Shining Bright: How Much Gold is Right for Your Investments?

What do you think is the basis for a good investment portfolio? Is it Diversification? Is it Asset Allocation? Is it Returns? Is it Downside protection? Or Is it a Good Investment strategy?

We believe it is a result of a combination of all these factors. While various asset classes contribute to diversification, asset allocation, and downside protection, a solid investment strategy dictates the proportion allocated to each asset class. The term "diversification" often brings to mind equity and debt, What about Gold?

Gold has been an investment since time immemorial. While we know for sure that it is an essential part of diversification and a hedge against inflation, what percentage of the portfolio should be allocated to gold remains a valid, important, and subjective question. Having too much allocation can restrict your portfolio’s growth, while too little may leave it vulnerable during inflation or market downturns. The trick lies in striking a perfect balance.

The key question to consider is, what is the optimal percentage of gold in a portfolio to achieve balanced performance across varying investment horizons?

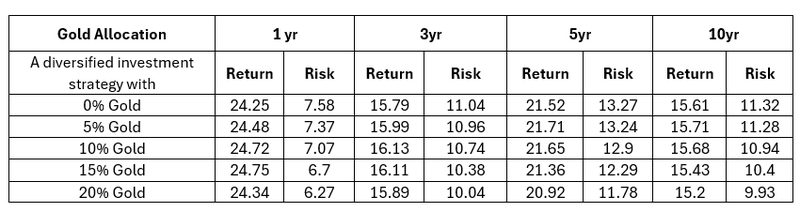

Here we have provided a comparative analysis to show how increasing or decreasing gold allocations in investment portfolios will determine the long-term risk-reward sustainability.

Objective: The analysis evaluates the impact of different levels of gold in a portfolio originally comprising only equity, arbitrage, and debt funds.

The comparison spans various periods, showcasing the impact during different market cycles

Key Observations:

- Returns vs. Gold Allocation:

- For 1-year, 3-year, and 5-year periods, returns improve up to 15% gold allocation but slightly drop at 20%. During this period, the world has seen many uncertainties like Russia-Ukraine war, Israel-Hamas war, recent corrections in the overvalued Indian equity markets. In such uncertainties, the gold has been looked upon as a safe haven and as such it has proven to perform well. This indicates that gold is a very good hedge to the portfolio in times of uncertainties.

For the 10-year period, returns peak at 5%, remain stable at 10%, and start declining from 15% onward. This indicates that equities are the best strategy for the long term.

2. Risk vs. Gold Allocation:

Analysis:

- Balanced Allocation (5%-10% Gold): Returns improve without a significant sacrifice in growth, while risk is reduced. This range represents the optimal balance between growth and stability.

- Higher Gold Allocation (>10%): The risk reduction continues, but the returns either plateau or decrease. Too much gold can limit portfolio upside potential.

- Ideal Range for Gold: Allocating 5%-10% gold enhances portfolio efficiency, balancing return and risk effectively. Allocating more than 10% may overly focus on stability at the expense of growth.

In conclusion, a moderate gold allocation of 5%-10% seems to strike the right balance for most investors. Maintaining 5% to 10% in gold appears to be the ideal range—it enhances the strategy's stability and efficiency without sacrificing much growth. Investing over 10% might diminish returns without providing substantial advantages in terms of risk reduction.

How much is too much? Well, you have the answer now.