Unveiling India's Growth Story

Unveiling India’s Growth Story: Why Long-term investing makes sense –

Financial markets often experience phases of relative calm followed by abrupt and usually unanticipated spikes in volatility. Investors must understand that volatility is normal and beyond their control. However, they can control how they react. Generally, the best reaction is no reaction at all. Pulling out of the market when it is volatile can lock in losses and prevent them from participating in any subsequent rally.

India's Economic Ascent

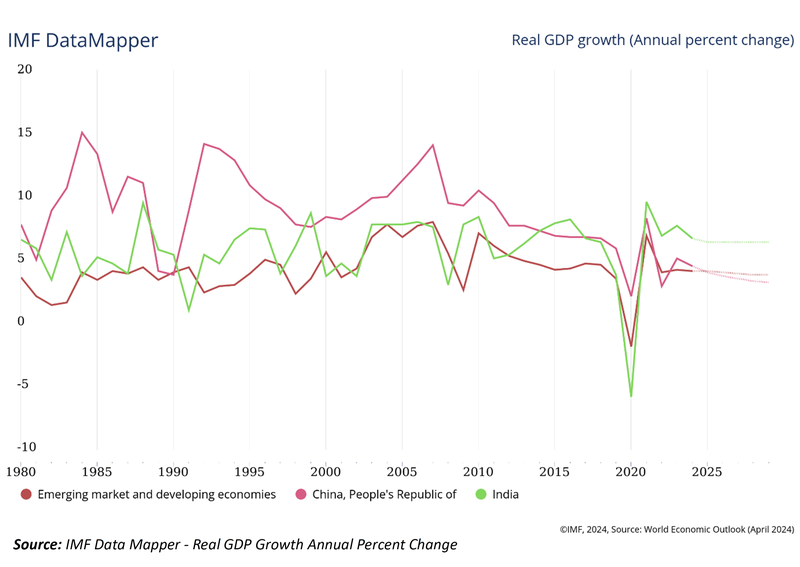

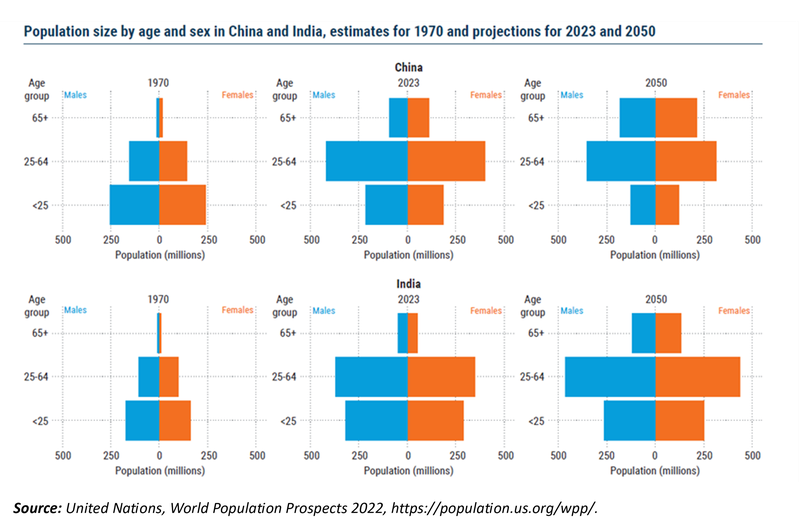

India's economy has taken impressive strides in recent years, outpacing China's growth rate. In 2024, India's GDP growth stood at a robust 6.8%, surpassing China's 4.6%. This shift marks India's emergence as a formidable economic force, creating a wealth of long-term investment opportunities. As China faces a demographic turning point with an ageing population, India benefits from its youthful workforce and is expected to continue contributing to its growth for decades.

While the proportion of adults aged 25-64 in India currently exceeds the number of younger people by 20%, this working-age population is projected to keep growing. In contrast, China is nearing the peak of its demographic advantage. This demographic divergence between the two countries is one of the key drivers behind India's strong economic prospects. Migration from northern and eastern India to more developed southern regions can also help sustain the demographic dividend in older areas.

Lessons from China’s Economic Journey

In 2021, China's per capita income ($12,556) was six times that of India's ($2,256). However, in 1990, India's per capita income ($368) was higher than China's ($318). China's significant progress is mainly due to its focus on manufacturing and infrastructure areas where India is now making substantial advances. Both these aspects have been at the forefront of Indian policymakers' agenda. Likewise, India could take other cues from the East and the West, emulate their fruitful measures, avoid their follies, and unlock our true potential.

Rising Incomes and The Digital Economy Boom

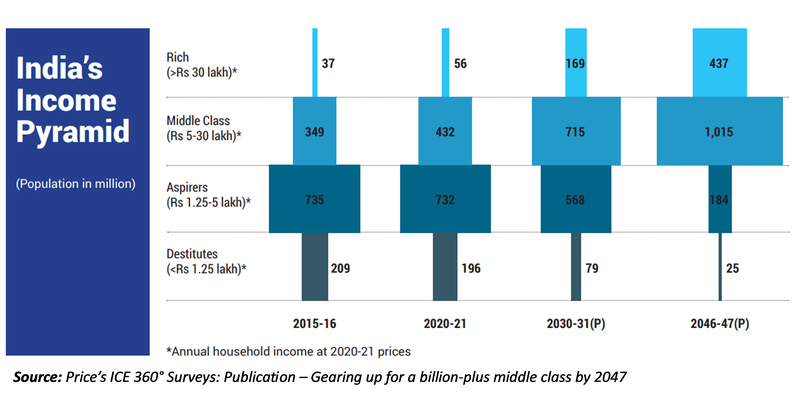

The projection of India's income pyramid highlights significant shifts in the distribution of income groups over three decades. Between 2015-16 and 2046-47, experts expect the population of the "Rich" (households with an annual income over Rs 30 lakh) to rise dramatically from 37 million to 437 million. They also project the "Middle Class" (households earning between Rs 5 lakh and Rs 30 lakh) to grow significantly, increasing from 349 million to 1,015 million. Based on prices from 2030-31, these projections indicate a pronounced shift towards higher income brackets, reflecting anticipated economic growth.

Source: Price’s ICE 360° Surveys: Publication – Gearing up for a billion-plus middle class by 2047

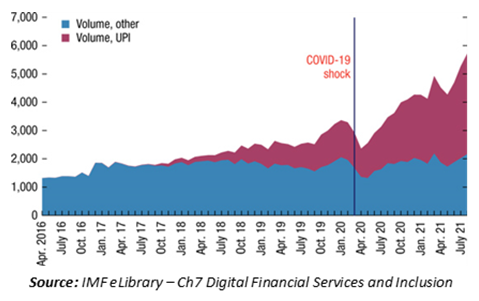

Digital financial services have played a significant role in achieving economic progress, supported by unique digital infrastructure and an enabling regulatory environment. Inventions like India Stack, which provide seamless access to financial services, have led to a significant rise in digital payments, reaching even rural areas. This surge has helped stabilize incomes and increase sales for businesses in the informal sector. Moreover, India Stack's capabilities extend beyond open banking, enabling open finance with potential synergies across banking, wealth management, insurance, and other financial products on a global scale.

In conclusion, India's youthful workforce, rising consumer spending, increased savings, and a sharp poverty reduction all contribute to an enhanced standard of living. These factors will likely attract more global investments, create jobs, and boost tax revenues, further fuelling India's growth story. Despite the current overvaluation in many market segments, timing the market is demanding. For long-term investors, the message is clear: staying invested in India's growth story could yield significant returns over time.

As India modernizes its infrastructure and embraces digital innovation, it will create more opportunities for investors and position the country as a significant player in the global economy for years to come.

Click here to read more on India: A Unique Growth Model The Investment Solution – https://blog.iodglobal.com/india-a-unique-growth-model-the-investment-solution/

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment