PMS vs AIF: Know the Key Differences

Choosing the right investment structure is important for long-term wealth creation. Portfolio Management Services and Alternative Investment Funds are two popular options for high-net-worth investors in India. While both offer professional management, they differ in structure, risk, liquidity, and taxation. Understanding PMS vs AIF helps investors align their choices with financial goals, risk appetite, and investment horizon. This guide breaks down the key differences in a simple and practical way.

What Is PMS? Meaning and Basics

Portfolio Management Services, often called PMS, is an investment service in which a professional manager manages an individual’s investments. The goal is to align the portfolio with the investor’s financial objectives.

Unlike mutual funds, portfolio management services do not pool money into a common fund. Each investor has direct ownership of stocks and other assets in their own name. This makes PMS investment more personalised and flexible.

PMS allows portfolios to be designed based on risk appetite, return expectations, and preferences. This level of customisation is one reason investors compare PMS vs AIF when choosing advanced investment options. To understand PMS suitability, read our guide on when it makes sense to invest in PMS.

Types of PMS

In India, portfolio management services are broadly classified into three types. The classification depends on the level of control the investor wants.

Discretionary PMS

- The portfolio manager takes full control of investment decisions.

- The investor does not need to approve individual trades.

- Suitable for investors who prefer minimal involvement.

- Common choice for hands-off PMS investment.

Non-Discretionary PMS

- The portfolio manager suggests investment ideas.

- The final decision to buy or sell is taken by the investor.

- Suitable for investors who want expert input but control execution.

- Often compared with AIFs vs. PMSs by investors seeking flexibility.

What Is AIF? Meaning and Structure

An Alternative Investment Fund, commonly known as AIF, is a privately pooled investment vehicle set up in India. An AIF collects capital from sophisticated investors and invests it in accordance with a defined investment strategy.

The AIF full form is Alternative Investment Fund. These funds can raise money from Indian or foreign investors. The investments are made for the benefit of investors and are guided by a specific investment policy.

An AIF investment differs from that of a mutual fund. AIFs are not covered under SEBI Mutual Fund Regulations or Collective Investment Scheme Regulations. They are governed separately under SEBI’s AIF Regulations.

Certain entities are not required to register as AIFs. These include family trusts set up for relatives, employee welfare trusts, gratuity trusts, and holding companies, as defined under applicable laws.

Categories of AIFs in India

SEBI classifies AIFs into three main categories. Each category follows a different investment approach.

Category I AIF

- Invests in sectors considered socially or economically important.

- Focuses on early-stage or growth-driven opportunities.

- Includes venture capital funds, angel funds, SME funds, social venture funds, and infrastructure funds.

- Often chosen by investors looking for long-term growth through AIF investment.

Category II AIF

- Covers funds that do not fall under Category I or Category III.

- Does not use leverage except for short-term operational needs.

- Includes private equity funds, real estate funds, and distressed asset funds.

- Common choice when comparing AIF vs PMS for structured investments.

Category III AIF

- Uses complex or active trading strategies.

- May use leverage and invest in derivatives.

- Includes hedge funds and PIPE funds.

- Suitable for investors with a higher risk appetite exploring advanced PMS AIF options.

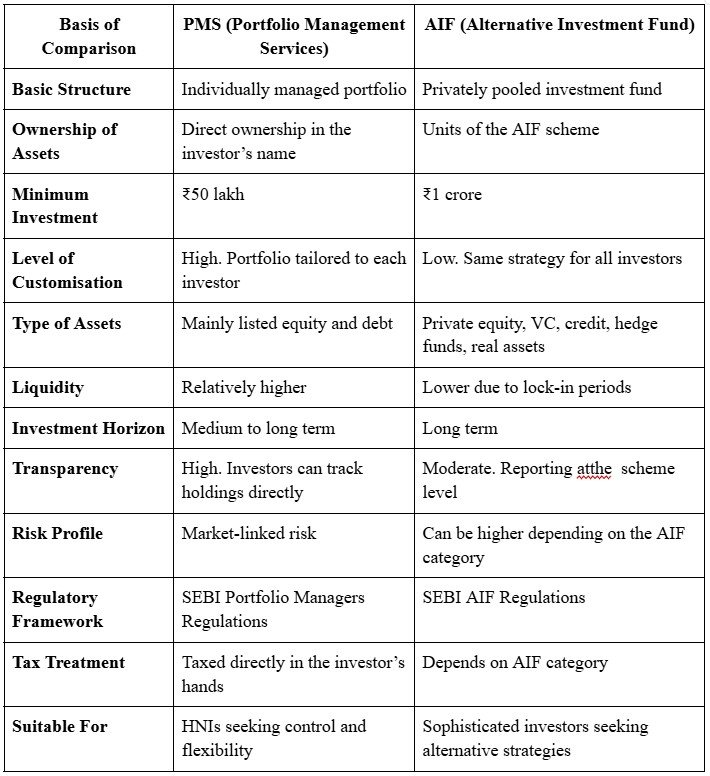

PMS vs AIF: Key Differences Explained

Regulatory Framework: PMS and AIF in India

The Securities and Exchange Board of India regulates both PMS investment and AIF investment. SEBI sets clear rules to protect investors and ensure transparency. While both fall under SEBI, they are governed by separate regulations and follow different compliance structures.

Regulatory Framework for PMS in India

Portfolio Management Services are regulated under the SEBI (Portfolio Managers) Regulations, 2020, as amended from time to time.

- Every PMS provider must be registered with SEBI.

- Only a body corporate can operate PMS services.

- The minimum investment for a PMS client is ₹50 lakh.

- PMS providers must maintain a minimum net worth of ₹5 crore.

- A written agreement with each client is mandatory.

- Client funds and securities must be kept separate from the PMS’s own funds.

- Regular reporting and disclosures to clients and SEBI are required.

- Portfolio managers must follow strict suitability and risk disclosure norms.

Regulatory Framework for AIF in India

Alternative Investment Funds are regulated under the SEBI (Alternative Investment Funds) Regulations, 2012, which have been amended multiple times over the years.

- Every AIF must be registered with SEBI before raising funds.

- AIFs must register under Category I, II, or III based on investment strategy.

- The minimum investment per investor is ₹1 crore.

- Funds cannot invite the public to invest.

- Each AIF scheme must have a defined tenure and investment policy.

- Changes to the strategy require investor approval.

- Regular disclosures, audits, and reporting are mandatory.

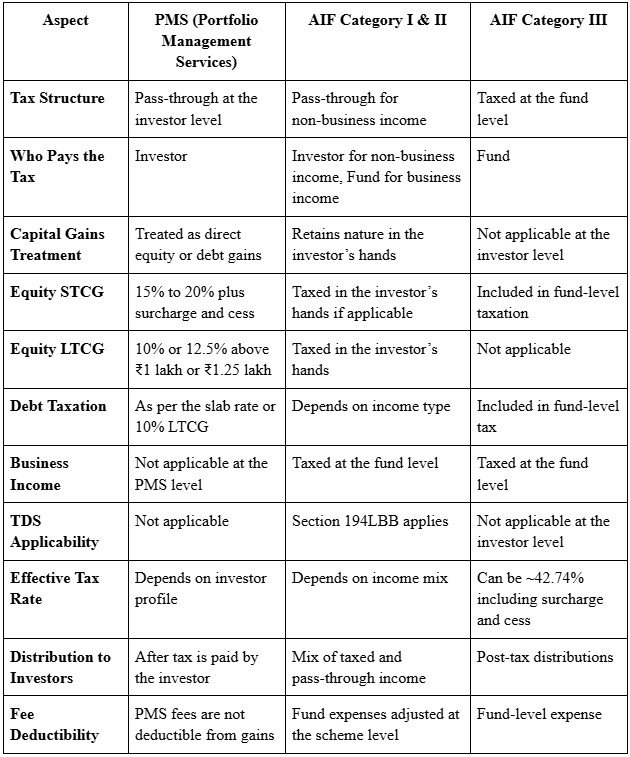

Taxation Differences Between PMS and AIF

Key Takeaway

- PMS investment follows direct taxation rules. The investor pays tax based on holding period and asset type.

- AIF Category I and II offer pass-through benefits for most income types, making them popular in AIF vs PMS comparisons.

- AIF Category III is taxed at the fund level, which can reduce post-tax returns but is well-suited to active trading strategies.

Who Should Choose PMS vs AIF?

PMS investment suits investors who want direct ownership and flexibility. AIF investment suits investors who are comfortable with pooled structures and alternative strategies.

Choose PMS if:

- You want control and transparency: In portfolio management services, securities are held in your own name. You can clearly track holdings and transactions.

- You prefer listed assets: PMS portfolios mainly invest in listed equity and debt instruments.

- You need better liquidity: PMSs generally offer more liquidity than AIFs, though they are less liquid than mutual funds.

- You are an HNI: PMS is designed for high-net-worth individuals looking for customised strategies.

Choose AIF if:

- You want alternative investment strategies: AIFs provide access to private equity, venture capital, credit, and hedge fund strategies.

- You have a long-term investment horizon: AIFs usually come with longer lock-in periods.

- You are a sophisticated investor: AIFs work for investors comfortable with pooled structures and lower day-to-day visibility.

- You seek specialised alpha: AIFs aim to generate returns beyond traditional markets through focused strategies. Portfolio diversification also plays an important role in managing risk across these investments.

How FinAtoZ Supports Your Investment Journey

FinAtoZ is a SEBI-registered investment advisory firm built by founders with a strong technology background. The focus is on combining expert advice with a human approach to investing. The goal is simple. Help investors make better decisions and stay on track over the long term.

Personalised Financial Planning With a Certified Adviser

A dedicated adviser reviews your current financial situation in a one-on-one discussion. This helps define clear goals, such as child education planning or retirement planning. The outcome is a personalised financial plan based on your real needs.

Investment Management Aligned to Your Risk Profile

FinAtoZ has a qualified investment team supported by in-depth research. Investments are selected based on your risk appetite, time horizon, and goals. Portfolios are adjusted as market conditions change.

Regular Reviews to Stay Aligned With Goals

Your adviser conducts periodic reviews to account for life changes, such as career moves or family updates. The investment performance is reviewed, and corrective actions are suggested when needed.

Technology-Driven yet Human-First Platform

FinAtoZ offers a secure online platform where you can connect with your adviser anytime. You can track your financial journey, investments, and progress in one place.

Structured Research-Backed Approach

All recommendations follow FinAtoZ’s in-house 5P Research Process. This ensures investments are planned, executed, and managed with discipline.

What FinAtoZ Helps You Do

- Plan your goals: Create a clear financial roadmap for life goals.

- Invest smartly: Make investments based on risk profile and objectives.

- Track and rebalance: Monitor portfolios and rebalance them as markets change.

Frequently Asked Questions

What is the minimum investment for PMS and AIF?

PMS requires a minimum investment of ₹50 lakh, while an AIF involves an investment of ₹1 crore.

Which is better, AIF vs PMS?

It depends on your goals, risk tolerance, and liquidity needs.

Is PMS more liquid than AIF?

Yes. PMS generally offers better liquidity than AIFs.

Are PMS and AIF regulated in India?

Yes. Both are regulated by SEBI under separate regulations.

Can investors invest in both PMS and AIF?

Yes. Eligible investors can invest in both as part of a diversified portfolio.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment