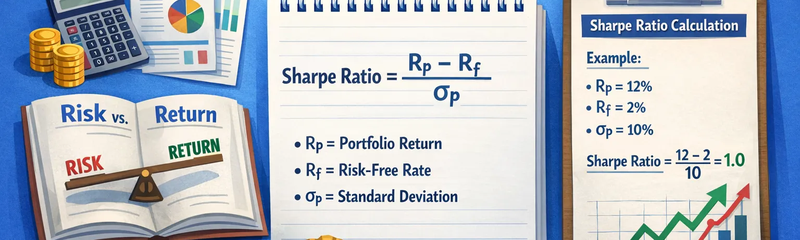

What is the Sharpe Ratio in Mutual Funds? Meaning, Formula, and Calculation

The Sharpe Ratio shows the risk-adjusted return of a mutual fund. In other words, it tells you how much extra return a fund gives compared to a risk-free option like a fixed deposit, and how much risk it took to earn that return. This is the core meaning of the Sharpe ratio.

Continue reading »