What is the Sharpe Ratio in Mutual Funds? Meaning, Formula, and Calculation

The Sharpe ratio in mutual fund investing is a simple way to gauge how well a fund performs relative to its risk. Economist William F. Sharpe developed it and is widely used by investors to compare mutual funds more smartly.

Before investing in any fund, it’s important to look beyond returns. This is where understanding the Sharpe ratio in a mutual fund becomes useful. It helps you see whether the returns you earn are actually worth the risk you are taking.

So, what is the Sharpe ratio in simple terms?

The Sharpe Ratio shows the risk-adjusted return of a mutual fund. In other words, it tells you how much extra return a fund gives compared to a risk-free option like a fixed deposit, and how much risk it took to earn that return. This is the core meaning of the Sharpe ratio.

A higher Sharpe Ratio usually indicates better performance. It means the fund has delivered higher returns relative to the level of risk it has assumed. That’s why investors say the Sharpe ratio measures how efficiently a fund converts risk into returns.

Investors who are comfortable with market swings may prefer funds with a higher Sharpe Ratio. Conservative investors may choose lower risk even if returns are moderate. Later, we’ll also see the Sharpe ratio formula and how to calculate the Sharpe ratio step by step, so you can use it confidently while selecting mutual funds.

Sharpe Ratio Meaning: What Does It Actually Measure?

The Sharpe ratio measures risk-adjusted returns. It compares a fund’s return with the risk-free rate and adjusts it for volatility to measure risk-adjusted performance.

At its core, what is the Sharpe ratio doing? It measures the excess return a fund earns over a risk-free investment such as a Treasury bill or fixed deposit.

This extra return is known as the risk premium. The Sharpe Ratio indicates whether this premium is worth the risk it entails.

When comparing two funds in the same category, the Sharpe ratio in mutual fund investing helps mitigate bias arising from sector or strategy differences.

The ratio also considers volatility. If higher returns are accompanied by significant volatility, the Sharpe Ratio will reflect this.

The Sharpe ratio indicates greater consistency when returns are high and volatility is low.

Investors use it to determine whether returns resulted from effective fund management or from taking excessive risk.

The Sharpe Ratio is based on historical returns and volatility. It does not guarantee future performance and should not be used in isolation.

It is primarily used to evaluate past risk-adjusted performance and should be combined with other metrics when making investment decisions.

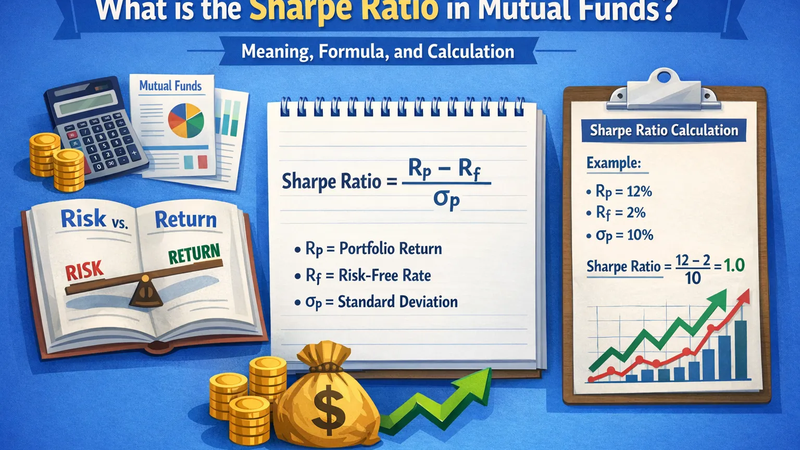

What is the Sharpe Ratio Formula

Sharpe Ratio = (Portfolio Return − Risk-Free Rate) ÷ Portfolio Standard Deviation

Formula Breakdown

Portfolio Return (Rₚ)

This is the return your mutual fund or investment earned over a period, usually one year. In the context of the Sharpe ratio in a mutual fund, this is the fund’s annual return.

Risk-Free Rate (R𝒻)

This is the return you could earn without taking any risk. Examples include fixed deposits or government bonds. It serves as the baseline return in the Sharpe ratio used in mutual fund calculations.

Standard Deviation (σₚ)

This indicates the extent to which the fund’s returns fluctuate. Higher fluctuation means higher risk. This is what the Sharpe ratio measures when it adjusts returns for volatility.

How to Read the Sharpe Ratio

- A higher Sharpe Ratio is better

- Sharpe Ratio above 1 is considered good

- Above 2 is very good

- Above 3 is excellent

However, these interpretations vary depending on the asset class and prevailing market conditions.

How to Calculate Sharpe Ratio (Step-by-Step Example)

Step 1: Find the average return of the investment

Start with the annual return of your mutual fund or portfolio.

For example:

Average portfolio return (Rₚ): 14%

This is the return on your investment delivered in one year. This step is crucial when calculating the Sharpe ratio in mutual fund analysis.

Step 2: Identify the risk-free rate

Next, note the return from a safe investment like a government bond or fixed deposit.

For example:

Risk-free rate (R𝒻): 5%

This represents the minimum return you could earn without taking any risk. This comparison is key to understanding the Sharpe ratio in mutual fund investing.

Step 3: Calculate excess return

Now subtract the risk-free rate from the portfolio return.

Excess return = 14% − 5% = 9%

This excess return is what the Sharpe ratio measures, the extra reward for taking risk.

Step 4: Find the standard deviation

The standard deviation indicates the extent to which the fund’s returns fluctuate.

For this example:

Standard deviation (σₚ): 12%

Higher volatility means higher risk.

Step 5: Apply the Sharpe Ratio formula

Now plug the numbers into the Sharpe ratio formula:

Sharpe Ratio = (Rₚ − R𝒻) ÷ σₚ

Sharpe Ratio = 9% ÷ 12% = 0.75

What does this result mean?

A Sharpe Ratio of 0.75 suggests moderate risk-adjusted returns.

Advantages and Limitations of the Sharpe Ratio

Advantages of the Sharpe Ratio

Helps Analyse Fund Performance

The Sharpe Ratio shows how well a fund has performed after adjusting for risk. It helps investors determine whether higher returns resulted from prudent investing or simply from greater volatility. This is the core meaning of the Sharpe ratio.

Makes Fund Comparison Easier

One of the biggest benefits is comparison. Beginners can compare Sharpe ratios across mutual fund schemes within the same category to identify which fund offers better risk-adjusted returns.

Shows Risk Taken for Returns Earned

The Sharpe Ratio clearly explains if the risk taken by a fund is justified by its returns. This is exactly what the Sharpe ratio measures.

Helps Investors Assess Risk Levels

Investors can use it before investing to understand risk. Existing investors can also review their holdings and switch funds if the Sharpe Ratio drops.

Useful for Portfolio Diversification

The ratio helps determine whether increasing funds can reduce risk. A higher Sharpe Ratio indicates better standalone risk-adjusted performance. However, diversification decisions should be evaluated based on how a new fund impacts the overall portfolio’s Sharpe Ratio.

Balances Risk and Return

A fund with slightly lower returns but stable performance may be better than a high-return fund with extreme volatility.

Limitations of the Sharpe Ratio

Assumes Normal Return Patterns

The Sharpe Ratio works best when returns follow a normal pattern. Some investment strategies with non-linear return patterns may not fit well within the Sharpe Ratio assumptions.

Can be Misleading in Rare-Event Strategies

Certain strategies exhibit small, steady gains but occasionally suffer large losses. Until that significant loss occurs, the Sharpe Ratio may appear very high and misleading.

Does not Capture Extreme Risks Well

Historical Sharpe Ratios cannot predict rare market crashes. Past stability does not always mean future safety.

Ignores Liquidity Risk

Funds that invest in illiquid assets may appear less volatile, thereby artificially improving the Sharpe Ratio. The Sharpe ratio formula does not account for this risk.

Because no single ratio captures the full picture, understanding the factors that shape investment decisions can help investors make more balanced choices beyond numerical indicators.

When Should Investors Use the Sharpe Ratio?

The Sharpe ratio in mutual fund investing is most useful when you want to look beyond raw returns and understand risk. It helps answer one simple question.

Are the returns worth the risk taken?

Here are the key situations in which using the Sharpe Ratio is appropriate.

Comparing Similar Mutual Funds

Use the Sharpe Ratio when comparing funds from the same category, such as large-cap, mid-cap, or debt funds. This helps you identify which fund offers better risk-adjusted returns. This is where what is sharpe ratio in a mutual fund becomes most valuable.

While the Sharpe Ratio helps compare funds, aligning investments with life goals is equally important. Read Objectives of Financial Planning to see how metrics fit into long-term planning.

Checking if High Returns are Worth the Risk

A fund may show high returns, but those returns could be driven by high volatility. The Sharpe Ratio helps you see if the extra return justifies the extra risk. This is what the Sharpe ratio measures.

Evaluating Portfolio Efficiency

Investors can use the Sharpe Ratio to check how different investments contribute to overall portfolio performance. It helps select assets that improve returns without unnecessarily increasing risk.

Assessing Fund Manager Performance

The Sharpe Ratio helps determine whether a fund manager is generating returns through skill or simply taking higher risks. A consistently high ratio signals better risk management.

Making Diversification Decisions

If adding a new fund improves your portfolio’s Sharpe Ratio, it may be a good diversification move. If it lowers the ratio, the added risk may not be worth it.

About FinAtoZ

FinAtoZ helps individuals and families plan their finances with clarity and confidence. The focus is simple—understand your goals, manage risk wisely, and stay on track through every stage of life.

At FinAtoZ, you work with a certified financial adviser in a one-on-one setting. Your adviser reviews your current financial situation and helps quantify your real needs. This includes important life goals such as planning for your child’s education, determining what is sufficient, and deciding when you can retire comfortably.

Your investments are handled by a highly qualified, research-backed team. Based on your risk profile and time horizon, they select suitable financial products and continuously adjust investments as market conditions change. Every decision is aligned with your long-term goals.

FinAtoZ also believes financial planning is not a one-time activity. Through periodic review meetings, your adviser revisits your plan annually, accounts for life changes such as career changes or family additions, and recommends timely adjustments. This ensures your financial journey stays on course and your goals remain achievable.

Frequently Asked Questions

Is FinAtoZ suitable for first-time investors?

Yes. FinAtoZ works well for beginners by offering guided planning and expert-managed investments based on individual risk profiles.

Do I get a dedicated financial adviser?

Yes. Each client is assigned a certified adviser for personalised planning and regular reviews.

How often is my financial plan reviewed?

Your plan is reviewed annually or whenever there is a major life change, such as marriage, career shifts, or new financial goals.

Are investment decisions adjusted in response to market conditions?

Yes. The investment team continuously monitors markets and adjusts strategies to stay aligned with your goals.

Does FinAtoZ support long-term goals such as retirement and education?

Absolutely. FinAtoZ specialises in goal-based planning, including child education, retirement, and wealth creation.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment