What are Active Funds and Passive Funds?

When starting to invest, one of the most fundamental decisions revolves around choosing between active and passive funds. While on the surface, both appear similar pooling money from multiple investors into securities, they differ profoundly in their goals, costs, risks, and outcomes.

Choosing between active and passive funds is quite an important task for investors with a long-term outlook, as this decision can significantly impact their financial future. This in-depth guide examines how these two fund types operate, assesses their actual performance, and investigates how investor sentiment influences money flow into funds.

What are Active Funds?

Active funds are overseen by a professional fund manager or a dedicated team, with the primary objective of delivering returns that exceed those of a benchmark, for example, the S&P 500 or Nifty 50. To achieve this, managers engage in thorough research, scrutinise corporate financials, assess broader economic trends, and apply quantitative analysis to uncover investment opportunities they believe the market has not yet fully recognised.

They can adjust their holdings swiftly, shifting out of sectors they expect to underperform or overweighting in companies that promise superior results. Such flexibility will help achieve better performance, but it also carries the risk of poor calls and timing errors.

Active funds typically have higher fees, reflecting the costs of research teams, market analysis. Annual expense ratios commonly range between 0.5% and 2.5%. These fees compound over time and can substantially reduce net investor returns.

What are Passive Funds?

Passive funds, also called index funds or passive ETFs, are designed to recreate the performance of a particular market index. Instead of trying to beat the market, they follow it. When the index adjusts its list of stocks, the fund adjusts its portfolio to match the index.

Because holdings are determined by rules rather than manager judgement, passive funds involve far less trading, reducing both direct costs and tax liabilities. The absence of extensive research teams and frequent trades means their expense ratios are typically in the 0.05% to 0.5% range an order of magnitude lower than active counterparts.

The passive philosophy appeals especially to long-term investors who value predictability, transparency, and low costs. As famed investor John Bogle, founder of Vanguard, said, "In investing, you get what you don't pay for."

Real-World Performance: What Do the Numbers Show?

Global Underperformance of Active Equity Funds

Studies consistently show that a majority of active equity funds underperform their passive benchmarks once fees are accounted for. The S&P SPIVA (S&P Indices Versus Active) reports that just 10% of international active funds beat the S&P over 20 years. Even over shorter horizons, about 90% of active funds fail to beat the index.

In the U.S., an overwhelming 92% of active large-cap funds have underperformed the S&P 500 over the past decade. A Reddit summary underscores: "Over the past 20 years, about 90% of active funds produce inferior returns to low‑cost index funds."

Morningstar's Active/Passive Barometer (June 2024)

- Approximately 51% of active funds surpassed their average passive peers across categories in the year to June 2024 almost a coin flip.

- However, only 29% outperformed over the prior decade.

- U.S. large-cap funds have performed poorly: just 37% outperformed over the year and only 7% over the past decade.

Sector Variation: Bonds and Small Caps

Not all asset classes are equal. Active managers have fared better in fixed-income markets, where Morningstar reports over 63% of active bond managers beat passive peers in 2024, and 79% did so in intermediate core bonds. Similarly, categories such as small-cap and emerging-market equities exhibit higher active success, but this varies regionally.

Fees, Taxation, Transparency: Costs Add Up

Expense Ratios: The Hidden Drain

The difference of a few tenths of a per cent in fees matters dramatically over decades. The Investment Company Institute reported that in 2021, active funds averaged 0.68% annually, while passive funds averaged just 0.06%.

Consider the following scenario: a ₹100,000 investment with a 2% annual fee grows to approximately ₹260,000 in 25 years, compared to ₹430,000 with a 0.5% fee. The disparity arises due to the compounding of fees.

Transparency and Control

Passive portfolios faithfully reflect an index's composition easy to analyse and monitor. Active funds disclose their holdings periodically (e.g., quarterly), providing less insight into their daily strategy. This opacity introduces added risk.

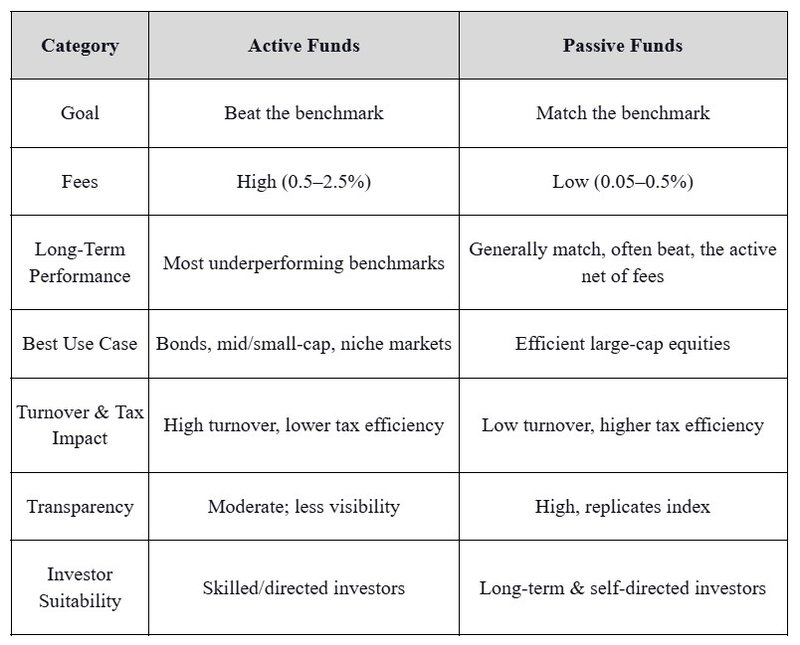

What is the Difference Between Active Funds and Passive Funds?

Though active funds and passive funds look similar, they are quite distinct. Here are the key differences between active funds and passive funds.

Broader Trends and Future Outlook

- Since 2008, there's been a major shift toward passive investing, now holding more assets globally. SPIVA data confirms that 79% of fund managers failed to beat their benchmarks in recent years.

- In many markets, passive assets now exceed active assets (e.g., U.S. passive ETFs recently reached $13.8 trillion).

- Technology's dominance, particularly among mega-cap firms such as Apple, Amazon, Nvidia, and Microsoft, has made it extremely challenging for active equity managers to outperform.

- Active ETFs are emerging but face the same fee and skill challenges as traditional active mutual funds.

- In both mature global markets and emerging economies, such as India, growth in passive fund adoption is likely to continue as investors are becoming increasingly cost-aware and tech-savvy.

Real-Life Examples and Insights

U.S. Large-Cap Equities

U.S. large-cap passive funds have steadily outperformed active funds, especially during 2024's tech-led rally. Passive S&P 500 returns reached 26.9%, while active U.S. large-cap funds averaged only 22.2%. Active managers who underweight mega-cap tech often lag the market, even if they succeed elsewhere.

Emerging Markets and Europe

Active management occasionally excels in niche global markets. For example, Japan and global emerging-market equity funds exhibit better active outcomes: 46% of active Japan funds and approximately 52% of emerging-market funds outperformed their benchmarks over five years. But long-term consistency remains rare.

Bond Market Success

The fixed-income arena is where active managers shine most. In 2024, 79% of intermediate-core bond managers beat passive peers, mainly by trading credit spreads and durations. Given the bond risk-return structure and lower liquidity, active decision-making will bring significant value.

India's Mid-Cap Opportunities

While passive equity funds are on the rise, India's mid-cap and small-cap segments now provide more opportunities for active managers. However, performance tends to be unpredictable, and fund managers struggle during market volatility. It is, therefore, essential for investors to carry out thorough due diligence.

Rebalancing and Monitoring Tips

- Regularly check performance versus benchmarks (1, 3, and 5-year returns).

- Watch fee trends higher expenses may justify exiting a fund.

- Rebalance yearly back to your core-satellite mix.

- In India, track passive fund growth and penetration periodically; expect stronger growth ahead.

Conclusion

The final call between active funds vs passive funds investing goes beyond personal taste it plays a crucial role in a plan to cut costs, handle risk, and boost returns. Active funds might yield better results in certain market areas, but passive funds tend to do better for most investors over time. Many people find that the ideal approach is to strike a balance by creating a portfolio that mixes the reliable nature of passive investing with specific active strategies.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment