Employee Stock Ownership Plan (ESOP)

In today's competitive job market, where employee compensation extends beyond basic salaries, the Employee Stock Ownership Plan (ESOP) stands out as an innovative approach. It offers employees a stake in their company at a favorable cost, a factor that can significantly influence their decision to join or stay with a company. The employers decide the beneficiary employees, the number of shares, and the price to be provided under ESOPs.

This article delves into the critical aspects of ESOPs, including domestic and international taxation. Understanding these tax implications is crucial for employees, HR professionals, and financial advisors, as it can significantly impact the financial outcomes of ESOPs. The article also covers key definitions and strategies to minimize tax liabilities.

Key Concepts in ESOPs:

Grant Date: The date when ESOPs are granted to employees.

Vesting Period: Once ESOPs are offered, they remain in a trust fund for a specific period, called the vesting period. During this period, employees must stay with the organization to exercise their stock options at a predetermined price, typically lower than the market value.

Taxation plays a critical role in ESOPs, impacting employees during:

- Allotment of shares – taxed as a perquisite (Amount paid by the employee to exercise the option – FMV of the stock as on the exercise date).

- Sale of shares – taxed as capital gains.

ESOPs can be segregated as follows for taxation purposes:

- Domestic ESOPs

- International ESOPs for Resident Indians

- ESOPs for Non-Resident Indians (NRIs)

Further, it can be categorized either as listed or unlisted:

- Listed Shares: FMV is calculated using stock exchange data on the exercise date.

- Unlisted Shares: FMV is determined by a merchant banker within 180 days of the exercise date.

How to calculate the Fair Market Value of ESOPs:

Listed Stock:

- Where shares are listed on one stock exchange on the date of exercising of ESOP: Average of the opening price and closing price of the share on that date on the stock exchange.

- Where shares are listed on more than one stock exchange on the date of exercising of ESOPs: Average of opening price and closing price of the share on that stock exchange which records the highest trading volume in the share.

- Where shares are not traded on the stock exchange on the date of exercising ESOP, the closing price of the share on the stock exchange is on a date closest to that date.

Unlisted Shares:

Value of share as determined by a merchant banker on:

- The date of exercising ESOP

- Any date earlier than the date of the exercise of the option (Not 180 days earlier than the date of exercise).

Capital Gains Calculation for Taxation:

Domestic ESOPs:

When the employee sells securities allotted under ESOPs, the gains from the sale will be taxable under Capital Gains. The period of holding these securities will be calculated from the date of allotment and ends on the date when employees transfer the securities.

The fair market value of securities on the date of exercising the option shall be taken as the cost of acquisition of such securities to compute the capital gain. As the difference between FMV and Option value is already taxed under Prerequisites, Capital gains will be calculated from the date of allotment to the sale of shares.

Capital Gains: FMV as on sale date – FMV as on date of exercising the option

Taxability:

Consider an example where a company provided 5000 shares to one of its employees, Mr. A, during FY 21-22, with an exercise price of Rs 150 per share.

- In June 2022, Mr. A Exercised the option when the Fair Market Value of the share is Rs 250.

Perquisite Value: (FMV of share on exercise date – Exercise price) * No. of shares

= (250-150) *5000

=Rs 5,00,000

So, Rs 5,00,000 will be added to Mr. A's taxable income for FY 22-23. This amount will be taxed on the tax slab.

- In August 2024, Mr. A Sold the shares at Rs 400 each.

Capital Gains: (Sale Price – Purchase Price) * No of shares

= (400-250) *5000

=Rs 7,50,000

So, gains over and above 1.25 lacs will be taxed at 12.5%. Effectively, in this case, Mr A will be charged 12.5% on Rs 6,25,000, which is Rs 78,125.

Know more about ESOP Taxation: Tax Treatment for ESOP

International ESOPs for Resident Indians:

Where an Indian employee (Resident Indian) is allotted shares of a foreign parent company, the company is regarded as holding foreign assets. It needs to be disclosed in the employee's Indian tax return.

For a Resident Indian, all the income from anywhere in the world is taxable in India. A non-resident or resident but not an ordinary resident is not liable to pay tax if they have sold shares outside India.

The first instance of taxation occurs when the resident employee entitled to ESOPs of a foreign company purchases the stock. Here, the difference between the fair market value of the stocks and the option price paid by the employee is taxed as a perquisite in the hands of the resident employee. (In India)

In the second instance, capital gains arise when the employee sells such stocks in the open market. Such capital gains are taxed under Income from Capital Gains.

Typically, as per the DTAA, ESOPs would be taxable only in the country where employment is exercised. In this case, it would be India. Therefore, in most countries (DTAA countries), no tax should be levied on the ESOPs granted, provided the tax residency certificate is submitted. However, capital gains from the sale of the allotted ESOPs would be taxable in that foreign country.

ESOPs for Non-Resident Indians (NRIs):

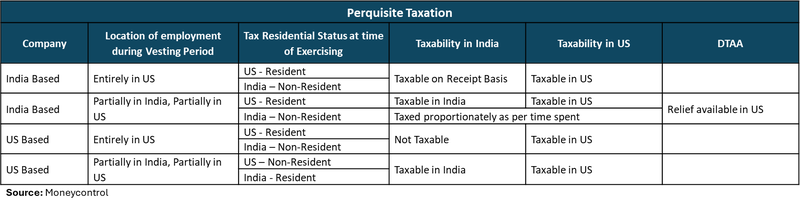

The taxation of ESOPs gets complex if you are an NRI (non-resident Indian). The taxation depends on the following factors:

- Location of employment during the Vesting period

- Tax Residential status at the time of exercising the option.

- Company based in which country.

Note: If a person has resided in more than one country during the vesting period (period from grant date until the point in time you can start exercising the ESOP), the perquisite value (taxable value) of ESOPs at the time of exercise may be allocated proportionately to these countries.

For an individual who is a US Person because of citizenship or the issuance of a Green Card, gain from the sale of shares in an Indian company will be subject to US tax regardless of physical residence.

Taxability:

When the employee finally sells the shares that have been allotted, Capital gains arise. The Capital Gains taxation is affected by Residency status and Company Registration status.

Check out for more details: An NRI’s guide for ESOP taxation in India

Is there a way to minimize the Capital Gains Tax?

Liquidating ESOPs does raise concerns about heavy tax implications. However, there is a way to minimize these Capital Gains. This provision comes from Section 54F of the Income Tax Act.

Section 54F:

Section 54F of the Income Tax Act allows one to claim exemption from tax on long-term capital gains arising from the sale of the shares if the same is used for the purchase or construction of a house within specified time limits. This section applies to NRIs as well.

Following are the key points in respect of this section:

- Assessee should be an Individual or HUF.

- Capital Gain should arise from selling any capital asset other than the Residential House.

- Capital Gain should be invested in purchasing or constructing a residential house in India within the specified time frame.

- Time limit for Purchase or Construction: The purchase should have been made either a year in advance or 2 years after the date of transfer, and construction should have been completed within 3 years from the date of transfer.

- As per Union Budget 2023, the Maximum Deduction allowed is Up to Rs. 10 crores.

54F provides an excellent opportunity for individuals seeking to minimize their tax liabilities. Proper understanding and utilization of this section can help people make informed decisions about reducing their tax obligations.

Capital Gains Account Scheme:

If the assessee cannot reinvest the proceeds immediately, which might result in disqualification for 54F Exemption, a provision is available in this situation. CGAS is a governmental scheme allowing taxpayers to park their capital gains in the CGAS account and secure their exemption under sections 54 and 54F if they cannot reinvest the proceeds immediately.

The government determines the interest rate, which can change occasionally.

Conclusion

ESOPs can be a powerful tool to meet financial objectives when effectively incorporated into a more comprehensive financial plan. By understanding the potential value of ESOPs and growth trajectory, employees can align these assets with specific goals such as buying a home, funding higher education, or building a retirement corpus. For instance, proceeds from ESOPs can be strategically used to meet short-term needs or invested further for long-term wealth creation. Diversifying the proceeds into other asset classes—such as equities, mutual funds, or fixed-income instruments—helps mitigate the risk of overexposure to a single company’s stock.

Additionally, employees can optimize their ESOP benefits by leveraging tax-saving provisions like Section 54F, which allows reinvestment of capital gains to reduce tax liabilities. Proper timing for exercising and selling ESOPs, informed by tax implications and market conditions, ensures that employees retain more of their hard-earned gains. Regular portfolio reviews and consultations with financial advisors can help make adjustments as goals or market dynamics evolve. ESOPs can transition from a workplace benefit to a cornerstone of personal financial security and growth when strategically planned.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment