All about Employee provident fund -EPF

Image source: INDIA TV

Employee Provident fund

The first question that a person asks HR when the salary is being discussed is “How much cash would I receive in-hand?” People often do not consider the deductions made in the salary only because they do not get in their own hands. Employee Provident Fund (EPF) is one of the deductions made from the salary account. Even though you don’t receive it in hand, it is one of the investments you make indirectly which would help you build your retirement corpus and make you ready for retirement.

What is EPF?

The Employees' Provident Fund is one of the most traditional and popular savings schemes launched in India under the supervision of the Indian government. The EPF is a retirement benefits scheme that is available to all salaried employees and is managed by Employee Provident Fund Organization (EPFO). Any company with more than 20 employees is required to register under the EPFO. The employee and the employer contribute to the EPF scheme on monthly basis in equal proportions of 12% of the basic salary + dearness allowance.

8.33% of the contribution made by the employer is directed towards the Employee Pension Scheme. Once an individual retires, both the contributions made by the employee and the employer until that period will be received as lumpsum along with interest, where the interest will be tax-free. The interest is a fixed percentage that is set by the EPFO every year.

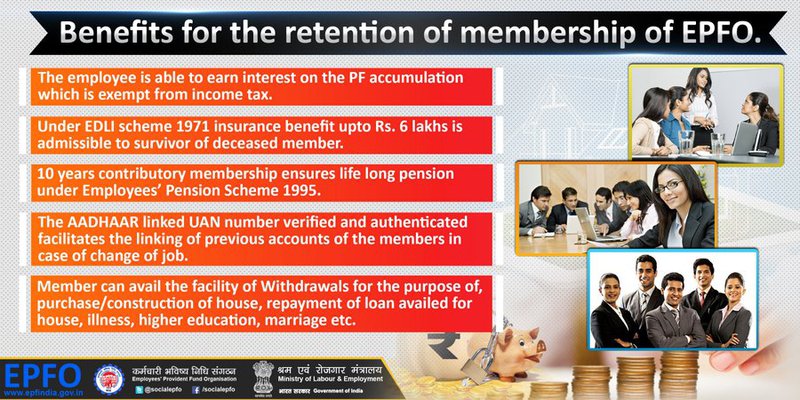

Benefits of EPF

-Tax Exemption- Taxes can be availed while on employer’s contribution, interest earned and on withdrawal.

- The employer’s contributions of 12% on an employee’s salary to EPF is tax-exempted.

- The interest earned on the entire EPF amount (including VPF) is also tax-free.

- The entire money you withdraw is entirely exempted from tax, provided you withdraw the amount after a minimum lock-in period of 5 years.

Employer contribution

Till March 2020, only employer contributions of over 12% was liable to tax. But as per the 2020 budget, the contributions to PF, National Pension Scheme and Superannuation fund in excess of 7,50,000 per annum and the interest thereon would be taxable in the hands of the employee.

Recent implications on taxation of EPF/VPF

It was also announced during the budget 2021 that the contributions made after April 2021, on both EPF and VPF over 2.5 Lakhs in a financial year will be taxable. Whatever is in excess of 2.5 lakhs, will be in a separate basket and interest on that corpus will be taxable. The 2.5 lakhs threshold is for non-government officials. In the case of Government officials, the threshold is set at 5 lakhs. This move was taken by the central government to potentially impact employees in the high-income bracket or employees making large voluntary EPF contributions.

-Insurance Benefits- Although this does seem to be a direct benefit, in the absence of group life insurance, the employer has to contribute 0.5% of the total basic towards life insurance.

-Added Benefits- The accumulated funds in EPF can be withdrawn for special occasions/ emergencies such as

· Housing- EPF holder can withdraw the EPF amount for the purpose of construction of a house, where the contribution has been made for 3 years. Whereas for renovation, the minimum contribution must be 5 years.

· Marriage/ Education- 50% of the EPF surplus can be withdrawn for a maximum of 3 times if the contribution has been made for 7 years.

· Unemployment- If a person faces an unemployment/ loss of income, they can use the PF amount as a supplement income. One can withdraw 75% of the fund after one month of unemployment, the rest 25% in the second month of unemployment.

· Medical emergency- No limit of minimum contribution.

· Easily accessible – With the linking of Aadhar to the UAN, a member can transfer his/her PF funds during the transfer of jobs automatically by submitting Form 13.

-After Death Benefits- You can nominate anyone for your Employee provident fund account. Although this is the most basic feature of EPF, not many people know that you can nominate any family member. This family member can then claim this account in case of the death of the account holder.

Employee Provident fund Interest rate (2020-2021) The EPF Interest rate is fixed at 8.50% for the financial year 2020-2021. The govt. of India along with the Central Board of trustees pre-decides the rate of interest and is fixed for a period of one year beginning from (1st April- 31st March). Though the contributions are made monthly, the interest is calculated yearly as follows

- Opening balance (IF any) + Contributions made during the year + Interest received on the contributions made during the year and the opening balance.

The latest amendment as of 20th November 2021 by the Ministry of Labour and Employment states that one need not worry about transferring or merging the EPF when a job change happens. The EPF account will continue to be the same even after the job change. Currently, the UAN number remains the same and the EPF account number changes. The new development will remove the requirement of transfer of account on change of jobs.

What happens if no contributions have been made for 3 years?

If no contributions have been made for a period of consecutive 3 years, the account becomes inactive though the interest keeps getting accumulated till the retirement period but is not paid for people post-retirement where the accounts have been inactive. It is also important to note that the interest earned on inactive accounts are taxable as per law.

Inactive Account vs Non-contributory account

EPFO defined inactive account as “any EPFO Account which fails to make contributions for 36 continuous months (3 Years) is called INOPERATIVE Account. In addition to this, the PF account will become inoperative if an employee does not apply for withdrawal within 36 months of retiring after attaining 55 years of age. If you are a resident Indian who has been contributing towards the PF account while working in India, the account can remain operative and can continue to earn interest on the accumulated sum even after becoming an NRI. If the person is going to settle abroad permanently, it is advised to close the account after withdrawing the total balance.

As per the current rules, EPFO will credit the interest on such non-contributory accounts up to the age of 58 years. After 58 years, the account will be treated as INACTIVE (but not immediately after 3 years non-contributory period). The retirement age for EPF is 55 years. Hence, EPFO will pay you the interest up to the age of 58 years (Retirement age+3 Years).

Employee provident fund tax implications

The contributions made under the EPF are exempt from taxes and fall under the EEE category- where no taxes are levied on the contributions made, capital gains and withdrawal. However, there are a few new exceptions to be checked. As of April 2021, If the contribution is made over 2.5 lakhs, the interest will be Taxable and come under the ETE Category.

Employee Contribution

A salaried employee contributing towards EPF can claim tax deductions of upto 1.5 lakhs under Section 80C Act. However, if the employee withdraws any partial amount due to emergencies, it would be taxable.

EPF withdrawal

The accumulated EPF amount is withdrawn at the end of the employment period. If the employee withdraws at the age of 58, 100% of the corpus can be withdrawn. 90% of the corpus if the person is over the age of 54 or above. EPF amount can be withdrawn at the time of any emergencies apart from the age criteria mentioned in the scheme.

Premature PF withdrawals are also allowed in case of financial emergencies like weddings, higher education, purchase of land/ house, medical emergencies, house loan repayment, renovating a housing property but these can be withdrawn only if the employee has completed 5 years of continuous service.

Taxes on withdrawal

Even though it is said that the taxes on the withdrawal are tax-exempt, it comes with certain exceptions.

Before 5 years- If the employee has not completed 5 years of service, then the amount withdrawn will be taxable in the hands of the employee at withdrawal. But there are a couple of exceptions to that rule.

· Firstly, if the employment is terminated due to an employee’s ill health, the employer has discontinued its business or any other reason for withdrawal which is beyond the control of the employee. In such a scenario, the EPF amount withdrawn before five years of employment is considered tax-free in the hands of the employee.

· Secondly, suppose the employee changes his employer in less than five years. In that case, the employee can transfer his PF account balance for the existing employer to the new employer. In this case, the PF balance remains tax-free.

After 5 years- Suppose the employee has completed a consecutive five years of service. In that case, the amount withdrawn is tax-free in the hands of the employee in the year of receipt.

Suppose the EPF withdrawal amount is less than Rs.50,000 before completion of 5 years of service, in such instances. In that case, the individual must pay tax on the EPF withdrawal amount if he falls in the taxable bracket (based on this tax slab rate).

Suppose the EPF withdrawal amount is more than Rs.50,000 before completion of 5 years of service, in such instances. In that case, TDS (Tax Deducted at Source) is deducted. If a PAN card is furnished, then 10% TDS is charged. If a PAN card is not submitted, then TDS is at the maximum marginal tax rate. However, No TDS if Form 15G/15H is submitted. (For further information please click here)

What happens to Post-Retirement EPF Balance

Till the time one remains under an employment contract and if the individual keeps the EPF investment intact till retirement, the complete amount is exempt from taxes, but if the withdrawal is delayed, any interest earned on the EPF balance post-retirement is taxable.

EPF regulations on International Workers who are not covered under the Social Security Act (SSA)

An SSA is a bi-lateral instrument that protects the interests of the workers in the host country. The Government of India through its initiative for the benefit of both the employers and employees has entered into an agreement with several countries to ensure that the employees of the home country do not remit contribution in that country, get the benefit of totalisation period for deciding the eligibility for pension, may get the pension in the country where they choose to live, and the employers are saved from making double social security contributions for the same set of employees.

As per the regulation, International workers can only withdraw their PF only at the age of 58 or permanent disability but only under the following conditions-

· If the international worker is covered by an SSA, the worker may withdraw the provident fund in accordance with the regulations of that particular SSA.

· If the worker is not covered by an SSA, you can withdraw the provident fund at the age of 58, which is the retirement age. However, exceptions are made if you have retired due to any incapacity for work or suffering from leprosy, cancer, and tuberculosis.

·An international worker under an SSA may have the provident fund credited to your bank account outside of India. However, if it does not cover SSA, the PF will be credited to your bank account in India.

·The Reserve Bank of India allowed expatriates to keep their bank accounts in India even after repatriation to pay their outstanding contributions.

Thus, EPF can be considered as one of the ways where a salaried employee can make a good corpus through regular investments while also having the tax benefits. It also benefits in the way that, even though you might change your job several times throughout your career, your benefits keep adding up to the UAN number which is registered under your name.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment