How to Choose a Financial Planner Near Me (Checklist & Costs)

Have you ever given thought to why some people have their finances sorted out so perfectly? They have steady investments, well-planned insurance, and a clear retirement goal. And you are still playing catch-up despite earning well.

The difference between you and another person is the right financial advisor on their side. In India, where the average investor still relies heavily on friends, relatives, or social media for financial advice, the need for certified, unbiased, and professional financial planning has never been greater.

According to a study, in India, only 15% of Indians seek financial advice from a certified financial advisor. For the rest, they take advice from unverified sources. It is a missed opportunity for the vast majority of the population.

A qualified financial planner can help you grow wealth strategically, protect it wisely, and plan for the long term. In this article, we will discuss how to choose the best financial advisor, what to look for, and how to ensure that your money is in the right hands.

Why is it Beneficial to Hire a Financial Advisor?

Today, managing money has become much more complex. Between choosing mutual funds, optimising taxes, planning for retirement, and managing inflation, it's easy to make costly mistakes.

Here are some benefits of having a financial advisor:

- Build a personalised plan based on your goals and risk tolerance.

- Stay disciplined during volatile markets.

- Avoid unnecessary products or bad investments.

- Save time and stress through expert oversight.

A study by Vanguard found that investors who work with financial planners can achieve approximately 3% higher annual net returns. Financial advisors help individuals make more informed and consistent decisions.

How to Choose a Financial Planner Near You?

When you decide to hire a financial planner, the planner being near your location is not the primary consideration; trust, transparency, and expertise are some important factors to consider. Several professionals claim to be "advisors"; however, this does not necessarily mean they possess valuable insights.

The right planner can help you make smarter investment decisions, reduce financial stress, and align every rupee you earn with your long-term goals.

Here is a step-by-step approach to help you choose the right financial planner when you are searching "investment advisor near me".

Step 1: List Out Your Financial Goals and Needs

Before searching "financial advisor near me" on Google, clarify what you want help with. Here are the things that you have to ask yourself:

- Do I need only investment advice or full-fledged financial planning?

- Am I looking for a one-time consultation or continuous portfolio management?

- Do I want a financial consultant for my business or for personal wealth management?

In case your needs are investment-specific, a registered investment advisor in India is the best choice.

Step 2: Check SEBI Registration and Professional Credentials

Anyone offering financial advice in India must be registered as a Registered Investment Adviser with SEBI. Check the following things before you finalise “the best investment advisor in India.

- SEBI registration number as per the official SEBI website

- Certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst)

- Years of experience and areas of expertise

- Whether they follow a fiduciary standard, they're legally obligated to act in your best interest

Pro-tip: Do not hire an agent who is not registered. As they earn mainly via commissions, there is a possibility that they will not offer you unbiased recommendations.

Step 3: Understand Their Advisory Process

When it comes to finding the best financial advisor in India, it is essential to know if they follow a structured and transparent process for making informed investment decisions, rather than offering random suggestions. A standard procedure includes:

- Understanding your income, expenses, assets, and goals

- Assessing your own risk tolerance

- Creating a customised financial plan

- Implementing investment recommendations

- Regular monitoring and rebalancing

To make sure that they are trustworthy, you can request a sample plan. The best financial advisor will clearly explain how they work and what you'll receive in return.

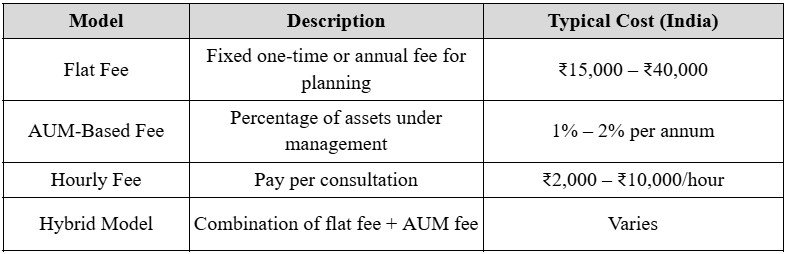

Step 4: Evaluate the Fee Structure: What Does It Really Cost?

Since it is all about the money, it is essential to consider pricing when you are struggling with the question of how to choose a financial advisor. Here is a fee model used by some financial advisors in India:

Note: This is just an example; the amount can vary as per various factors, such as the services being offered, location, and the advisor's experience.

Step 5: Check for Transparency and Conflicts of Interest

For the best results and optimum profit margin, it is advisable to ask the financial advisor how they are compensated. You can approach this with questions like:

- Do you receive commissions from product companies?

- Are you independent or tied to specific brands?

- Will I get a written breakdown of all fees?

- How often will you review and update my plan?

If you come across an advisor who promises guaranteed returns, it is best to steer clear, as the market is dynamic and there is no assurance of consistently gaining profit.

Step 6: Assess Communication and Compatibility

The role of a top financial advisor extends beyond investment planning; it also involves educating clients about how the market works and which investment decisions will best suit their needs.

Here is what you can do:

- Notice if they listen to your needs first

- Check if they explain concepts clearly (without jargon)

- Gauge how comfortable you feel discussing personal finances

When you are looking for "best financial advisor near me", it is essential that the advisors that you shortlist make you feel confident and not confused.

Step 7: Review Ongoing Support and Exit Terms

It is best when the relationship with the best investment advisor in India is long-term and also flexible. You can get more clarity by asking certain questions, like:

- How often will you review my investments?

- Will I get quarterly or annual reports?

- What happens if I want to end the engagement?

Mistakes You Must Avoid When Choosing a Financial Advisor

Even after being careful with every step in choosing the best financial advisor in India, mistakes can still occur. Nonetheless, here are some things that one must avoid:

- Picking an advisor just because they are easy to access due to their location or offer services at a low cost.

- Ignoring SEBI registration or CFP credentials

- Not clarifying the fee structure and deliverables

- Trusting agents who double as product sellers

- Overlooking exit clauses or review frequency

Conclusion

When the question of how to find the best financial advisor near me comes to mind, there are several aspects that you need to take care of. A trusted investment advisor in India helps you turn financial confusion into clarity, aligning your goals, managing risks, and building long-term wealth. Moreover, it is essential that you do not rush the process, check the SEBI registration, understand their pricing, and ensure that the financial advisor has your best interests in mind. The right financial consultant doesn't just grow your portfolio; they help you secure your future with confidence and peace of mind.

Frequently Asked Questions - FAQs

What is the primary distinction between a financial planner and an investment advisor in India?

A financial planner provides comprehensive wealth management services, encompassing budgeting, insurance, and retirement planning. An investment advisor in India focuses mainly on portfolio management and investment strategy.

What are the benefits of hiring an investment advisor near me?

A local investment advisor near me offers easy communication, a better understanding of your goals, and personalised service, ensuring your investments align with your lifestyle and tax situation.

Can a financial advisor also assist with tax and insurance planning?

Yes. Most comprehensive financial consultants offer tax planning, insurance advice, retirement strategies, and investment management services.

What are the red flags to avoid when choosing a financial advisor?

Avoid advisors who promise guaranteed returns, push specific products, or refuse to disclose fees. A trustworthy financial planner near you will always prioritise transparency.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment