Impact of Global Events (Oil, Geopolitics) on Indian Investments

Whether it is a war in the Middle East, a policy change in OPEC, or even a natural disaster in a nation known for its major exports, it can shake the financial markets in several countries worldwide.

These changes always end up having a huge impact on the investment landscape. In fact, India imported over 88% of its crude oil in the financial year ending March 2025 and faced a big challenge. From oil prices to currency movements, these global shocks can affect inflation, company profits, and even the portfolio of an investor.

Today, we will examine the impact of geopolitics, analysing how geopolitical events and natural disasters affect Indian investments and what investors can do in such conditions.

Why Understanding the Impact Matters to Indian Investors?

The global market plays an essential role in the Indian economy, particularly in the oil and natural gas sectors. Here is why investors must understand the impact of geopolitics:

- Whenever oil prices spike due to war, sanctions, or production cuts, India's import bill rises sharply.

- This leads to higher inflation, a weaker rupee, and lower corporate profits, all of which directly affect investor returns.

So, when geopolitics becomes heated, investments in India also feel the impact.

How Do Geopolitics and Oil Prices Influence Indian Investments?

Global events have a direct impact through various key channels. It acts like a domino effect that starts in a foreign land, but it highly impacts and shapes the returns that you get here.

Trade and Fiscal Impact: The Rising Import Bill

Because India heavily relies on imported crude, the oil prices rise, which essentially means:

- A larger import bill,

- A wider current account deficit (CAD), and

- Pressure on the Indian rupee.

Thus, when the value of the currency weakens, foreign investors often pull money out of Indian markets, creating volatility in both stocks and bonds.

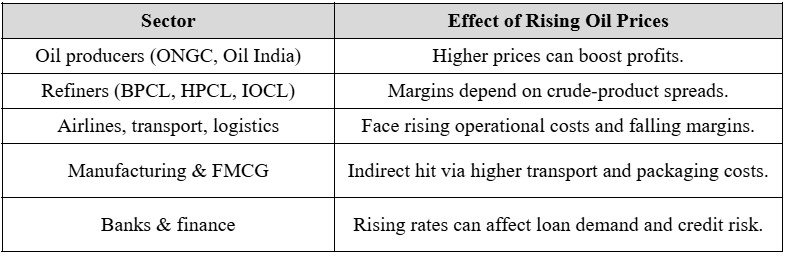

Corporate Profits and Sectoral Impact

The fluctuations in prices do not have an equal impact on all sectors. Let us look at the impact of geopolitics across industries:

In short, global oil and geopolitical shocks can have winners as well as losers within the stock market, largely due to the degree of exposure each sector has to these events.

Currency and Capital Flow Volatility

When the oil import bill rises, it leads to a depreciation of the rupee. It ends up affecting:

- Foreign Institutional Investor (FII) returns lead to outflows.

- Import-dependent businesses face cost pressures.

- Investor confidence is affected as market volatility spikes.

The impact of geopolitics extends beyond the stock market, reshaping capital flows and exchange rates.

Inflation and RBI Policy Response

The Consumer Price Index (CPI) also rises when the price of oil or other commodities increases as part of the impact of a natural disaster. Thus, the RBI tightens the monetary policies to control inflation, which:

- Raises borrowing costs,

- Slows economic activity, and

- Lowers corporate profitability.

Sentiment and Risk Perception

When there is high geopolitical tension, such as wars, sanctions or trade disputes, it is common for investors to move towards options like gold investments, the US dollar and even government bonds.

It leads to:

- FII withdrawals from emerging markets like India,

- Falling stock prices, and

- Surging volatility in equity indices.

Whether a country like India is directly involved in the crisis or not, the impact of geopolitics on global investments affects domestic investment trends.

The Impact of Natural Disaster on the Indian Economy

The impacts of natural disasters are a critical factor that shapes the financial markets. Floods, cyclones, earthquakes, and droughts can disrupt production, supply chains, and commodity prices, which eventually lead to significant economic impacts.

The impact of natural disasters on the economy includes:

- Damage to crops, factories, and infrastructure reduces supply.

- Rebuilding costs strain fiscal budgets.

- Global commodity shortages drive up prices.

- Reduced agricultural output leads to food inflation.

- Disruptions in transportation and manufacturing tend to hurt GDP growth.

- Lower rural income reduces demand for consumer goods.

What Are the Factors Affecting Commodity Prices?

To understand how global events impact different markets, investors must be aware of the primary factors influencing commodity prices.

- Supply disruptions can occur due to war, sanctions, or OPEC production cuts.

- Faster growth raises energy and metal demand.

- Since the inventories are tight, the prices have sharper swings.

- It can also lead to shipping bottlenecks, such as blocked trade routes (like the Suez Canal or Hormuz Strait).

- When the dollar gets stronger, it lowers commodity prices.

- Futures and ETF trading amplify volatility.

- Production and transportation see significant impact from natural disasters on the Indian economy, as they are key factors affecting commodity prices.

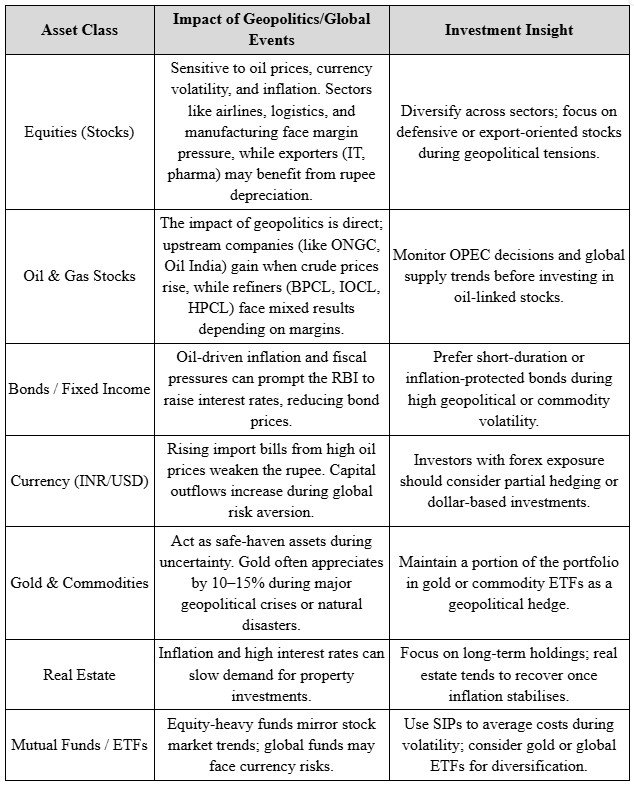

How Do Indian Asset Classes Respond to Global Shocks?

When there are geopolitical conflicts, it leads to a price surge, which has the power to shake the Indian markets. For example, the Russia-Ukraine conflict has led to a price increase of about $120 to $130 per barrel, which has a subsequent effect on the economy.

The table below shows how different Indian asset classes typically react to such global shocks, from geopolitical tensions to the impact of natural disasters, and what investors can do:

What Investment Strategies Can Help Investors?

A smart, diversified strategy can help investors protect their returns and manage their risk effectively in times of global uncertainty. Here are investment decisions that can be tried:

Diversify Your Portfolio

It is best not to rely heavily on oil-sensitive or export-dependent sectors. Diversify your investment options. A diversified portfolio cushions you when one asset class underperforms due to external shocks.

Use Inflation-Protected Assets

Consider inflation-indexed bonds, short-term debt funds, or gold ETFs; these tend to hold their ground during inflationary periods.

Track OPEC Meetings and Global News

The impact of geopolitics starts when there are changes in oil supply and trade policies. Staying updated on OPEC announcements, important diplomatic developments, or natural disaster forecasts helps investors anticipate shifts in commodity prices and market sentiment.

Adopt a Long-Term Approach

Short-term volatility is driven by emotion and uncertainty quite often. It is therefore best to focus on long-term financial goals. It is a known fact that Indian equities and mutual funds have recovered strongly after global disruptions.

Maintain Liquidity

You can also include liquid funds or cash equivalents in your portfolio. It will offer stability and also allow you to seize attractive buying opportunities when markets correct.

Monitor the Rupee and Oil Prices

Even small changes in the INR-USD exchange rate or crude oil prices can signal larger market trends. If the rupee weakens, it may be beneficial for exporters to absorb the increased import costs. It will further influence inflation, interest rates and also the investment sentiment.

Hire a Financial Advisor

Financial advisors have great market insights and strong experience to help you make informed decisions, especially in cases where the impact of natural disasters on the Indian economy is prevalent.

Conclusion

Geopolitical conflicts and natural disasters are global events known to shape India's investment landscape. While their impact is unavoidable, a balanced, diversified, and informed investment strategy will help the investors to turn volatility into opportunity. Investors have to stay alert about global events and their effects, stay adaptable, and focus on their long-term goals to thrive even in uncertain times.

Different asset classes tend to react differently during uncertain times. When one market faces pressure, others may offer stability or growth. This balance allows investors to remain aligned with long-term financial goals rather than react to short-term disruptions. Staying informed about global developments, remaining adaptable, and maintaining a well-structured diversified portfolio can help investors navigate uncertain markets and turn volatility into opportunities over time. At FinAtoZ, managed portfolios are designed to spread risk across multiple asset classes and strategies. This structured diversification helps investors remain adaptable, protect capital, and turn market uncertainty into long-term opportunity through disciplined investment planning.

Frequently Asked Questions

How do global geopolitical events impact Indian investments?

The impact of geopolitics on Indian investments is significant. Conflicts, sanctions, or diplomatic tensions can affect oil prices, trade routes, and investor sentiment. For example, the Russia-Ukraine conflict caused volatility in equities and currency markets, pushing Indian inflation higher.

What is the impact of natural disasters on the Indian economy?

The impact of natural disasters on the Indian economy means disruptions in agriculture, supply chains, and infrastructure. Floods or droughts can lead to food inflation and lower productivity, which in turn affects GDP growth and investment stability.

What are the key factors affecting commodity prices globally?

Factors affecting commodity prices include geopolitical tensions, demand-supply imbalances, natural disasters, and OPEC production decisions. Currency fluctuations and inflation expectations tend to play important roles in determining prices.

Do Indian equities perform well during global crises?

Indian equities have experienced short-term volatility during global crises but also recover fast due to the power of domestic consumption.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment