Employee Benefit Analysis of ESOPs, ESPPs, and RSUs

Employee benefits are the additional advantages that companies offer beyond salary. These benefits support employee well-being, financial security, and work-life balance.

In India, employee benefits have changed a lot over the years. This shift is driven by changing workforce expectations, economic growth, and new regulations. Today, employees look for more than just pay. They expect benefits that protect their health, support long-term savings, and improve their daily work life.

To meet these expectations, Indian companies are expanding their benefit structures. These benefits also form a key part of employee benefit expenses and play an important role in attracting and retaining skilled talent.

Common Types of Employee Benefits in India

- Provident Fund and Pension Schemes

- Gratuity Benefits

- Health and Medical Insurance

- Paid Leave and Holidays

- Performance Bonuses and Incentives

- Employee Stock Options and Equity Plans

- Employee Share Ownership Plan options

- Work from Home and Flexible Work Policies

What Is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a type of employee benefit that allows employees to own shares in the company.

How Does an ESOP Work?

- ESOPs are set up as trust funds.

- The trust can receive newly issued shares of the company.

- Companies may also contribute cash to buy existing shares.

- In some cases, the ESOP borrows money to purchase shares.

- ESOPs are used by companies of all sizes, including public companies.

- Companies must follow non-discrimination rules.

- A trustee is appointed to manage the ESOP in the employees' interests.

Advantages of ESOPs

- ESOPs motivate employees to focus on company performance.

- Employees benefit when the share value increases.

- They act as a reward for long-term commitment and effort.

- ESOPs increase overall compensation without an immediate cash payout.

- Employees gain a sense of ownership through employee share participation.

What is ESPP?

An Employee Stock Purchase Plan, or ESPP, is an employee benefit that allows employees to purchase company shares at a discount. It is often part of a broader employee share ownership plan offered by employers.

What Is an Employee Stock Purchase Plan (ESPP)?

- An ESPP lets employees purchase company stock directly.

- Shares are usually offered at a discount of up to 15% off the market price.

- Employees contribute through regular payroll deductions.

- These deductions are collected over a fixed period.

- On the purchase date, the accumulated amount is used to buy company shares.

- ESPPs are included in overall employee benefit expenses.

Key Takeaways

- ESPPs allow employees to purchase employee stock at a discount.

- Plans can be qualified or non-qualified.

- Qualified ESPPs offer tax benefits but need shareholder approval.

- Employees contribute through salary deductions during offering periods.

- There are eligibility rules based on employment duration and ownership limits.

- The maximum annual contribution is capped in accordance with regulatory guidelines.

- Employees can sell shares immediately after purchase.

- Holding shares longer may reduce capital gains tax on profits.

What Is an RSU?

Restricted Stock Units (RSUs) are a common form of equity-based compensation offered to employees. RSUs are simply a company's commitment to grant shares to an employee at a future date. The shares are not given upfront and are subject to certain conditions.

Restricted stock units are issued under a vesting schedule. This means employees must meet specific requirements before the shares are transferred to them. These conditions usually involve staying with the company for a fixed period or achieving defined performance goals. Until these conditions are met, the RSUs hold no actual value.

Once the RSUs vest, they are assigned a fair market value. At this point, they are treated as income. A portion of the shares is withheld to cover income tax, and the remaining shares are transferred to the employee. The employee can then choose to hold or sell the shares.

RSUs are often used as a long-term retention tool. They encourage employees to remain with the company and contribute to its growth. If the employee holds the shares after vesting and the company’s stock price rises, the gains may be taxed as capital gains.

From an employer’s perspective, restricted stock units are easier to administer than many employee stock options. Shares are issued only after vesting, which helps delay dilution and keeps administrative costs low.

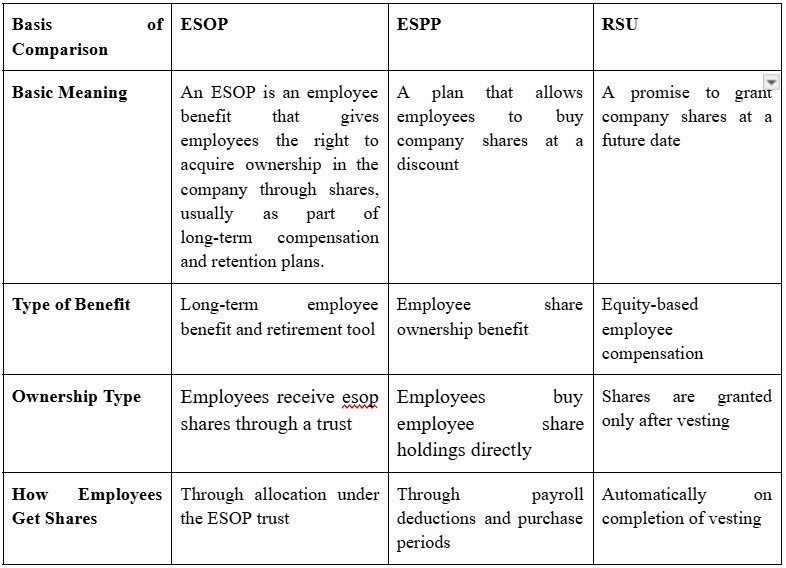

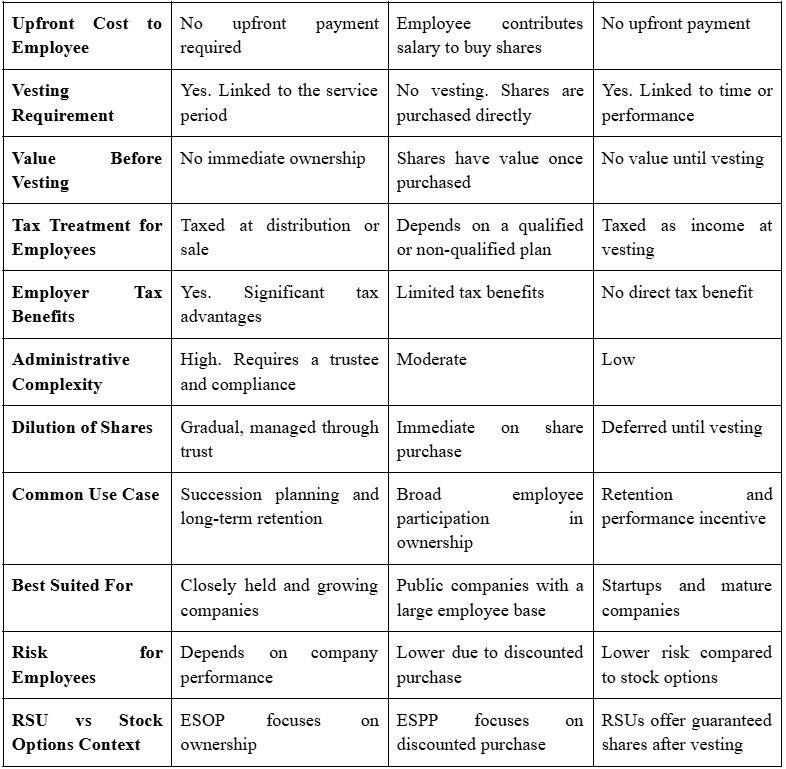

ESOP vs RSU vs ESPP: Key Differences Explained

Employee Benefit Expense Analysis: Cost to Employers

In India, employee benefit expenses account for a significant share of overall compensation. For most companies, these costs add 15-30% to salaries. Mandatory contributions and rising healthcare costs mainly drive this increase. Employers must balance statutory requirements with voluntary benefits while keeping the Cost to the company under control.

Key Components of Employer Costs in India

Mandatory Contributions: Mandatory benefits usually account for about 17 to 20 percent of salary. EPF contribution is 12% of the basic salary. ESI contribution is 4.75 percent of wages for employees earning below INR 21,000.

Health and Wellness Costs: Health insurance and medical benefits are rising costs. Medical costs in Asia are rising, which directly impacts employer benefit budgets.

Voluntary Benefits: These include health and life insurance, paid leave, retirement benefits, and flexible work options. Employers may also offer travel or internet reimbursements and wellness programs such as yoga or meditation.

Overtime Costs: Overtime expenses vary by industry. Manufacturing and factory roles are subject to specific labour rules, which can increase benefit-related costs.

How Employers Analyse Benefit Costs

Employee Benefits Ratio: This ratio helps measure the true cost of benefits.

Formula: Total Benefits Cost divided by Total Salary Cost multiplied by 100.

Cost to Company (CTC): CTC includes gross salary plus all benefits. For example, a salary of ₹1,00,000 with benefits worth ₹25,000 results in a CTC of ₹1,25,000.

Impact on Profit and Loss: Employee benefit expenses are a major line item in financial statements. They affect margins and must comply with accounting standards such as IND AS 19 or IAS 19.

Benefits of ESOPs, ESPPs, and RSUs for Employees

Equity-based benefits such as ESOPs, ESPPs, and RSUs offer employees more than regular pay. They allow employees to share in the company’s growth and build long-term financial value. These benefits are an important part of modern employee stock options and overall compensation.

Benefits of ESOPs for Employees

- Provides ownership through esop shares

- Helps employees feel connected to company success

- Rewards long-term commitment through vesting

- Acts as a retirement-focused benefit in many companies

- Increases total compensation without an immediate cash payout

Benefits of ESPPs for Employees

- Allows employees to buy employee share holdings at a discounted price

- Uses payroll deductions, making investing simple

- Offers potential gains if the company’s stock price rises

- Provides flexibility to sell shares immediately or hold them longer

- Forms part of a broader employee share ownership plan

Benefits of RSUs for Employees

- Provides guaranteed shares after vesting

- No upfront investment required from employees

- Easier to understand compared to complex stock options

- Supports long-term retention and stability

- Lower risk when comparing RSU vs stock options

How FinAtoZ Helps with Employee Benefit Planning

FinAtoZ supports both employees and employers in planning equity-based benefits such as ESOPs, ESPPs, and RSUs. The focus is on clarity, suitability, and long-term financial outcomes.

Personalised Financial Planning With a Certified Adviser

A dedicated adviser meets you one-on-one to review your current finances. The goal is to clearly define your needs. This helps answer practical questions around child education, retirement timing, and long-term wealth creation from employee stock options and equity benefits.

Investment Planning Based on Risk Profile

FinAtoZ has a qualified, research-backed investment team. They recommend suitable products based on your risk appetite and goals. Investments linked to employee benefits, such as ESOP shares, RSUs, or employee share ownership plans, are aligned with market conditions and time horizons.

Periodic Reviews to Stay on Track

Your adviser conducts regular reviews. These sessions factor in life changes, such as career moves or family updates. The investment journey is reviewed, and corrective steps are suggested to ensure goals stay achievable.

Goal-Based Investment Execution

Investments are executed based on your defined goals and risk profile. This ensures employee benefit-related gains are planned, not accidental.

Diversified Investment Options

FINATOZ helps you invest across mutual funds, PMS, and structured real estate products. Selection follows a structured, research-driven process.

Strong Research and Product Selection

Each asset class is evaluated using a rigorous internal research framework. This helps identify products that suit both short-term and long-term financial needs.

Consolidated Investment View

FinAToZ offers an online portal to consolidate existing investments. This gives a clear picture of overall wealth, including benefits linked to employee benefit expenses and equity compensation.

Frequently Asked Questions

What are employee stock options?

Employee stock options give employees the right to buy company shares at a fixed price after a vesting period.

What is the difference between ESOP and ESPP?

ESOPs provide ownership through a trust, while ESPPs allow employees to buy shares directly at a discount.

What is RSU, and how does it work?

Restricted stock units are shares granted to employees after meeting vesting conditions such as time or performance.

Are ESOPs, ESPPs, and RSUs part of employee benefit expenses?

Yes. These equity-based benefits are included in employers' overall employee benefit expenses.

Which is better: RSUs or stock options?

RSUs carry lower risk since shares are granted after vesting, while stock options offer higher upside if the share price rises.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment