7 Steps To Overcome Bad Money Habits and How to Avoid

Most people don’t struggle with money because they lack financial knowledge. They struggle because money habits are shaped long before we start earning, by beliefs, emotions, and experiences we rarely question.

Take Vikas, for example. He grew up hearing, “Money always finds a way to disappear. Just enjoy life now.” Years later, he now spends most of his salary on impulse purchases, struggles with savings, and feels stuck in a financial loop.

Vikas doesn’t have a money problem. He has a money mindset problem.

Most of us do.

In this blog, we’ll explore seven proven steps, inspired by books like Rich Dad Poor Dad, Atomic Habits, and I Will Teach You to Be Rich, to help you break harmful money habits and build ones that actually serve your future.

You don't have to be a finance expert, just someone willing to build better money behavior—slowly, consciously, and intentionally.

Step 1: Find the Stories You Tell Yourself About Money

(Inspired by I Will Teach You to Be Rich by Ramit Sethi)

Many of our money habits don’t start with numbers—but with beliefs.

Beliefs like:

- “Everyone has debt—it’s normal.”

- “I don’t even know how much I owe.”

- “It’s just ₹500, not a big deal.”

These invisible beliefs called Money Scripts are the root of subconscious financial decisions. They don’t just influence how we spend, but how we think about money altogether.

If you often feel confused about where your money goes or how to plan, understanding why financial advice matters is a great place to start.

Shift From Bad Money to Good Money:

- Bad money behavior = Avoidance, emotional purchases, living paycheck to paycheck.

- Good money behavior = Tracking, planning, automating, consciously choosing where money goes.

Try this:

Create a Money Script Reflection Sheet where you write:

- A spending habit you regret.

- The belief behind it (“I deserve it”, “It’s just ₹500”).

- What you will practice instead (tracking, limit setting, delaying purchase).

Step 2: Stop Working for Money and Make Money Work for You

Robert Kiyosaki explains that bad money habits begin when people only learn how to earn money, not how to grow money. As he says:

“The poor and middle class work for money. The rich make money work for them.”

To begin shifting this mindset, consider a simple journaling exercise:

Each day, write down one decision where money influenced your behavior and reflect on how you could have approached it with a mindset of making money work for you.

This practice can help you become more aware of your financial habits and initiate meaningful change.

Actionable steps

- Track income and expenses — identify how much goes to liabilities vs. assets.

- Replace the question “Can I afford this?” with “How can I afford or build it?”

- Start building assets (investments, skills, side income) instead of buying only liabilities.

- Learn one financial concept weekly: assets, passive income, compound growth.

Download this Monthly Cash Flow Tracker

It includes:

- Income, Assets & Liabilities tracking tables

- Net cash flow summary

Step 3: Money Habits Aren’t Logical. They’re Emotional.

People know saving is good and debt is bad, yet they still overspend, take on debt, or invest impulsively. This happens because money decisions are deeply psychological, not mathematical.

Good money habits start with managing emotions like fear, greed, and comparison. Financial success needs patience, discipline, and long-term thinking.

To improve behavior, shift from emotional reactions to intentional decisions. Good and bad money habits are shaped more by behavior than by knowledge.

Actionable Steps:

- Track emotional triggers when spending.

- Wait 24 hours before making any non-essential purchase.

- Use a money journal to record “why” behind each expense.

Money Behaviour Reflection Tracker

Step 4: Live Below Your Means (Even If You Earn Well)

Many people earn well but still struggle financially because they spend in anticipation of future income instead of managing what they already have.

Wealthy individuals focus on financial independence, not on looking rich. They live below their means, avoid lifestyle inflation, and control expenses even when their earnings increase. Understanding how to invest your Provident Fund after retirement can help you convert savings into a reliable income.

Buying luxury cars, branded products, and expensive gadgets is a common trap that drains long-term wealth. Most people accumulate liabilities while believing they are building assets.

Millionaires track their expenses, maintain budgets, and delay gratification. They do not chase status; they chase financial freedom.

Actionable Steps:

- Track all lifestyle expenses for 30 days to identify unnecessary spending

- Set a monthly savings goal before planning expenses

- Delay any lifestyle purchase by asking, “Will this improve my financial future?”

- Focus on owning assets, not displaying wealth

Practice Tool

Create a Lifestyle Expense Filter Sheet with three columns: Need, Want, and Status Purchase. Each time you spend, classify it. This simple habit separates good money behavior from bad.

Step 5: Eliminate Debt Before It Eliminates Your Freedom

(Inspired by The Total Money Makeover by Dave Ramsey)

Bad money behavior often begins when debt becomes normal. Credit cards, EMIs, personal loans, and overspending force people into a cycle where income is spent before it is earned. Ramsey calls this financial slavery.

The first major step toward good money behavior is building a small emergency fund and then clearing all consumer debt using the Debt Snowball Method. The goal is to create breathing room where money is yours—not borrowed.

Good and bad money habits can be identified by how you use debt:

- Bad money behavior: using loans for lifestyle, gadgets, travel, or daily expenses.

- Good money behavior: using income to build assets—not to pay interest.

Financial freedom begins when you stop relying on debt and start relying on discipline.

Actionable Steps (The Total Money Makeover Method):

- Build your first emergency fund of ₹50,000 (or one month of expenses).

- List all debts—credit cards, EMI, loans.

- Pay off the smallest debt first (Debt Snowball Method).

- Stop using credit cards and borrowing for non-essential expenses.

- Track every payment to stay motivated.

Free Tool from the Concept

Create a Debt Snowball Tracker with columns:

- Debt Name

- Total Amount

- Monthly Payment

- Status (Paid/Unpaid)

- Target Payoff Date

This simple sheet helps you turn debt repayment into a winning habit

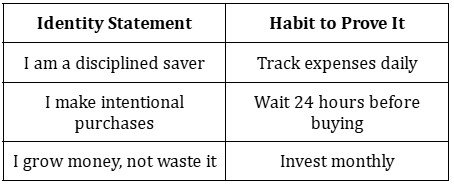

Step 6: Build Identity-Based Money Habits

(Source: Atomic Habits – Chapter 2: How Your Habits Shape Your Identity)

Instead of saying “I want to save money,” say, “I am someone who manages money wisely.” Your identity shapes your habits, and your habits reinforce your identity.

People struggle because they focus on goals (save ₹50,000, clear debt) rather than on systems (daily money tracking, budgeting). To break bad money habits, shift from outcome-based to identity-based behavior.

Example:

Goal: Save money → System: Track expenses → Identity: “I am a disciplined saver.”

How to build identity-based money habits:

- Decide the type of money person you want to be.

- Prove it with small, consistent actions.

- Repeat daily rituals like expense tracking, saying no to impulse purchases, or investing ₹100.

Identity statements you can start using:

- I am someone who respects money—good money, bad money, both teach me discipline.

- I am someone who plans, not reacts.

- I am someone who makes intentional financial choices.

Actionable Practice: Habit Identity Card

Write your new money identity and keep it in your wallet or money journal.

Free Tool Inspired by the Book

Create a Money Identity Habit Card, write your identity statement, and one daily habit to prove it.

Step 7:Value Your Money by Valuing Your Life Energy

You trade hours of your life to build wealth. When you understand this, you stop accepting low pay, casual spending, and random work choices.

To replace bad money behavior with good money decisions, value your effort and seek the highest income possible without harming your health or integrity. This is not greed. It is self-respect.

When you increase income wisely, you gain:

- More savings

- Less debt

- More peace of mind

- More freedom to choose work on your terms

Actionable Steps

- Evaluate your actual hourly wage and compare it to the effort you put in.

- Ask: Am I getting a fair return for my time?

- Look for ways to earn more using your existing skills—negotiation, better roles, freelancing.

- Avoid jobs that drain energy without fair pay. Respect time as your most valuable asset.

To turn your money into long-term security, explore the retirement bucket strategy, which helps reduce anxiety about future income.

Free Practice Tool: “Life Energy Worth Sheet”

Create a simple worksheet with these columns:

| Job/Task | Hours Spent | Income Earned | Real Hourly Rate | Worth My Life Energy? (Yes/No) |

- Use it to decide which work aligns with your energy, health, and financial goals.

- Once these steps are completed, consider setting a monthly review to assess your progress and make adjustments as needed.

- Create a long-term vision for your financial goals and identify a new habit or mindset shift to focus on each month.

- This approach will help ensure that your good money habits continue to evolve and strengthen over time.

FAQs

How can I adapt these steps if my income is irregular or very low?

Start with tracking every rupee, build a small emergency fund, avoid debt, automate tiny savings, and focus on budgeting for essentials before applying advanced money habits.

After completing these steps, what should I focus on to keep improving my finances?

Focus on investing regularly, increasing income sources, protecting money with insurance, and consistently reviewing spending patterns to stay aligned with long-term financial goals.

What is the simplest habit to start improving both good and bad money behavior?

Track every daily expense. It builds awareness, prevents emotional spending, and helps you understand how your money flows—before you plan or save.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment