Budget 2025: A Windfall for the Middle Class!

The much anticipated and awaited Budget 2025 has finally been unveiled, bringing a wave of relief and optimism for the middle class. With a series of well-targeted measures, the government has addressed key concerns and provided substantial financial benefits to this crucial segment of society. Budget 2025 promises to enhance the quality of life for millions of middle-class families across the nation. Let's delve into the highlights and understand how this budget is set to transform the financial landscape for the better.

1. Union Finance Minister Nirmala Sitharaman announced a host of measures while presenting the Union Budget 2025-26 in the Parliament on February 1, Saturday. The most important for middle-class and salaried taxpayers was the ‘zero’ income tax for those earning up to ₹12 lakh (or ₹12.75 lakh for salaried taxpayers with a basic standard deduction of ₹75,000). This measure aims at giving more disposable income in the hands of the common people.

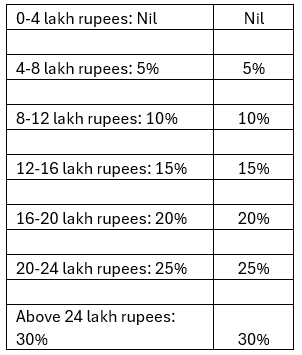

For a salaried taxpayer earning more than 12 lakhs of income, below are the new proposed slab rates for the new tax regime and their income tax liability will be calculated as per these slab rates:

The move is expected to boost household consumption, savings and investments and thereby uplift the economic growth. For people with financial goals, step-up SIPs can be now executed at enhanced levels to reach financial goals faster.

2. Start Ups to get further boost with increased funding options from the Government and increased credit guarantee cover. Hence AIFs for startups and FoFs to receive expanded funding scope. For UHNIs, wider and newer opportunities in startup investments can be expected.

3. Providing more clarity to income generated from AIFs the budget announced that going forward, all the income generated by Category I and II AIFs shall be treated as capital gains taxed at 12.5%. If such an income is categorized as business income, it would be taxed at 30% for residents and upto 39% for non-residents.

4. The credit guarantee cover for micro and small industries is also doubled, while also increasing the investment and turnover budget which will in turn help create more jobs.

5. The TDS on Senior citizen interest income will be levied on such an income exceeding 1 lac per year, as against 60k earlier. Retirement income from fixed income sources can be better planned & aligned.

6. TDS on dividend income - No TDS will be deducted up to ₹10,000. Earlier a dividend of ₹7,000 attracted a 10% TDS. It’s a small relief for retirees depending on dividend income.

7. TDS on Rent Payments - Applicable TDS rate is 10%. No TDS will be deducted on rent payments up to ₹5,00,000 per annum. Earlier TDS was applicable on rent payment of ₹3,00,000 in a financial year. It’s a decent relief for retirees depending on rental income. This may also indicate further increment in rents charged.

8. Remittance under LRS and overseas tour program package – Applicable TDS rate is 5%. No TCS is collected up to ₹10,00,000 of remittance. Earlier above 7 lacs of remittance attracted TDS. This is a decent relief for overseas investment options and overseas discretionary travel goals.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment