SIP (Systematic Investment Plan): A Beginner's Guide

Does the idea of investing in mutual funds or investing in stocks overwhelm you? Well, you're not alone. The world of investing can be complex and risky, particularly for those new to the field. However, there is a simple and easy way to build your wealth over time, without the need to invest a huge amount right from the start. This is possible with a Systematic Investment Plan (SIP). SIP is not a payment mode; it's a powerful tool for creating wealth. It's a great way to save for your retirement, your child's education, or to grow your wealth. SIP offers a more structured and long-term approach to investing.

If you are a beginner looking to understand what SIPs are and the associated risk factors in SIP investments, then keep reading as we demystify the concept of systematic investment plans for you.

What is SIP?

A SIP, or Systematic Investment Plan, is a method used for investing a fixed amount of money at regular intervals. It can be monthly or even quarterly. This money is invested in mutual funds and even in stocks.

SIP is helpful for investors to start more and invest consistently, irrespective of market performance. It is a strategy that promotes financial discipline and ultimately leads to the accumulation of wealth over time.

Key features of the SIP:

- The frequency of investments is typically monthly or even quarterly.

- You can even start by investing ₹500 per month in most mutual fund options.

- SIP eliminates the need to time the market, giving you market independence.

- You can buy more units when the market is low and fewer units when the market is high.

According to AMFI, SIPs have crossed the ₹27,000 crore mark.

Are SIPs Safe?

Every investor looking to invest in a SIP has one common question: Are SIPs safe? Well, when compared to lump-sum investments, they are relatively safer; however, it does not imply that they are risk-free. The risk will still be there; however, it will be lesser compared to other types of investment.

Let's understand why SIPs are relatively safer:

- The investments under SIP are primarily in mutual funds, which invest in various financial instruments, including equities, hybrid assets, and debt funds.

- SIPs are known to reduce the risk through regular investing. However, the market performance will still have an impact.

- Debt funds, which carry significantly lower risk, on the other hand, stocks are more volatile; however, they also offer higher returns when considered for long-term investments.

To conclude, if you are an investor looking to invest long-term while ensuring that your investments are safe and your wealth grows at a good rate, opt for an SIP.

Different types of SIP

SIP doesn't come in a one-size-fits-all investment portfolio. The choice of investment can also depend on the investor. Investors can choose to invest in mutual funds, stocks, or debt funds. Other factors that can impact the choice are cash flow, investment strategy, and financial goals.

Let's understand the different types of SIPs an investor can choose:

1. Regular SIP

- Under this type of SIP, a fixed amount is deducted at a fixed interval of time.

- This type of SIP is great for individuals with a stable income who are on a budget.

2. Step-up SIP

- Under this type of SIP, you have the option to increase the amount at predefined intervals automatically.

- This is a great option to align your investment with income growth or salary hikes.

3. Flexible SIP

- Flexible SIP allows investors to adjust the investment amount according to their financial situation.

- It is a great option during economic fluctuations and is also well-suited for freelancers with inconsistent income.

4. Perpetual SIP

- Perpetual SIP includes continuous investments until you cancel it.

- At the start of the investment, there are no end dates.

5. Trigger SIP

- This type of SIP starts when a specific event or market condition is met. For example, nifty falling below a certain level.

- This is recommended only for highly experienced investors, as timing can be somewhat complex.

6. Stock SIP

- Under this type of SIP, investments are made in individual stocks rather than mutual funds.

- SIP in stock is a great choice for investors seeking a diversified stock portfolio.

Is SIP a Good Investment?

SIP has several advantages, but it also has a few disadvantages. So, is SIP a good investment? The answer is yes, it is a good investment, and here are the reasons why:

- SIPs are all about investing in a disciplined manner, which is the hardest part for a beginner.

- SIP is a great place to start with a small amount, making investments less intimidating.

- Even modest SIPs can bring substantial results with compound interest.

- SIPs are comparatively less volatile than other types of investments.

- You get the option to pause, stop, and even increase the SIP amount as needed.

Advantages and Disadvantages of SIP

Like any investment, even SIP has advantages and a few disadvantages as well:

Advantages of SIP:

- SIP is quite budget-friendly, allowing you to start with as little as ₹500.

- It's automatic, meaning you can set it up once and let it run automatically.

- It promotes habit formation, enabling you to become more disciplined in your investing.

- You can gradually understand market volatility management.

- Long-term compounding amplifies returns.

- Investor customisation options in terms of fund type, frequency, and amount.

Disadvantages of SIP:

- Returns from SIPs are subject to the mutual fund's performance.

- When it comes to equity funds, there are also risks of short-term losses.

- During a financial crunch, fixed deductions may be inconvenient at times.

- Since SIPs are more automated, investors can rely overly on the automation and stop tracking their performance.

Risks in SIP

There is a common misconception that SIPs are risk-free; however, a small level of risk is still associated with SIPs. Here are the various types of risks in SIP.

- Market Risk: Equity funds can fluctuate significantly in response to changes in the stock market.

- Credit Risk: If the underlying company defaults, there are risks associated with the debt SIP as well.

- Interest Rate Risk: When interest rates rise, it can affect debt funds.

- Liquidity Risk: Some SIP funds may also have lock-in periods or exit loads.

It is best to choose funds depending on your investment horizon and risk tolerance. Additionally, review and rebalance as needed.

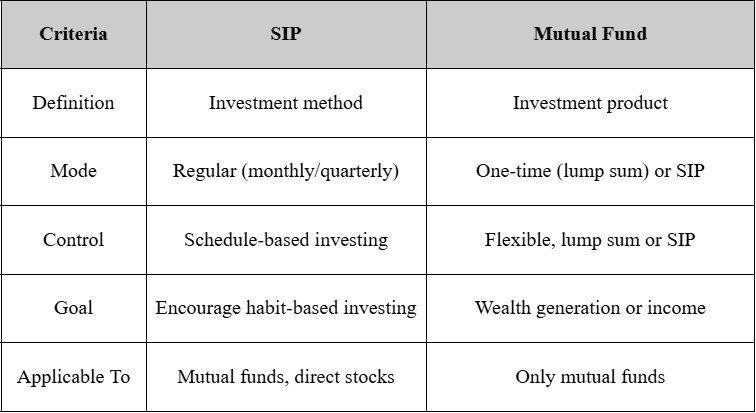

What is the difference between SIP and Mutual Funds?

The key differences between SIP and mutual funds are explained in the table below:

How SIP in Stocks Works?

Although SIP is primarily into mutual funds, SIP in stocks is also gaining considerable momentum. Here are some key points for investors to remember.

- It is essential to buy shares in small proportions.

- It is best to diversify your stock portfolio gradually.

- SIP stocks are available on various platforms, including Zerodha, Groww, and Upstox.

Conclusion

SIP provides a smart, beginner-friendly, yet disciplined way to invest in mutual funds or stocks. Investments are not risk-free; thus, SIP also involves some risk. Nonetheless, they manage market volatility better and build wealth through consistency and compounding. SIP is the right balance between accessibility and potential discipline when it comes to finances. Before starting the SIP investment, consider all aspects carefully.

FAQs About SIPs

Is there a lock-in period for SIPs?

Most SIPs have a lock-in period for at least six months. Also, the lock-in amount will depend on the mutual fund scheme you have selected.

Is skipping SIP payment possible during a financial crisis?

Yes, it is possible to skip or cease SIP payments in case of a financial crisis. However, it is highly recommended not to skip any SIP payment.

What is NAV in SIP?

NAV is the Net Asset Value, which is the price per unit of a mutual fund.

Can I secure my future with SIP?

Yes, whether you want to save for retirement or support your child's education, it is possible through SIP.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment