Union Budget 2023-24

Directing India towards the 5 trillion economy:

By: Anshuman Meher | Ass. Wealth Manager | FinAtoZ – RightFocus Investments Pvt. Ltd.

With the celebration of the 75th Independence Day, on 1st Feb - the Minister of Finance Nirmala Sitharaman has presented the budget for FY 2023-24, the first budget in 'Amrit Kaal'. The budget primarily focuses on increasing consumption for all income classes and improving the education and healthcare sector for robust economic growth in FY 2023-24. Despite the massive global slowdown caused by Covid and war, India has not only managed to recover efficiently but has achieved the highest growth rate among the developed and developing economies.

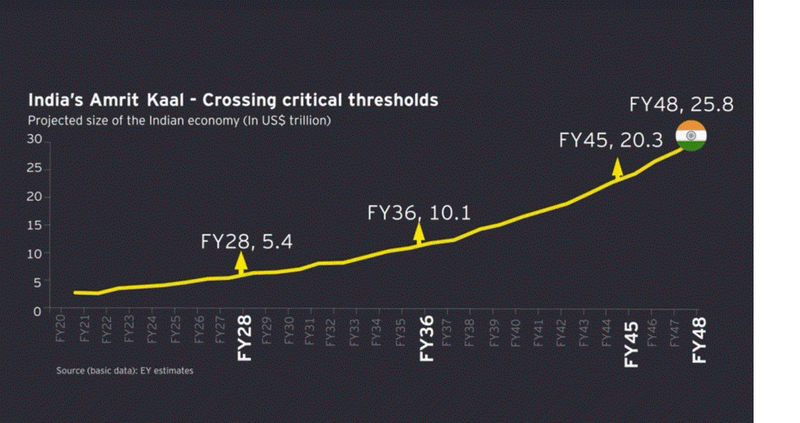

With our policies and strategies in place, the world has recognized the Indian economy as a 'bright star' with an estimated GDP growth rate of 7% in the current year. It is expected to reach the 5 trillion mark by early 2028 (source: EY data).

Some key features of the 2023 budget:

- Significant changes in personal income tax:

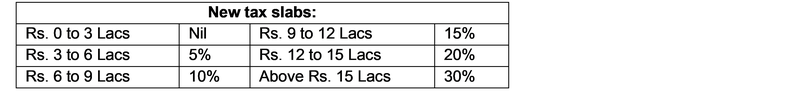

- The new tax regime will be the default tax option.

- The income tax rebate limit increased to Rs. 7 lacs under the new tax regime.

- The tax slabs will be limited to 5 in the old twin structure system introduced in 2020, and the tax exemption limit has been increased to 3 lacs.

- The highest surcharge rate was reduced to 25% from the earlier 37% in the new tax regime.

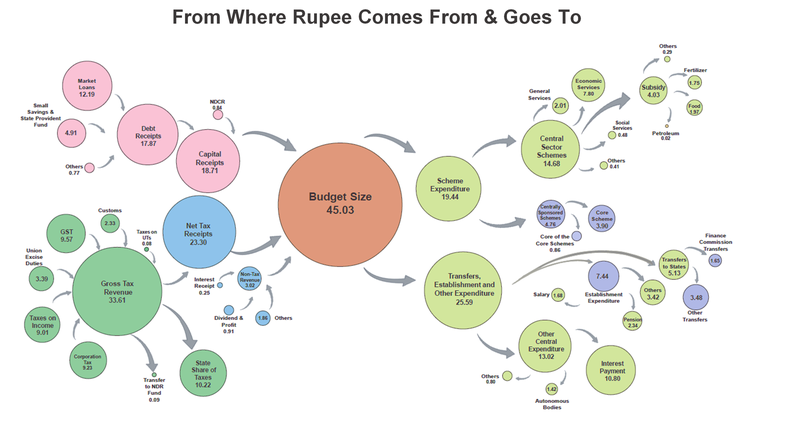

- Capital expenditure increased by 33% to Rs. 10 lac crores.

- The agriculture credit target increased to 20 lac crores from 18 lacs crores in 2021.

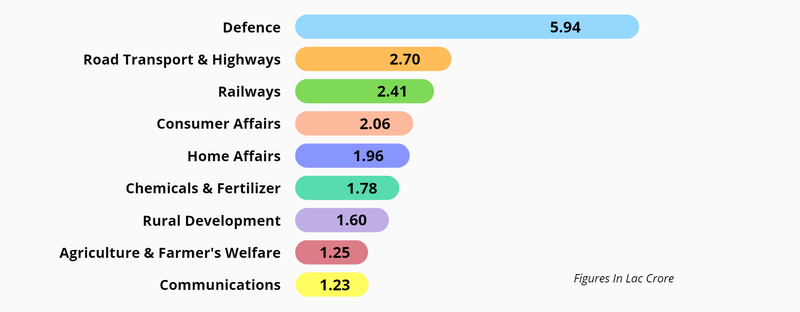

- A capital outlay of Rs. 2.4 lac crores have been assigned to Railways.

- Establishment of 157 new nursing colleges.

- Setting up a National Digital Library.

Breakdown of the Union Budget:

Allocation of budget for specific ministries:

The effect of union budget 2023 on different sectors:

In light of the budget 2023 Agri, Infrastructure, Fintech among 7 sectors to benefit the most:

A. Agriculture:

Indian agriculture and allied industries are the 2nd largest producer in the world and have reached a market value of more than 400 billion USD in 2022. The market is further expected to reach an approx. value of 580 billion USD by 2028 at a CAGR of 4.9%.

Agri accelerator fund, open-source digital public infrastructure, agri start-ups by young entrepreneurs, and a horticulture clean plant program will bring growth and generate enormous opportunities for the sector. The agriculture credit of 20 lac crores will be focused on bringing innovations and technologies to transform agricultural practice as well as other allied services like animal husbandry, dairy, and fisheries.

B. Infrastructure:

The Minister of Finance, in her budget, had a clear focus on long-term GDP growth by multiplying investment outlay towards infrastructure, e.g., connectivity, logistics, health care, education etc. This will have a large multiplier impact on economic growth and employment generation.

The capex investment has been increased by 33% from last year's allocations to Rs. 10 lac crores. This will benefit the players in infra development and capital goods manufacturers, i.e., steel and cement companies, infrastructure development companies, etc.

C. Fintech:

The budget's major focus on fintech was the financialization of assets, simplifying the taxation process and ease of investments.

Under the digital India initiative, simplifying the KYC process with a one-stop digital solution gives us freedom from the existing 'KYC Raj'. In addition, using Digilocker coupled with 5G service, Aadhar (for individuals) & PAN (for non-individuals) as foundational identity/common identifiers for all digital systems will curtail the time significantly for new KYC registration and KYC updation.

Further, the 'National Financial Information Registry, an open-source consent-based data repository, will be a public good, unlike the close credit bureau.

The issuance of legal heir certificate or succession certificate as transmission documents will be simplified as Tehsildar, and above gazetted revenue officials will be allowed to document the same for smoother and simpler succession.

Making the transfer of physical gold into electronic gold receipt (EGR) and vice versa has been made tax neutral to bring in the 25,000 tonnes of physical gold held by Indian households and temples to the financial system. This will help the govt. to reduce the import of gold and keep the rupee value at a maintained level by managing the foreign reserve account.

However, the budget had some bleak effects on the high-value real estate properties and MLDs (Market Linked Debentures). These products will now be less attractive to investors as the government eliminated or curtailed most of the tax benefits.

The unlimited exemption of LTCG (Long-term Capital Gains) on house properties under section 54 and section 54F of the Income Tax Act was removed, and a cap of Rs. 10 crores was placed instead. This will discourage individuals from holding multiple high-value real estate properties.

MLDs are like derivatives and provide variable interests as they are linked with market performance. These were previously taxed as long-term capital gains at 10% without indexation, but as proposed in the budget, they will now be taxed as short-term capital gains irrespective of the holding period and per the individual's slab rate.

‘Is the budget in line with the long-term projection?’

Overall, the budget is positive for all sectors as it gives more consumption capacity to the consumers, and the capex is up sharply, which clearly shows a higher growth in GDP. Moreover, with the increased cash flow, the spending and investment capacity will add up to the financial system and boost the domestic economy.

Further, simplified taxation, capital expenditure, promoting domestic value addition and local manufacturing, tweaking in custom duties, improving the ease of doing business, better logistics and connectivity all support the growth process.

One of FinAtoZ's recommended 'BCAD-themed Unifi PMS' products is likely to perform well in the long run as it is focused on consumption-oriented companies and stocks.

India, a young populated nation, has a solid and capacity-building workforce to drive the economy towards being the 3rd largest economy and a global power by 2030.

The minister of finance also said there will be a revenue loss of approx. Rs 40,000 crore (5 billion USD) because of the new tax proposals. So, 5 billion USD for a projected 5 trillion USD economy is not significant enough to move the needle. The budget is never aligned with short-term growth but is focused on long-term projections.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment