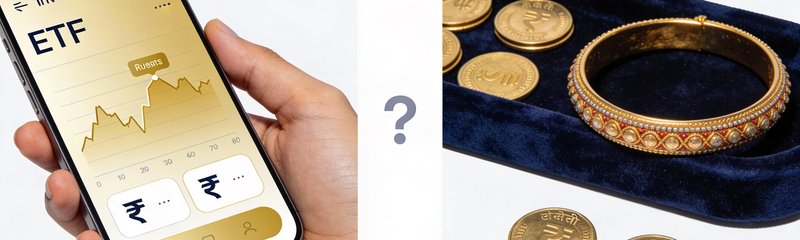

Gold ETFs vs Physical Gold: Which One for You?

Gold ETFs and physical gold are two popular ways to invest in gold in India. While physical gold offers emotional value, Gold ETFs provide liquidity, transparency, and ease of trading. This guide helps investors choose the right gold investment based on their financial goals.

Continue reading »