When it makes sense to invest in PMS?

Have you ever came across to any wealth manager pitching Portfolio Management Services to you. If yes, he might have told you about the high expectation of returns from PMS. However, very few of you might have finally ended up doing any investments in PMS.

Why? Because you don't only want the returns, you want to have clarity about the product, its working and moreover suitability in your portfolio.

In this article, we are going to analyse when and why PMS makes sense in your portfolio. After reading this article, you should be able to decide whether PMS fits as a suitable product for your financial journey.

When it make sense to invest in PMS?

Let us first understand what it is?

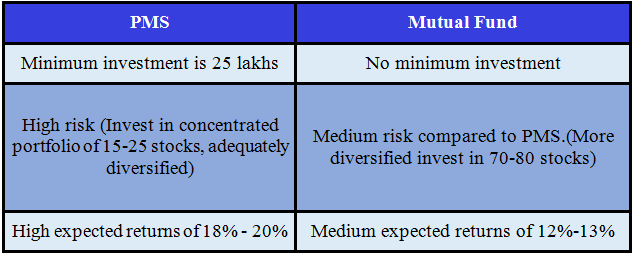

Portfolio Management Services is a tailor-made investment service offered by a portfolio manager to cater the investment objectives of high net worth individuals. The PMS strategy will invest in a focused and customized portfolio of 15-25 stocks. As the diversification is concentrated, the risk is high and accordingly expected returns are also high.

Types of PMS

Discretionary - Where the investment is at the discretion of the fund manager and the client has no intervention in the investment decision.

Non-Discretionary - Under this service, the portfolio manager only suggests the investment ideas. The choice, as well as the timings of the investments, rest solely with the investor. However, the execution of trades is done by the Portfolio Manager.

So, ideally who should invest in this high risk, high return instrument?

Who can invest in PMS?

There are two suitability Criteria.

1. Ability to take the risk-

PMS is suitable for only those investors whose net-worth is approx 2 cr to 3 cr. because It is advisable to allocate approx. 15%-20% of total assets in PMS. Let's understand this thing by taking two different examples.

Suppose you have a net worth of Rs. 50 lacs and you are putting 25 lacs in PMS. It means you will end up investing 50% of your portfolio in PMS. So half of the portfolio is locked in one product which has a high correlation with the market. There are basically 2 issues with this strategy. First, high liquidity risk as money will not be readily available in case of urgent need. Even, if you were successful redeeming it, you might end up in big losses. Secondly, 50% of the portfolio is concentrated in one product. Any good correction in PMS in short term will turn out as a reasonable correction for your overall lifetime savings.

Now, suppose you have a net- worth of Rs. 3 cr and you are investing Rs. 50 lac in PMS. It means you are investing only 16% of your portfolio in PMS. This takes care of liquidity as well as concentration risk. Maximum recommended allocation is 15-20% of the overall portfolio.

2. Willingness to take the risk:

After SEBI’s categorization mutual funds can mostly invest in the top 100 or 250 stocks whereas PMS is customized and can have an exposure to any stock in addition to this top 250 stocks. So, if someone looking to take exposure in stocks beyond 250 stocks in terms of market cap with a guided hand, its a go-to product.

The thought process behind launching PMS

Usually, PMS is based on certain themes or any specific situation in the economy. The ultimate goal is to take advantage of these situations.

Let's try to understand this thing with some examples:

A. GST Beneficiary- Business migration from unorganized to organized.

B. Agriculture -A play on rising rural income.

C. Affordable Housing - Government focus on housing for all by 2022.

D. Electric cars - Companies which are into the manufacturing of electronic cars.

Let's understand how PMS is different from an equity mutual fund?

The Mutual fund collects your money and invests in stock, bonds or mix of both along with another investor’s money. In a mutual fund, you own units of the fund, whereas in PMS you own individual securities. We can basically say PMS invests in the ideas and Mutual funds invest in the market.

Charges

PMS Charges will be 2.5% of the AUM. It may have other charges also like entry load, fund management charges, profit sharing charges etc. depends on the provider. Mutual funds mainly have an expense ratio of 2%- 2.5% and for some funds exit load also there if they exit before 1 or 2 years.

Taxation

In PMS, taxation is based on the transaction. All the transactions are tax liable if there is any capital gain. Whereas in mutual fund taxation is based on the units and tax will be there only if the investor exits from the fund.

What as an advisor we do?

As an advisor, we provide a suitable investment option for our customers based on their requirement. So if you actually believe that this product is suitable for you then based on our research & analysis, we will give you the best PMS providers. Also, we keep a track of the chosen PMS provider's performance and analyze them regularly.

To compare the PMS providers and their performances please click on the below link.

To know more about the PMS provider’s performances, you can check on the SEBI’s site on the below link.

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doPmr=yes