Comparison of different Financial Advisors

Picking the right financial advisor is incredibly important. You're selecting the person who will be in charge of your money, and who (you hope) will make that money grow over the years. Hire the wrong financial advisor, and you could end up spending your golden years struggling to scrape by.

On the other hand, the primary job of a financial advisor is to help you understand your goals and achieve them, by managing risk and investing your money in the suitable instruments. A financial advisor can help you purchase a stock or insurance policy, but a good financial advisor will put your needs first – regardless of any benefit they might earn from the sale of a product.

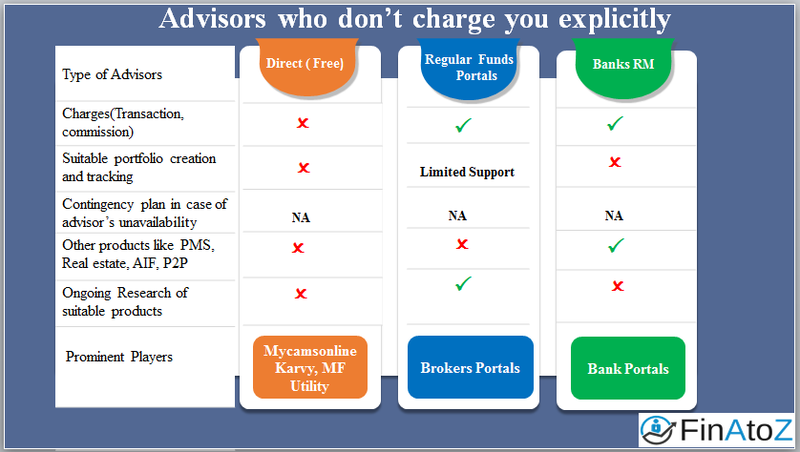

We have divided the various types of advisors into two categories. Category 1, is the set of advisors / portals who don't charge you explicitly for their advice. Second is Category 2, for the type of advisors who charge you explicitly for their advice. Below is a detailed comparison of the different types of advisors:-

Category 1: Financial Advisor who don't charge you explicitly

I. Direct (Free)

Portals like mycamsonline, mfutility etc. provide the option for you to invest in Direct Mutual Funds. This mainly suits the “do it yourself” person who manages her investments on her own. The first advantage here is that you get the consolidated view of all your direct mutual funds holding at one place, which otherwise is not possible if you invest with the mutual fund company directly. Secondly, this is the cheapest way to invest in the mutual funds. The drawback here is that you have to track the investments on a regular basis, monitor the markets and watch out for all possible risks. Also, there is very minimal assistance available in case you need help in choosing and tracking your investments. However, this space has become exciting with the entry of Paytm and let us see how they launch their services.

II. Regular Fund Portals

These are the online portals of your stockbroking company like hdfc-securities, icicidirect etc. They work on commissions and provide only suitability advise, ie, whether the advised Mutual Fund is good for short-term or long-term investments. The key advantage here is that they provide assistance in dealing with the Mutual Fund companies for offline holding redemptions, kyc renewal etc. While you get operational convenience, but there is very little personalised advice available from them as per your overall financial situation. Such a planning may be insufficient for most of us. And in our experience we have seen this work for cases where total investment is lesser than your annual salary. In such a scenario, there are some good portals like www.fundsindia.com which one can explore.

III. Banks

The primary difference between private banking and wealth management is that private banking does not always deal with investing clients' assets. Private bank staff may offer clients guidance on certain investment options, but not all banks will be involved in the actual process of investing assets for their clients. They don’t provide full-fledged advisory services. Instead, they push you into buying their co-branded products. For eg: HDFC Bank will encourage you to buy HDFC Life Insurance, Hdfc Ulip, HDFC Mutual Funds and so on. Besides, every six months, the advisors change and even though their original intent was to help you but the new person cannot continue as he will have to spend a lot of time to understand you and your portfolio all over again. This could again put you at risk as there is no single point of contact.

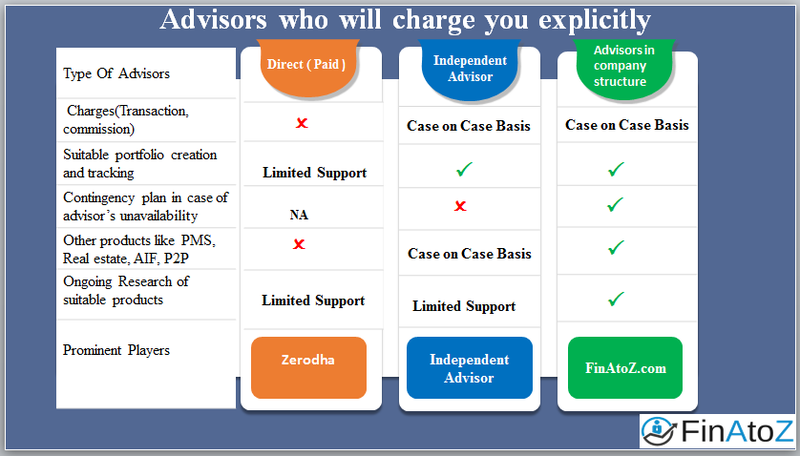

Category 2: Financial Advisor who charge you explicitly

IV. Direct (Paid)

They charge a fee for advisory since they give you the convenience of tracking all your direct funds at one place. However, if you want personalised advice or want to invest in products other than Mutual Funds, then they have very limited options. Their support regarding KYC renewal or changing address etc. is much better than the first option discussed as Direct (Free). So, they are the option for someone who wants lesser cost than the second option of Regular Fund Portals and better features than Direct (Free).

V. Independent Financial Advisors

They charge an advisory fee and could also charge other transaction charges and commissions depending on the engagement. The biggest advantage of an IFA (Independent Financial Advisor) is that they create a suitable portfolio for individuals and track it on a periodic basis. Also, most of the IFAs offer multiple financial products for investments other than Mutual Funds as well. However, since, they are mostly one man show, regular research can be challenging for some of them, and you may have to be satisfied with sub-par product options. Though you get personalised attention from one individual, in case of him being unavailable or any untoward incident, he will not be able to manage your finances, then you are left with no one trusted to take care of your finance. This can be really frustrating as you need to sync. up to about everything again with the new advisor.

VI. Financial Advisors in a company structure

This is far more reliable than any of the above options making your investments safe and secure. Financial Advisors, provide advice to clients to help them improve their overall portfolio allocation. A financial advisor sits down one-on-one with each client and discusses goals, comfort levels with risk, and any other personalisation the client may have regarding her investments. The financial advisor then composes an investment strategy that incorporates all information gained from the client to help the client achieve his goals. The financial advisor continues to manage the client’s money and utilises investment products that coincide with the client's risk-taking ability.

Also, in case your portfolio has to be transferred from one financial advisor to another, it can be quickly and very conveniently done in a company structure. Such advisors give you unbiased advice and suggest all kinds of products as per your portfolio, be it PMS, Real Estate Advisory, Peer to Peer lending, AIFs (Alternative Investment Funds) for suitable portfolios and so on. Having a company structure allows such advisors to have a dedicated team for research for comparing and analysing new products which are launched in the market. Also, their up-to-date analysis w.r.t new regulations help the advisors to be top of all the changes in the market. SEBI Recategorisation of Mutual Funds

In summary, if you don't need advice and can choose funds and other products on your own then Direct (Free) or Direct (Paid) are very cost effective options for you. However, if you need advice due to lack of time or knowledge about the various financial products then hiring a personal finance advisor in company structure is the most prudent thing to do.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment