What is a Lump Sum Investment? And How to Invest a Lump Sum Amount Smartly

When it comes to investing money, many people wonder what a lump sum investment is and whether it's a good option for them. A lump sum investment means investing a large amount of money at one time in a financial product, like a mutual fund. Unlike regular investments, where you invest small amounts every month, a lump sum investment happens just once.

Many investors ask, What is a lump sum in a mutual fund? In simple terms, it is when you invest the entire amount you have into a mutual fund in a single go. This method can be a smart choice if done at the right time and in the right way. But how can you ensure that your lump sum investment works for you? Let’s find out.

Why People Choose a Lump Sum Investment

There are several reasons why investors prefer a lump sum investment over other methods like SIP (Systematic Investment Plan). Here are some key benefits:

- Simple and Easy: You invest the entire amount at once. There is no need to keep track of monthly investments.

- Takes Advantage of Market Opportunities: If the market is down, investing a large sum at once can help you get more units of mutual funds at lower prices.

- Good for Short-Term Goals: If you have a financial goal within the next few years, a lump sum can help you grow your money faster.

However, not everyone is sure about where to invest a lump sum amount. Mutual funds are a popular choice because experts manage them and offer diversification.

How to Invest a Lump Sum Amount in Mutual Funds

Investing a large amount at once requires careful planning. Here are the steps to invest a lump sum amount smartly:

Understand Your Financial Goal

Is It Good to Invest a Lump Sum in Mutual Funds Now?

Many investors ask, Is it good to invest a lump sum in mutual funds now? The answer depends on the current market conditions and your financial goal.

- If the market has recently corrected or is at a lower level, a lump sum investment can be a great opportunity.

- For long-term goals, a lump-sum investment is generally beneficial because markets grow over time.

- However, if you are worried about market volatility, you can split your lump sum into a few parts and invest gradually (called staggered investment).

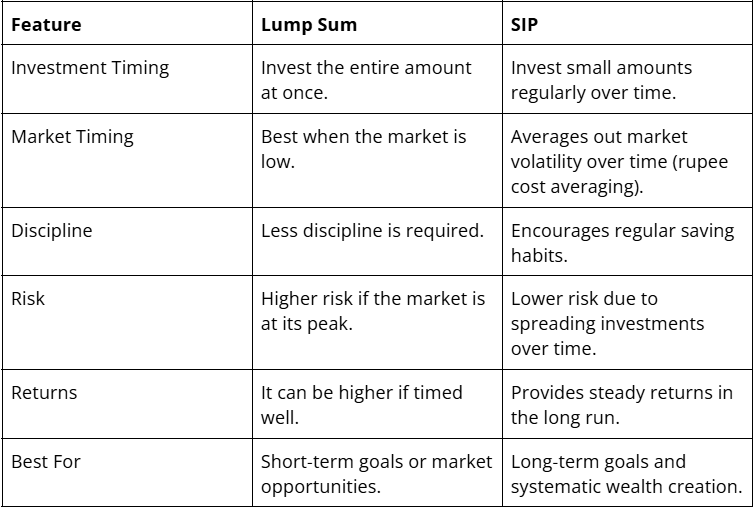

Lumpsum vs SIP: Which Is Better?

A common question is, Lump Sum vs SIP. Both have their advantages:

So, if you have a large amount ready and the market is favorable, a lump-sum investment can offer better returns than SIP. But if you want a safer, steady approach, SIP is a good choice.

Best Way to Invest a Lump Sum Amount

The best way to invest a lump sum amount is to follow a well-thought-out plan. Here are some important tips:

- Diversify Your Investments: Don’t put all your money in one fund or sector.

- Invest in Different Asset Classes: Combine equity, debt, and balanced funds.

- Choose Funds with Low Expense Ratios: It helps keep more returns in your pocket.

- Avoid Chasing High Returns: Don’t select funds just because they performed well last year.

- Please consult a Financial Planner: They can help create a strategy based on your goals.

Where to Invest a Lump Sum Amount?

Many people ask where to invest a lump sum amount. Here are common options:

Mutual Funds

For most retail investors, mutual funds offer the best balance of risk and return.

How FinAtoZ Can Help You Invest a Lump Sum Amount

At FinAtoZ, we prefer using an STP (Systematic Transfer Plan) approach for lump-sum investments. It helps reduce market timing risks and ensures steady deployment of funds.

Here’s how it works:

If large-cap funds are fairly valued, we invest 30% of the lump-sum amount on Day 1, and the remaining 70% is gradually invested through STP over the next 3 months.

The same logic applies to other equity classes depending on their market valuations.

Below is an example of FinAtoZ’s lump-sum investment strategy:

In extreme market conditions, we may even use STP through Balanced Advantage Funds (BAF) to ensure smoother market entry and better risk control.

This STP-based strategy ensures that your lump sum amount is not exposed to market volatility all at once. It’s a disciplined way to invest while taking advantage of market opportunities over time.

Learn more about how we can help you at FinAtoZ or read customer experiences at Customer Testimonials.

Lumpsum Investment Options

Here are popular lump-sum investment options you can consider:

- Equity Mutual Funds: Suitable for long-term wealth creation.

- Debt Mutual Funds: Good for short-term goals and stability.

- Balanced Funds: Combines equity and debt for moderate risk.

- Fixed Deposits (FDs): Offer guaranteed returns but lower than mutual funds.

- Gold ETFs: Safe investment against inflation.

- Government Bonds: Low risk, moderate returns.

Each option has its own pros and cons. The right choice depends on your goal, risk tolerance, and investment horizon.

Wrapping Up

Understanding what a lump sum investment is and how to invest a lump sum amount smartly is key to making your money work for you. Whether you choose mutual funds, FDs, stocks, or bonds, the most important part is to have a clear plan. Evaluate your goals, risk appetite, and market conditions before investing.

If you are unsure where to start, consulting experts like FinAtoZ can make the process easier and more efficient. A well-planned lump sum investment can help you grow your wealth and achieve your life goals faster.

Start smart investing today to secure your tomorrow. To know more, explore FinAtoZ's informative blog section!

Frequently Asked Question - FAQs

- What is a lump-sum investment, and how does it work?

A lump-sum investment means putting a large amount of money into an investment, like a mutual fund, all at once. Instead of spreading your investment over time, you invest the full amount in one go. It works well when the market is low, helping you get more units of the fund. - Is a lump-sum investment better than SIP for long-term wealth creation?

Both have pros and cons. A lump-sum investment can give better returns if invested when the market is low. But SIP (Systematic Investment Plan) spreads your investment over time, reducing the risk of market volatility. For beginners or those unsure about market timing, SIP is usually safer. - What are the best lump-sum investment options in India?

The best lump-sum investment options include mutual funds (equity, debt, or balanced), fixed deposits (FDs), government bonds, gold ETFs, and stocks. Mutual funds are the most popular because experts manage them and offer good returns over time. - How much should I invest as a lump sum amount in mutual funds?

There is no fixed amount for a lump-sum investment. It depends on your financial goal and risk capacity. Generally, it is better to invest only what you can afford without affecting your emergency savings. Many start with ₹50,000 or more. - What are the risks involved in a lump-sum investment?

The main risk of a lump-sum investment is market timing. If you invest when the market is high, your investment may lose value in the short term. Also, unlike SIP, you don’t spread your investment, so market volatility can impact your returns more.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment