How to reduce the impact of Long Term Captial Gains Tax?

In personal finance, a significant change announced in the Union Budget 2018-19 was the reintroduction of Long-Term Capital Gains Tax, imposing a 10% tax on gains from selling shares held for over a year. This tax rate increased to 12.5% following the Union Budget 2024 -2025.

For more details on how long-term capital gains will be calculated, please refer to this article.

In this article lets us have a look at the various options available to a long-term investor to best handle this new reality of LTCG.

Option1: Need to replan your savings plan

We do savings to achieve our long-term goals like child education and retirement. And this requires to create a financial plan and estimate the expected long-term returns. Since now the expected long-term returns will reduce by 12.5%, one has to increase the amount of investments to reach the earlier goal amount. This means we should increase our SIPs by approx. 12.5% to nullify the effect of 12.5% tax on LTCG.

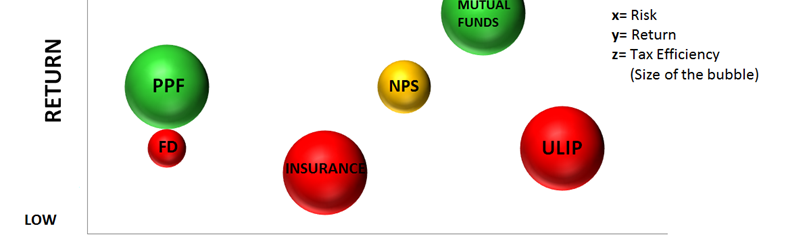

Option2: Choose the right investment

With the imposition of 12.5%, LTCG tax one should not believe that she should not invest in equities now. As compared to other asset classes like gold, debt and real estate, 12.5% tax on long-term equities is still the least of all asset classes. So, we strongly suggest that one should choose equity mutual funds for achieving the long-term goals. However, you should select the right type of mutual funds. For example, with the introduction of Dividend distribution tax, it is advisable to go for Growth option in Mutual funds, instead of Dividend option. Also, one should track the markets for the launch of new products from mutual funds which will be more tax efficient.

Option3: Partial withdrawals of fund to maximise 1.25 Lakh exemption in LTCG

Since, Rs 1.25 lakh of Long-term gains are tax-free every year, at the end of every year, we can actually sell investments that would generate that much returns and immediately repurchase them. Though this may look a bit trivial things, but this can effectively save you Rs 15,625 every year. Hence, on a periodic basis, one should take advantage of the given exemption.

This also means that the closed-ended funds and ELSS will not have this flexibility of selling units pertaining to 1.25 lakh capital gains every year. However, this exercise of selling units corresponding to 1.25 lakh gains can be done for ELSS once, in every 3yrs.

Option 4: Leverage Income Tax Slabs Below ₹5 Lakhs

If you are a Resident Indian and your income falls within the tax slabs below ₹5 lakhs, capital gains can be significantly reduced. In such cases, planning your withdrawals and aligning them with your overall income can help minimize or even eliminate the LTCG tax burden. This strategy is particularly beneficial for those with lower taxable income.

Click here to read more about this

Option 5: Delay Redemption as Much as Possible

Delaying the redemption of your investments can defer the tax payment, allowing your investments to compound further. By postponing the realization of capital gains, you can potentially pay tax on a much larger amount later. This strategy works well if you don't need the funds immediately and prefer to let your investments grow for a longer period.

To summarise, long-term investments in equity markets is still the best way to achieve the long-term goals. However, one needs to be more diligent and has to take some periodic actions to make the best out of the given scenario. Also, there is a case to increase the monthly investments towards your long-term goals to achieve them.

Book a consultation with the Certified Financial advisor Click Here

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment