Investment strategy when the stock market corrects

Are you a seasoned investor or just getting started in the stock market? Either way, it's important to understand how market corrections can affect your investment strategy. A market correction is a temporary decline in the overall value of the stock market, and it's often driven by a variety of factors, including economic conditions, political instability, or global events.

When the market corrects, it's easy to let your emotions take over and make hasty investment decisions. But as a savvy investor, you know that making emotional decisions can be a recipe for disaster. Instead, take a deep breath and consider the following strategies to help you weather the storm:

First and foremost, stay calm and remember that market corrections are a normal part of the market cycle. Don't let fear drive your investment decisions.

Consider purchasing high-quality stocks that have been undervalued by the market. This can be a great opportunity to buy stocks at a discount.

Investing in exchange-traded funds (ETFs) or mutual funds that have exposure to the areas of the market that you believe will rebound strongly after the correction is another smart strategy.

Rebalancing your portfolio is important during a market correction. If your portfolio was heavily invested in equities and the market correction caused your holdings to drop significantly, consider selling some equities and investing in other asset classes, such as Debt market or real estate.

Diversification is key to managing risk. Make sure your portfolio is well-diversified across different asset classes, sectors, and geographic regions. This can help mitigate the impact of a market correction on your portfolio.

Finally, remember that investing is a long-term game. Market corrections are a natural part of the market cycle, and over the long term, the stock market tends to go up. Stay focused on your long-term goals and stick to your investment plan.

Learning from past market corrections:-

Here are some examples of stock market corrections that have occurred in the past:

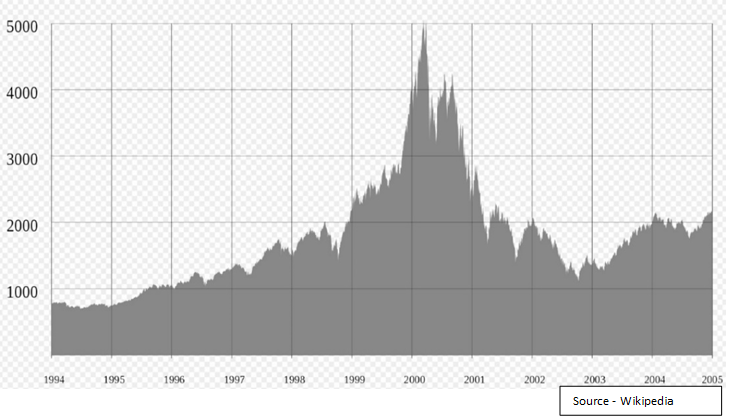

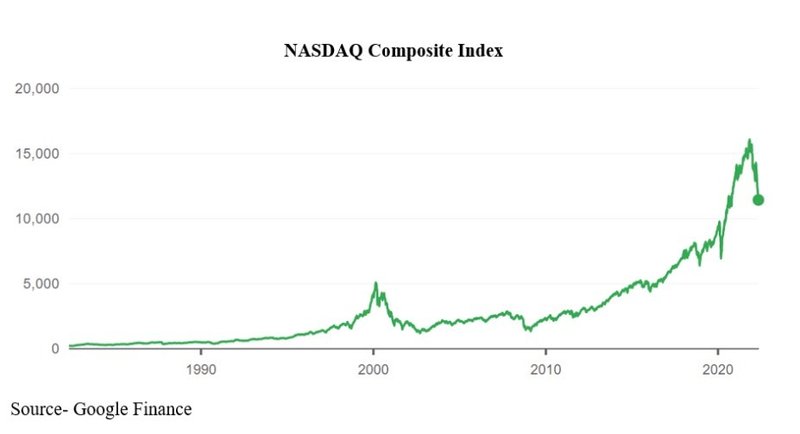

- Dot-com bubble (2000-2002): During the late 1990s, the technology sector experienced a speculative bubble that eventually burst in March 2000. The Nasdaq Composite Index, which is heavily weighted towards technology stocks, fell from a high of 5,132 in March 2000 to a low of 1,114 in October 2002 - a decline of nearly 80%.

- COVID-19 pandemic (2020): The COVID-19 pandemic caused significant market volatility and a steep decline in global stock markets. In March 2020 NASDAQ 100 Index was trading at the price of 7,000 & in January 2022 It was trading at the price of 16,500.

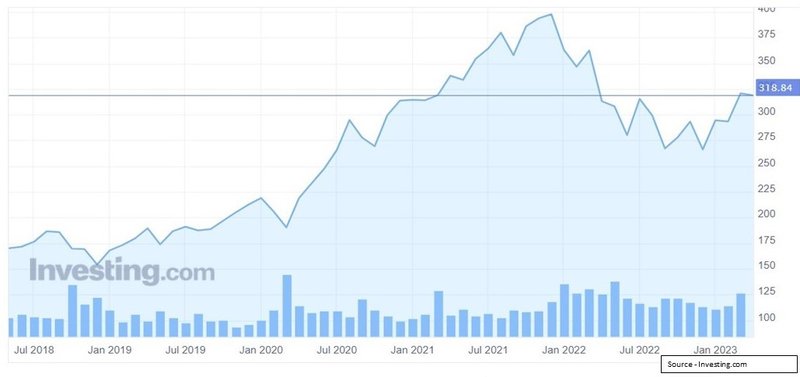

Lets see the journey of an ETF (Invesco QQQ Trust (QQQ) of last 5 years :-

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index, which is made up of 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

- As of January 2018, the QQQ was trading at $160 and price in February 2020 was $220.

- As of January,2022, the QQQ has delivered a very good return since the market low on March 23, 2020. This outperformed the S&P 500 index as well.

- The price of the QQQ In March 2020 was at $169 and in January 2022 It was trading at around $400.

- Due to Russia-Ukrain war in January 2022 market started falling and it affected the performance of this ETF as well. There was a huge correcting in market and from the level of $400 It was trading below $275 In December 2022 but since then market is seeing some recovery and ETF is also trading at $318 as on 17th April 2023.

Point of action from Investor’s perspective during market correction:-

- it's important to stay calm and avoid making emotional decisions. Avoid selling your investments in a panic, as this may cause you to miss out on potential gains when the market recovers.

- Use it as an opportunity to reassess your portfolio and make sure it aligns with your long-term goals and risk tolerance. Consider rebalancing your portfolio if necessary to ensure it remains diversified and aligned with your long term & short term financial goals.

- Market corrections can create buying opportunities for long-term investors. If you have a long-term investment horizon, continue to invest regularly through a systematic investment plan (SIP) for rupee-cost averaging. This allows you to take advantage of the market's fluctuations and potentially buy more units at lower prices. To know more about it click here

- Seek Professional Advice: If you're unsure about how to navigate a market correction, consider seeking the advice of a financial advisor. A professional can help you evaluate your portfolio, assess your risk tolerance, and develop a long-term investment strategy. To know more about it click here

Here is a takeaway :-

One of the key lessons from market corrections is that markets are remarkably resilient. Even after significant market declines, they have always rebounded and continued to grow over the long term.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment