What Happens to Your 401K When You Move Back to India for Good

Hey there! So, you're a working professional in the U.S., but now you're gearing up to head back to India That’s a huge and exciting move! But wait what about that 401K? It's just sitting there in your financial portfolio, and you're probably wondering, 'What happens to it once I make the big move?' Let’s break it down.

What Exactly Is a 401K?

You probably already know this, but let’s quickly recap the essentials of a 401K before diving deeper. It's a U.S. retirement savings plan that allows employees to save a portion of their paycheck before taxes are deducted. The money is invested and ideally grows over time, and many employers sweeten the deal by matching contributions essentially free money! These plans are tax-deferred, meaning you won’t pay federal income taxes until you withdraw, typically after age 59½.

Now, just as a refresher, here are the three main types of 401K plans:

> Traditional 401K

Contributions: Pre-tax

Taxes: You pay taxes when you withdraw

Employer contributions: Optional and may have vesting schedules

> Safe Harbor 401K

Like a Traditional 401K but with a twist: employer contributions must be fully vested immediately

No annual testing needed (great for businesses!)

> SIMPLE 401K

Designed for small businesses

Fewer rules, easier to manage

Employees can’t get contributions from other retirement plans

What Happens to Your 401K When You Move to India?

Spoiler alert: You don't have to panic. You've got options.

Option 1: Leave It Alone (For Now)

Your 401K doesn’t disappear when you move. You can leave it as is, and it will still grow with the market. But remember:

Withdraw before age 59½ → 10% penalty + taxes

Withdraw after 59½ → No penalty but still taxed as income in the U.S.

If you want to use this money in India, you can transfer the funds to your Indian bank account via bank or money transfer services under the correct purpose code. You can either do a lump-sum withdrawal or a pension-style monthly withdrawal. The respective tax implications are mentioned further.

Option 2: Rollover to a Traditional IRA

A Traditional IRA is a retirement savings account that allows individuals to contribute pre-tax income, which can grow tax-deferred until retirement. You can ask your old 401K provider to move your money. Some of its benefits are:

However, if the withdrawn funds are not deposited in an IRA within 60 days or are deposited incorrectly, it could be treated as a distribution, leading to taxes and early withdrawal penalties.

Option 3: Rollover to a Roth IRA

You pay taxes now, but withdrawals in retirement? 100% tax-free

Great if you expect to be in a higher tax bracket later

Watch out: rolling over a pre-tax 401K to a Roth IRA triggers an immediate tax bill!

Tax Impact on Withdrawal in U.S and India

Lump Sum Withdrawal

In the U.S.

Taxed as ordinary income

30% withholding tax for non-residents

Plus, a 10% early withdrawal penalty if you're under 59½ (unless you qualify for exceptions)

Let's understand this with the help of an example. Suppose you are over 59.5 years of age and want to withdraw $100000, then:

Tax withheld by IRS (flat 30%) = $30000

Net amount received = $70000

If you were under 59.5 years, you would have received $60000 after deducting the early withdrawal penalty of $10000 (10%).

In India

If you're a Resident & Ordinarily Resident (ROR): 401K income is fully taxable

If you're a Resident but Not Ordinarily Resident (RNOR): some tax benefits for 2–3 years after moving

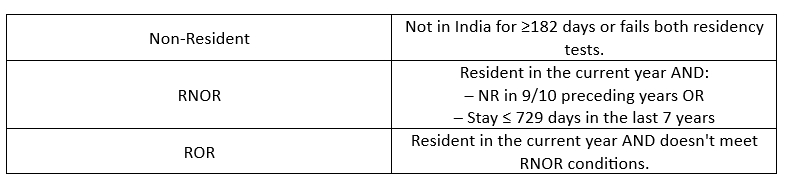

Here is a guide to know which category you lie in:

Good news: The India-U.S. DTAA (Double Taxation Avoidance Agreement) lets you claim credit for taxes paid in the U.S. (Use Form 67 in India)

Monthly Pension-Style Withdrawals:

> India taxes it (as per your income tax slab)

> U.S. shouldn’t tax it but only if you submit IRS Form W-8BEN to your 401K provider

> This tells the IRS you're a resident of India and eligible for tax relief under DTAA

> Without this? You’re stuck with a 30% U.S. tax hit

How to Bring the Money to India (Repatriation Tips)

When you begin withdrawing funds from your U.S.-based 401K account while residing in India, you would want to transfer (repatriate) those funds to your Indian bank account for use or investment. This process involves a few important regulatory and compliance steps:

Use an NRO Account (Non-Resident Ordinary):

An NRO account is a rupee-denominated bank account used by NRIs to manage income earned in India, such as rent, dividends, pension, or any Indian-source earnings.

> Best for foreign income like rent, dividends, and 401K withdrawals

> Funds are taxable in India

> Repatriation is allowed but needs RBI compliance + tax documentation

Skip NRE for This:

An NRE account is a rupee-denominated bank account opened in India by an NRI to park foreign earnings.

NRE accounts are for tax-free foreign income

Most 401K withdrawals don't qualify for direct NRE deposits

Stay FEMA-Compliant:

Follow FEMA and RBI rules for inward remittances

Use Form 15CA/CB when repatriating larger amounts

6 Smart Planning Tips (Trust Me on These)

> Don’t withdraw all at once it could push you into a crazy high tax bracket

> Rollover to an IRA for better investment control

> Use Form W-8BEN (U.S.) and Form 67 (India) to avoid double taxation

> Know your Indian tax residency RNOR status can save taxes in your early years back

> Hire a cross-border tax advisor they're worth their weight in gold

> Keep all your documents clean and updated especially addresses and tax forms

Mistakes to Avoid

> Forgetting to report 401K income in India (can lead to big fines)

> Trying to use an NRE account improperly

> Not telling your 401K provider you’re no longer a U.S. resident

TL;DR (For the Skimmers 😄)

Need help with the tax side? Or want to make your money work smarter in India?

Connect with us @FinAtoZ.com- RightFocus Investments Pvt Ltd.

Frequently Asked Questions - FAQ's

What happens to my 401k if I move to India?

You can leave your 401k as-is, roll it into an IRA, or withdraw it—each option has tax and legal implications for US and Indian residents.

Can I withdraw my 401k after moving to India?

Yes, but withdrawals may be subject to US taxes and a 10% penalty if taken before age 59½. Indian tax rules may also apply under DTAA.

Is it better to roll over my 401k to an IRA before leaving the US?

Rolling over to an IRA can offer more control and investment choices, and may simplify tax reporting if you're planning to settle in India.

Do I need to pay taxes in India on my 401k?

Yes, India may tax 401k withdrawals as global income. However, DTAA between India and the US can help avoid double taxation.

What is DTAA and how does it help with 401k withdrawals?

The Double Taxation Avoidance Agreement (DTAA) allows you to claim tax relief when withdrawing US retirement funds while living in India.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment