Short-Term vs Long-Term Financial Goals: Key Differences

Short-term financial goals are the first step toward building a strong financial future. They help you manage money in the near term while preparing for bigger milestones ahead. On the other hand, long-term goals focus on wealth creation and stability over decades. Both play a crucial role in the objectives of financial planning, and knowing the difference between them will help you design a strategy that works for your financial success.

In this guide, we will explore short-term financial planning, long-term wealth building, and the differences between short-term term medium-term term and long-term goals. We will also look at suitable financial instruments in India for each stage of the planning.

What Are Short-Term Financial Goals?

Short-term financial goals are targets you want to achieve within 1 to 3 years. They are usually smaller, time-sensitive, and linked to immediate needs.

Examples include:

- Building an emergency fund.

- Paying off small loans or credit card debt.

- Saving for a vacation.

- Setting aside money for festivals, weddings, or family events.

- Buying gadgets or home appliances.

These goals require safer, more liquid investments since you cannot risk losing money when you need it soon.

What Is Short-Term Finance?

If you are wondering what short-term finance is, it is the funds you raise or set aside to meet expenses that are due in the near future. For individuals, this may include quick loans, salary advances, or liquid savings. For businesses, it can include working capital loans or trade credit.

Short-term finance helps in:

- Meeting urgent cash needs.

- Managing lifestyle expenses.

- Avoiding debt traps by planning.

What Are Long-Term Financial Goals?

Long-term financial goals usually extend beyond 5 to 10 years. They involve larger sums of money and require disciplined savings and investments over time.

Examples include:

- Retirement planning.

- Buying a house.

- Children’s higher education or marriage.

- Building long-term wealth through equity or real estate.

Unlike short-term goals, these can tolerate market fluctuations since time allows investments to recover and grow.

Understanding Medium-Term Goals

When talking about short-term, medium-term, and long-term goals, the medium term often gets overlooked. Medium-term goals fall in the 3 to 5-year bracket.

Examples include:

- Buying a car.

- Funding a postgraduate degree.

- Saving for a down payment on a property.

- Building a larger emergency fund.

Medium-term goals need a balanced approach between safety and growth.

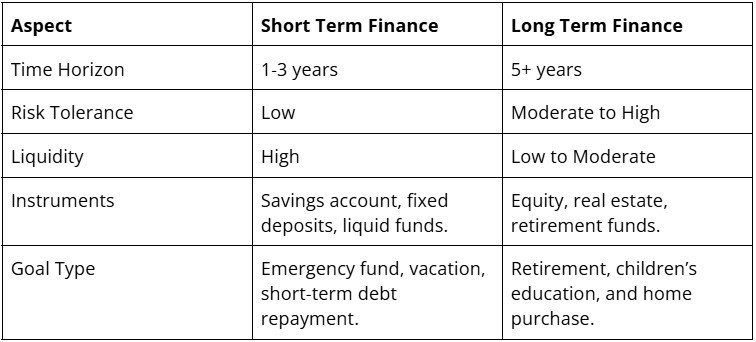

Key Differences Between Short-Term and Long-Term Finance

Understanding short-term and long-term finance is important to decide how to allocate money.

Here’s a breakdown:

Best Financial Instruments in India for Short-Term Goals

For short-term financial planning, safety and liquidity matter more than high returns. Some popular financial instruments in India include:

- Savings Accounts: Provide easy access to cash, though with low returns.

- Fixed Deposits (FDs): Offer guaranteed returns with flexible tenure.

- Recurring Deposits (RDs): Help you save monthly in small amounts.

- Liquid Mutual Funds: Provide slightly better returns than savings accounts, with quick withdrawal options.

- Short-Term Debt Funds: Suitable for those willing to take minimal risk for higher returns.

Best Financial Instruments in India for Long-Term Goals

For wealth creation, long-term investments provide growth over time. Some options are:

- Equity Mutual Funds: Ideal for long-term wealth building with SIPs or lump sum investments.

- Public Provident Fund (PPF): A government-backed scheme with tax benefits and a 15-year lock-in.

- Employees’ Provident Fund (EPF): Mandatory savings for salaried employees that build retirement funds.

- National Pension System (NPS): Helps in retirement planning with a mix of equity and debt.

- Real Estate: Property investments for appreciation and rental income.

- Stocks: Direct equity investments for long-term capital gains.

Why Both Short and Long Term Goals Matter

Balancing short-term and long-term finance ensures you don’t compromise your present needs while planning for the future.

- Short-term goals help you stay financially stable and stress-free.

- Long-term goals help you achieve dreams like retirement, home ownership, or children’s education.

- A proper mix ensures you don’t dip into long-term savings for short-term needs.

How to Prioritize Between Short, Medium, and Long-Term Goals

Managing short-term, medium-term term and long-term goals requires clear priorities.

Start with Short-Term Goals

- Build an emergency fund.

- Clear high-interest debts.

- Cover immediate lifestyle needs.

Plan Medium-Term Goals

- Save for milestones like a car, higher studies, or a home down payment.

- Use a mix of FDs, debt funds, and balanced funds.

Secure Long-Term Goals

- Begin retirement planning early.

- Invest in equities, PPF, or NPS.

- Stay disciplined with SIPs and systematic investing.

Steps for Effective Short-Term Financial Planning

Here’s how you can manage short-term financial planning effectively:

- List Your Goals: Write down expenses due within the next 1-3 years.

- Set a Budget: Allocate monthly savings for these goals.

- Choose the Right Instruments: Use safe and liquid options like FDs, RDs, or liquid funds.

- Avoid Risky Investments: Do not invest in high-volatility assets like stocks for short-term needs.

- Review Regularly: Track progress and adjust savings if required.

Mistakes to Avoid While Planning Goals

Many people confuse short-term financial goals with long-term planning. Avoid these mistakes:

- Using long-term investments for short-term needs.

- Ignoring emergency funds.

- Taking on high-interest loans instead of saving in advance.

- Not reviewing and rebalancing investments regularly.

How Can FinAtoZ Help?

Planning for both short-term financial goals and long-term wealth can feel overwhelming without the right guidance. It is where FinAtoZ steps in. Being a SEBI-registered financial planner in India, FinAtoZ focuses on helping you create a clear path for your money and future.

Here’s how FinAtoZ can support you:

- Personalized Goal Planning: Whether it’s saving for an emergency fund, buying a house, or preparing for retirement, FinAtoZ helps you design a financial plan that matches your life goals.

- Smart Investment Management: Your risk profile, income, and future needs are taken into account to suggest the best investment mix.

- Continuous Tracking and Rebalancing: Markets change, and so do your needs. FinAtoZ monitors your investments and rebalances them when needed so you stay on track.

By combining research-backed strategies with practical solutions, FinAtoZ ensures that you achieve financial security while building long-term wealth.

Learn more: FinAtoZ Website.

See what clients say: Customer Testimonials.

Wrapping Up

Both short-term financial goals and long-term goals are essential for a secure future. While short-term planning ensures you can handle emergencies and lifestyle needs, long-term planning helps you achieve life’s bigger dreams.

By choosing the right financial instruments in India, prioritizing wisely, and balancing short-term and long-term finance, you can create a roadmap that supports your present and builds your future.

To know more, explore FinAtoZ’s expert financial blog section!

FAQs on Short-Term Financial Goals

What are short-term financial goals?

Short-term financial goals are money-related targets you want to achieve within 1 to 3 years. Examples include saving for a vacation, building an emergency fund, or paying off small debts.

How do I plan for short-term financial goals?

For effective short-term financial planning, start by listing your goals, setting a budget, and saving monthly. Choose safe and liquid options like fixed deposits, recurring deposits, or liquid mutual funds to ensure money is available when you need it.

What is the difference between short-term and long-term financial goals?

The key difference is the time horizon. Short-term financial goals are usually for 1–3 years and focus on immediate needs, while long-term goals extend beyond 5–10 years and cover milestones like retirement or buying a house.

Which financial instruments in India are best for short-term financial goals?

For short-term financial goals, safe options include savings accounts, fixed deposits, recurring deposits, liquid mutual funds, and short-term debt funds. These provide liquidity and stability without exposing your money to high risks.

Why are short-term financial goals important?

Short-term financial goals are important because they help you manage urgent needs without disturbing your long-term savings. They give you financial security, prevent debt traps, and ensure you stay on track with larger wealth-building plans.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment