Why investing in ULIP is a Mistake?

How many times your bank relationship manager has pitched you ULIP (Unit-Linked Insurance Plan) and has discussed with you about different advantages of ULIP. So, we all are well aware of the advantages of ULIPs but none of us is aware of the hidden disadvantages of ULIP.

In this blog, we are going to talk about some mistakes which investors make in their early life. Many experienced investors would be able to relate to it because often we make these mistakes as there was no one to guide us when we started our journey of wealth creation.

Mentioned below are the mistakes which we generally make:

- Mixing insurance with investments.

- Relying on some Endowment plan for the Retirement.

- Investing in Some Kid's ULIP policy for the kid's graduation and post-graduation.

- Thinking that insurance cover which we got with the ULIP and Endowment plan will be enough for our dependent if we are not there.

Reasons we get into these wrong financial products:

There are millions of investors in India, who have lost a lot of money in bad products which were sold to them by someone close to them.

Investors trust close relatives and friends while investing their hard-earned money and invest money based on relations, hearsay or recommendations and don ’t think enough before writing that cheque. Often relatives pressurize you to take a policy. This is particularly true for Endowments policies, ULIP’ s and other insurance products. You will often find someone in your close circle who is an agent and your parents trust them like anything and force you to buy a policy from them

So the family uncle becomes the insurance advisor and the tax-saving expert, and the friend in the next cubicle is your financial advisor at times.

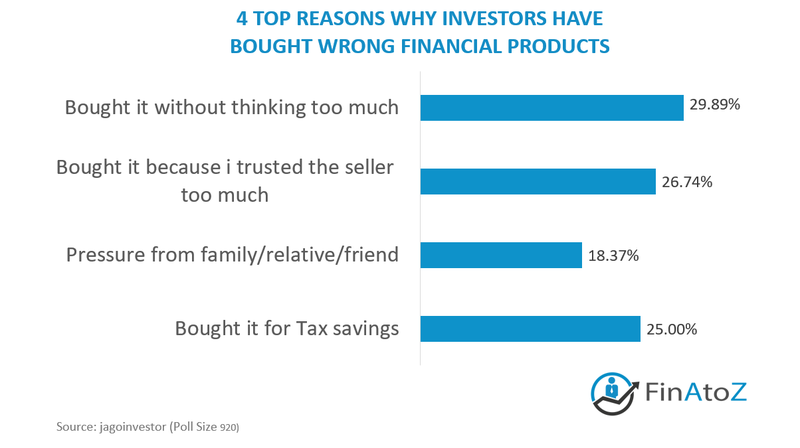

Check the poll results below where 920 investors have shared why they bought a financial product which they realized is a wrong one for them:

.

Why we should not invest in Products like Endowment Policies and ULIP's?

High Expense -

In these types of plans, from the premium you pay, the insurer deducts charges towards life insurance (mortality charges), administration expenses and fund management charges. So only the balance amount is invested. Due to these costs, the residual investment of your ULIP may give lower returns even if the market is doing well. These types of policies are sold hard due to the attractive commissions for the agent.

Mentioned below are the charges :

Less cover and high premium-

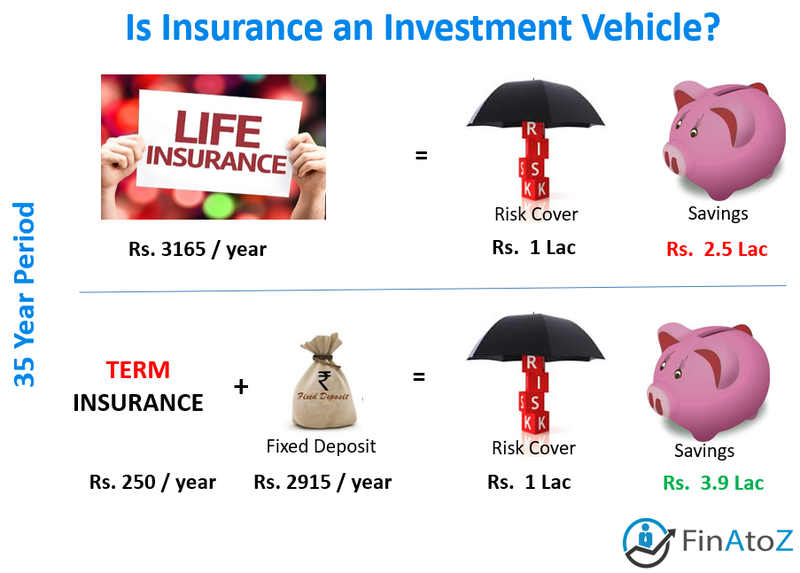

Now let's understand this thing with the help of an example that how much extra do we pay for buying this packaged product and what all benefits do we miss as compared to pure term plan and FD.

As mentioned in the above image, In the case of ULIP the annual premium which we pay is around is Rs.3165/year for that we receive the cover of around 1 lac and at the time of maturity total investment corpus will be around Rs. 2.5 lacs. In the second image if we go ahead with the option of Rs.1 lac term insurance then we will be paying the premium of around to Rs.250 per annum and the remaining amount Rs. 2915 ( 3165 - 250) if will invest that amount in FD every year then the total corpus at the end of 35 years will be Rs. 3.9 lacs. There will a difference of around Rs. 1.4 lacs in the total corpus which is more than 50% as compared to the first image scenario.

What to do in case you have already purchased a ULIP?

Now, will see what are the corrective measures to come out from these policies.

Surrender- In ULIP's there is a lock-in period of 5 years. So, if the investor has completed the first 5 years then the way out is to surrender the policy. Hence, there will be no surrender charges or tax liability on surrender.

The process of surrendering the policy is not as easy as buying the policy. The only available way is to do it offline. You have to visit the branch of the policy provider and submit the policy documents and copy of Pan Card. But you need to be very careful while visiting the branch for surrendering the policy because this is very common that they will convince the investor to buy the new policy and you will again get into the same trap.

Paid-up - Another available option is to stop paying the premium and make it paid up. This option is relatively very easy compared to the first one. In this option, you just need to stop paying the premium and at the time of maturity, you will get the accumulated premium paid till today compounded at the rate of saving bank account.

Hence below is a very crisp checklist of what a new investor can start with.

- See how much term plan you need and take it

- See that you buy a good health insurance policy.

- See that you have started a recurring deposit or SIP in mutual funds for a minimum amount you are sure will not stop for the next 5 yrs.

- Keep 2 months worth of expenses on the side in a saving account which you generally do not touch.

- Make sure you are meaningfully saving your taxes.

- Hire a good financial advisor if you feel you need handholding.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment