Why staying invested for the long term is key to success in the market?

Th most common thing we hear from our clients is how about if we always invest in a deep bear market and book profits in a strong bull market. The following points should be considered before dwelling further:

1) Whether is this possible? Yes, one can make a one-time profit or loss in short term. However, one cannot create long term wealth with this approach.

2) Is this even a strategy? Definitely No. To tide over the market, one needs a strategy to create long term wealth, that can be replicated consistently over different time periods.

Now let’s elaborate on both the above questions. In this article, we will try to understand why timing the market is next to impossible for anyone and what one should do to get good investing experience in the long term. We will take few major events of the recent past and quantitative analysis, to understand this thing better.

Major events of the recent past:-

1) Demonetization-

Demonetisation means an act of stripping the legal tender status of currency units. It happens whenever there is a change in any national currency. It involves the withdrawal of the current form or forms of money from being circulated usually replaced with new notes or coins. Seldom, a country entirely replaces the old currency with a new currency.

This was the time when all the investors got panicked and assumed that the market is going to correct by at least 20%. There were enough reasons to believe that the market is going to fall, few of them were:

1. There was a mismatch between the demand and supply.

2. MSME was going to suffer.

3. Challenge the 'status quo' of the sector and render the business environment adverse for non-compliant unorganized players.

4. Impact on the GDP of the country

But the reality was quite different Sensex on 7th Nov 2016 was 27458 and exact after 6 months on 9th May 2017 it was at 29926 there was a surge of 8.98% in 6 months. The investors who pulled out their money missed the opportunity to create long term wealth.

2) Covid-19

March 2020 was much worse. There were ample reasons to pull out money from the markets. Lockdowns, uncertain future, no visibility of vaccine and so on. Unfortunately, many retail investors booked huge losses; some even stopped their SIPs as well.

However, against all expectations, markets bounced and gave higher double-digit returns in the next 1yr.

3) Quantitative Analysis:

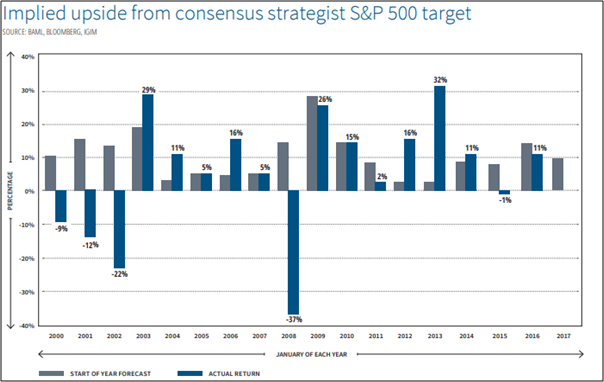

Is timing the market is possible based on the expert opinion?

The above chart captures the implied forecast for the S&P 500 index returns over the past 17 years along with the actual returns. As you can see in the years 2000, 2001, 2002 and 2008, the prediction was highly optimistic, but the reality was different. Likewise, in most other instances, you can see that prediction and the actual numbers were different. So, we can conclude that the entire effort of trying to time the market based on experts' opinions and consensus estimates is hardly likely to improve your performance.

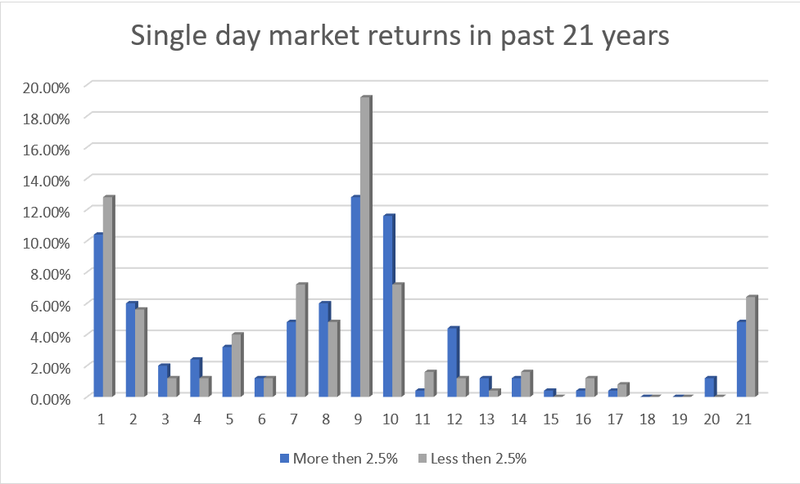

So, we have seen that timing the markets is next to impossible in the above-mentioned points. And now let us see what is the real cost of trying to time the market. The below chart captures the Sensex returns over the past 20 years from 2000 to 2020. It captures more than and less than 2.5 % single-day returns of Sensex.

Over 5-20 years, there will be days when the markets will either spurt sharply or correct sharply. In the process of timing the market, it is very possible that we can miss out on few such days. Staying out of the market during these days, makes a long term portfolio underperform the index !! So, this is what happens when you try to time the market.

So, if the above approach will not work, then how can we create long term wealth? If we cannot time the market, what is the solution available for us?

There are many variables, external as well as internal like liquidity, earnings, GDP, etc which are affecting the markets. Unfortunately, investors cannot control these variables. But, the good news is that we have something called “asset allocation and rebalancing” which are far more in control of an investor, than uncontrollable variables. And hence, rather than thinking like a speculator, one should think like a long-term investor and follow the below-motioned strategies for creating long term wealth:-

1) Asset Allocation- Stick to your asset allocation for the long term. It helps in diversifying your portfolio among various asset classes like domestic equity, international equity, gold, fixed deposits, and real estate. To know more about Asset Allocation click here.

Proper asset allocation also helps us in managing the downside of the overall portfolio as well. We should do asset allocation as per our goals. For the short term goals, money should be parked in the debt instrument and for the long term goals (which are at least 5 years away), money should be invested in the equity instruments.

2) Rebalancing is a scientific way of booking profits and entering the markets at low. It should be done on a half-yearly basis and instances when there is some big change either, in the market or, in your personal circumstances. Rebalancing, bring your portfolio back on track to your original asset allocation. To know more click here.

Conclusion:

As discussed there is evidence that suggests that the time you invest in the market is more important than timing the market. Additionally, the historical performance of SENSEX shows that there are more instances of positive upward movements in the market than negative downward movements. So, ignore the daily ups and downs, follow proper asset allocation, rebalancing and stay invested for the long term.