negatively correlated to interest rates in the economy. Lower interest rates are good for borrowers as they can purchase assets at cheaper interest cost. Hence they are good for business/stocks. However, it is bad for debt holders as the FDs will fetch lower returns.

Diversification is spreading one’s investments to protect against unexpected/ unpredictable events.

What is an unpredictable event?

Unpredictable events can be witnessed across various levels. It can happen at a corporate level or an overall industry level. This can also go to the extent of the entire country!!

1. Company – Proper governance is required to facilitate effective and good management of the organization. Investors can’t truly rely on the financial numbers reported if their governance is in question. This makes their investment decisions extremely difficult. We learnt this from the downfall of big giants like CG Power, Satyam, Talawalkars, Enron and many more. Investments in these companies got wiped out on account of poor governance. So, to secure your money from events as such we advise for diversification of your investments.

2. Industry – It covers wide ranging factors that involve the whole sector or industry in question. Factors like environment, social, govt regulations, transitions, cyclical nature etc. are the key events that might cause the damage. It can change the risk profile of an industry dramatically. This can be well explained with the current situation of the auto sector. Once auto sector was the darling of investment managers. Now due to combined effect of some of the above mentioned factors, it became a risky bet for them. Following combined factors led to a dramatic change in its risk profile:

a. Government increased mandatory insurance period from 1- 3 years

b. Transition from Bharat Stage IV to Bharat Stage VI

c. Change in taxation due to GST

d. Transition from Internal Combustion Engine to Electrical vehicles by 2025-2030

No wonder, many people are now predicting the collapse of the Indian Auto Industry.

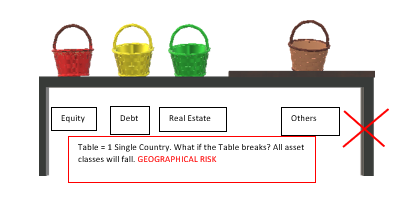

3. Country – It is considered critical when investing in a developing or underdeveloped nation. Factors like political unrest, economic growth, technological influences, exchange rate, etc comes into play to explain the risk exposure at the country level. Venezuela, Zimbabwe are two countries which immediately come to mind when one talks about hyperinflation. At its height (Q4 2018) the value of the Venezuelan currency was depreciating against the dollar by 90% within 5-6 months.

Issue with country risk is across all asset classes. Every asset class gets beaten down in this scenario. The only way to protect against this risk is to diversify in other high performing countries.

Case Study I - Rise of Japan post WW II

Post the devastation of nuclear attacks on Hiroshima and Nagasaki, Japanese economy rose like a phoenix from its ashes. Nikkei the stock market index reflecting the prosperity, grew from 100 to 2500 in 40 years (25X). Whereas on the other hand, US Dow Jones rose from 200 to 2900 in this period, roughly 14.5X. So, Japan had out down US by nearly 72%. Therefore, $100 invested in both countries in 1970 would have become $2500 in Japan and $1450 in US.

But even this long period of 40 years could not prepare an investor for what was to unfold in the coming 2 decades.

What would have happened if one had just stayed with the past performance? They would have continued to invest in the Japanese stock market over the US market. Therefore, incurring huge losses as shown below:Japan – The Lost Score

Following the collapse of the Asset price bubble in early 1992, the two decades of deflation that followed (90’s) is often referred as “The Lost Score” (lost 20 years). In nominal terms the GDP fell from $5.33 Trillion to $4.36T.

From the peak in Jan 1990 of 38K, Nikkei (Japanese Equity index) was struggling at 14K by the end of 2000. But Dow Jones moved up sharply from 2600 to 10900 in the same period.

Talking in numbers, a $100 invested in each region would have become $36 in Japan and a whopping $ 419 in US. More than 11x out-performance by the US as compared to Japan.

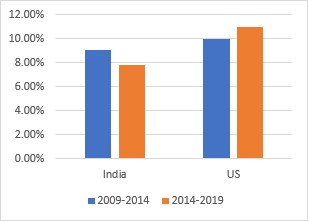

Though there have been multiple reasons attributed to this. However, the fact remains no one has a crystal ball and hindsight is always 20/20. Therefore, it is advisable to invest across geographies as they are expected to do reasonably well in the long term. One might feel overconfident about the prospects of home country. But it is better to be safe than sorry.

Source - Charles Schwab & Co., Inc.

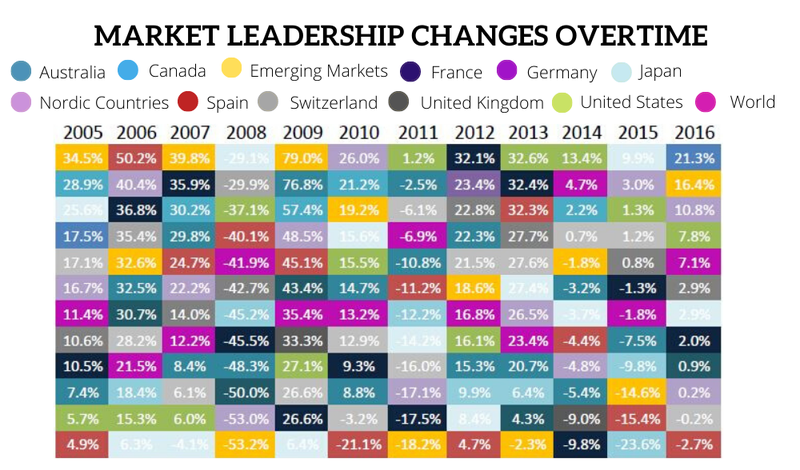

Case Study II: Spread risks by buying a basket of Developed economy stocks

Scenario 1: All in Indian Equity (BSE Sensex Sept’14 26600 yielded CAG 7.8% with Sept’19 at 38823)

Scenario 2: All in US Equity would have yielded 11% (Dow Jones moved from 16000 to 27000).

BSE Sensex v/s Dow Jones Equity Returns

As we can see in the above graph, both the markets gave similar returns for the period 2009-2014. But, US market outperformed for the period 2014-2019.

Also, if we consider currency depreciation of about 4%, the US market outperformed in the whole period. There are many more studies like this which proves the same point. We can gain more by diversifying across economies.

What do we get by diversification?

The idea behind diversification is to create a portfolio with assets which are not correlated. Asset allocation should be in such a way that we can reduce the risk and pump up the returns. We consider risk and returns to be the most important parameters when planning a long-term investment. Following basic principles of diversification enables us to create a portfolio with lower risk and higher return potential:

- Asset Allocation: diversification among the asset classes, majorly debt, equity and real estate. The allocation is according to the risk profile and investment goals.

- Sector Diversification: diversification across several industries like Financials, Basic Material, Energy, Technology.

- Geographical Diversification: diversification across various economies all over the world (e.g. Indian equity market and non-Indian market).

- Securities Diversification: diversification across the securities in a way that no single security contributes to more than 5% of the folio.

- Product Diversification: diversification across products like Mutual Funds, Portfolio Management Services (PMS), Peer-to-Peer lending (P2P), Alternate Investment Funds (AIFs), Real Estate Investment Funds (REITs) etc.

Diversification is not limited to just these types. Within the same asset class, it can be further bifurcated. To give an example, within equity we can classify among large, mid and small cap. You will find too many funds even within the three categories. And many other classifications based the on similar parameters.

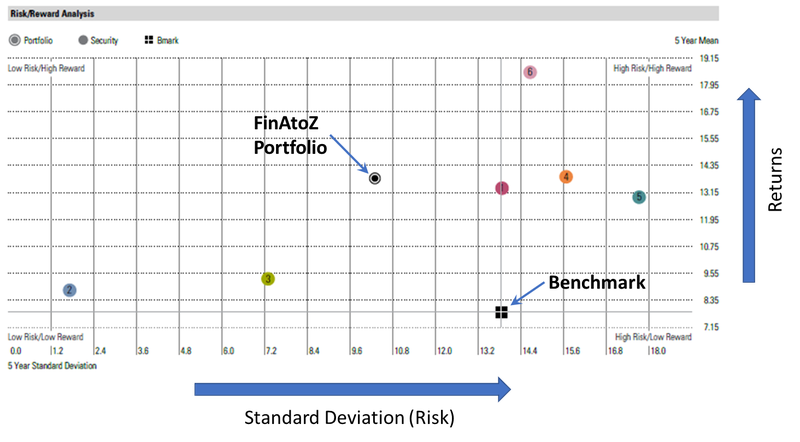

How we create portfolios @FinAtoZ

Basic objective at FinAtoZ is to create a portfolio which has lesser risk and better performance as compared to the chosen benchmark. The portfolio should also be objective and track-able. Let us show you one such portfolio where we have reduced the risk but at the same time, enhanced the returns:

In the image above, we have plotted the risk-reward scatter plot for 5 years. We can see that our portfolio risk is about 25% less than that of the benchmark (S&P BSE 500). But the returns are 76% more than the benchmark. The other unmarked co-ordinates are the individual funds having their risk and return profile. Investments are allocated in such a way that we reap the benefits from both the sides. We get to lower our risk plus increase our returns. Thus, gaining extra alpha from our research.

Click here to know more about how we select funds in FinAtoZ.

To summarize, it makes a lot of sense to enjoy the only free lunch available in finance world. We advise you to put your best efforts to diversify your portfolio. However, keep in mind that diversification should be optimum. Over or under diversification is not a good sign for your portfolio. Remember, diversification has multiple facets. You need to diversify into various asset classes like equity, debt, real estate and gold. You also need to diversify into various types of equities like large-cap, mid-cap, sector and international equity. Further, also look to diversify into various products like mutual funds, peer-to-peer lending, portfolio management service, alternate investment funds, real estate investment trusts, gold ETFs etc.

Happy Investing!

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment