Risk of investing in Real Estate!

"Real estate investment gives you high returns, great value and low risk”. In the past decade, a majority of Indians believed in this statement. As a result, we were not surprised to find that more than half of our customers had around 80% of their wealth invested in real estate. Though real estate investment is a good option in general, allocating such a high proportion of one’s hard earned savings to one asset class is a big risk. Let us see the main reasons why over allocation into real estate could be a risky proposition.

Risk No. 1: Low long term returns

Traditionally, it is a common belief that real estate investments gives great returns in the long run! However, if we look at the actual rate of return, we find that a significant part of the return goes into expenses like interest on home loan, maintenance, registration, electricity and miscellaneous costs. So, after deducting these costs one may realize that the actual annualized returns are much lesser than what was earlier thought of. Even if we ignore all these costs, the annualized returns in real estate do not look as great. They barely beat inflation as has been shown by taking a simple example below.

Let us consider, Mr. Raghu bought a flat for 40 Lakh in 2006, and sold it for 1 Crore in 2016. He is very excited that the sale value is 2.5 times that of the purchase value.

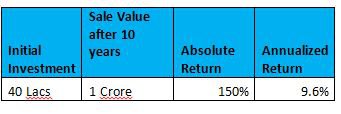

Now let us see, how much Mr. Raghu has actually earned. The below table shows the comparison.

The actual return on this investment is just 9.6 percent per annum. If we add other costs like interest on housing loan, registration etc. the annualized returns will be reduced by around 1% to 2%. These returns hardly beat inflation which was around 8% during this period.

Risk No. 2: High Maintenance costs

The cost of maintaining real estate can be pretty high. There is property taxes, brokerage, repairs, and other costs that needs to be met on a regular basis. Moreover, if the property is rented out then it may consume a significant amount of one’s time to manage the tenant. There can also be periods when the property is vacant and not earning any rent. As a result the returns can be much lower than what is anticipated for.

Apart from the monetary aspects, there are issues of managing the property. One has to take a lot of headache in maintaining a real estate investment. They require regular upkeep and must be rehabbed, maintained, and managed on a continual basis.

Risk No. 3: Low rental yields

Most of us plan to buy one more house as an investment and create an additional source of income from the rents. If it is so then we should definitely evaluate the yield on the investment.

For instance, Let us consider a flat in Bangalore, which costs Rs. 80 Lakhs could fetch rent of up to Rs 20,000 a month. That means, this investment is generating an annual income of Rs. 2.4 Lakh (20K *12) as rent. Now if we calculate the rental yield, it is around 3% ([2.4L / 80L]*100), which is pretty low.

Low rental yields of around 2-3% which is less than the post-tax FD returns can be a significant risk.

Risk No. 4: Problem of liquidity

Real Estate investment by its very nature is non-liquid in nature. There’s no ready market to sell this investment whenever required. Lack of buyers is not a rare phenomenon for real estate investors. Market is full of stories where one had to sell his real estate investment at a significant discount to the expected price. This is because he needed money in a short span of time and couldn’t find a buyer who could pay the market price. This risk is further compounded by the fact that currently is no regulatory body which can monitor the real estate prices. Supply is primarily controlled by the real estate builders and their nexus with politicians.

It is a significant risk, if one needs money at a short notice and he has skewed allocation towards real estate as an asset class.

Risk No. 5: Legal Issues

Real estate ownership is inherently of very high emotional value. Most of the land parcels which are developed by the real estate developers were previously held by multiple owners of one or many related families. There is always a risk of some family member not being consented properly for the sale of the property to the other party. There are also instances of people claiming the right of ownership of property even after they have made a conscious sale because of high emotional value. Then there are other instances of illegal occupation, forgery of documents, pending litigations etc.

Indian laws are framed in such a way that the property buyer is expected to do a thorough due diligence before entering into a sale agreement with the seller. Even if one consults a good lawyer and does all necessary checks, there is still a chance that the property being bought can come under some sort of litigation in the time to come. Luck plays a major factor as far as mitigation of this risk is concerned. Hence, this factor is one of the significant risks which needs to be considered before buying a property for long term investment purposes.

Conclusion:

It is clear that there are some significant risks of investing in real estate. At the same time it is also important to understand that real estate investments are an important part of one’s asset allocation. Real estate investment has traditionally given higher than inflation returns and is less volatile than other growth assets like stock markets or mutual funds. Hence some part of your growth asset allocation should go into real estate. However, over allocation of your investments to real estate needs to be avoided.

In general, you can plan for around 30% allocation of your long term investment into real estate. Higher allocation than this might increase your risk substantially. Wise men say “Don’t put all your eggs in one basket”. So, you should have a mix of assets in your portfolio which can include real estate, equity, gold and bonds. Diversification will not only reduce your investment risk substantially but will also help you to increase liquidity to your portfolio.

In the end, our two cents are as follows: Construct a properly diversified portfolio with the help of your certified financial adviser.

Invest right! Invest for Long Term! Live a peaceful life!!

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment