Retirement Planning - Delay is costly!

“Retirement...what the heck?”. “I am just 30 now. Why should I worry about Retirement?” exclaimed Rajan! Rajan was furious with his friend Raghu who was giving him an idea to start saving for Retirement goal.

Raghu, Ram & Rajan are college friends. All are 30 years of age and work in an MNC in Bangalore with handsome package of Rs 1.5 Lacs/month. They were having this conversation over a Dinner table.

Raghu: Hey guys I am thinking to start saving for retirement. I just came across Finatoz retirement calculator and found that we all will need around 10 Crore at the time of retirement.

Ram: Don’t you think that this is the first year of our happily married job life and we should wait for at least some-time to start saving for retirement. I will probably start after 2-3 years.

Rajan: How both of you can be so boring? This is really too early and I will enjoy my life fully for next 5 to 10 years. Only after that I will think of saving for retirement.

Who amongst them is right?

To find the answer; let’s do a simple math for each one of them.

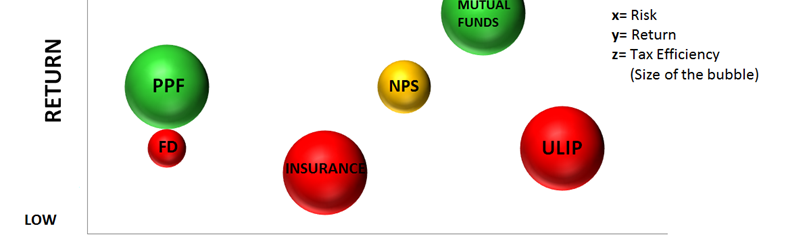

Let’s assume that all three decided to invest in diversified equity mutual funds with expected returns of 12%.

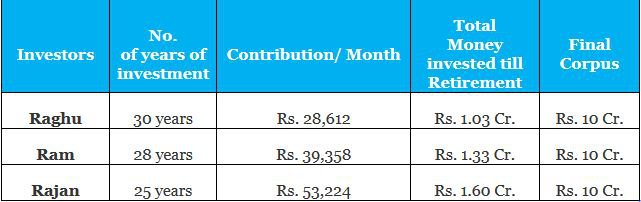

However, Raghu starts investing right away, Ram starts investing after 2 years and Rajan starts investing after 5 years.

Let us summarize the key points of their individual journey:

- By starting two year late, Ram will have to invest Rs. 30 Lacs more as compared to Raghu to achieve same amount of corpus. Rajanwill have to invest Rs. 57 Lacs more to achieve the same amount.

- By deferring just 2 year for investment, Ramwill have to contribute 39% more monthly investment as compared to Raghu.For Rajan, it will be massive 86% more than Raghu’s per month contribution.

Why there is so much difference even if we delay the saving by just two years. Answer lies in harnessing the “Power of Compounding”.

Albert Einstein had said, “Compounding is the 8th wonder of the world”. Result is very much evident.

So at the end Raghu is the clear winner. By going the smart way (opting to invest right from start), he has made his financial journey lot easier.

Whereas Rajan by taking an easy way (opting to expend for first 5 years carelessly), makes his rest 25 years a lot more difficult.

Now it’s time for all of us to decide what we want to be- Raghu, Ram or Rajan.

" When you throw away time, you throw away money. Get started for your retirement now while you can."

Happy Investing!