New categories of Mutual Funds: How to choose the right one?

New Categories of Mutual Funds as per SEBI’s norms seeks to declutter the mutual fund selection process. It's supposed to makes the mutual fund selection process easier, simpler, and transparent. Is it really so? Lets try to find out!

In our previous blog on the same topic New Mutual Fund Categories and what you need to do,we gave an overview about SEBI’s Categorization & Rationalisation of mutual funds. In this article, we will try and explain how to select the appropriate mutual fund based on your risk profile and investment tenure.

As per new categories, mutual funds are further classified based on the market capitalisation, maturity of underlying securities etc. First, lets try to understand what are the changes after the new categorisation.

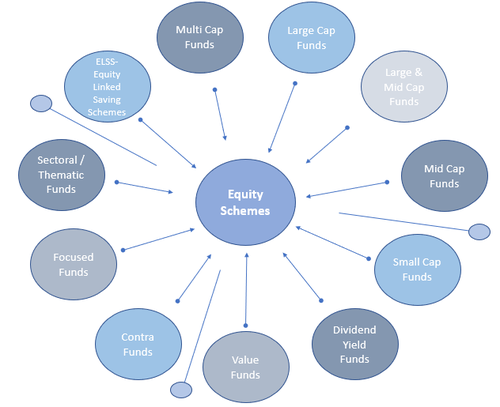

Equity Sub Categorisation

Equity funds are further divided into sub-categories based on the market capitalization. As per the SEBI’s guidelines the new categories of mutual funds has to group their equity schemes into Large, Mid and Small cap.

To ensure uniformity Large cap, Midcap & Small cap are defined as:

- Large Cap : 1st - 100th company in terms of full market capitalisation

- Mid Cap : 101st - 250th company in terms of full market capitalisation

- Small Cap : 251st company onwards in terms of full market capitalisation

Below funds are categorised based on the Market Capitalisation.

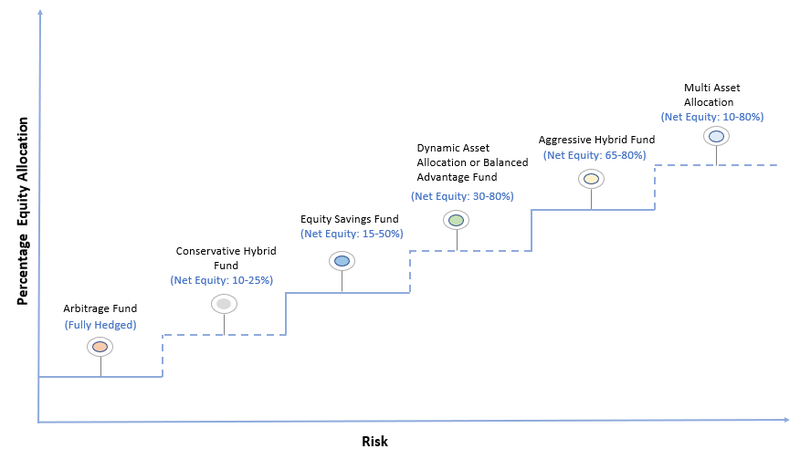

New Category: Hybrid Funds

Earlier there were mainly two hybrid funds. But as per the new categories of mutual funds there will be seven hybrid funds. Hybrid funds are mutual funds which invest in both debt and equity to achieve maximum diversification and good returns. Hybrid Fund has a balanced portfolio which is allocated in equity and debt in varying propositions. Hybrid Funds are safer than pure equity funds and give more returns than debt funds. Below is a short glimpse of different Hybrid schemes, classified as per the asset allocation.

Scheme Categorisation: Hybrid Funds

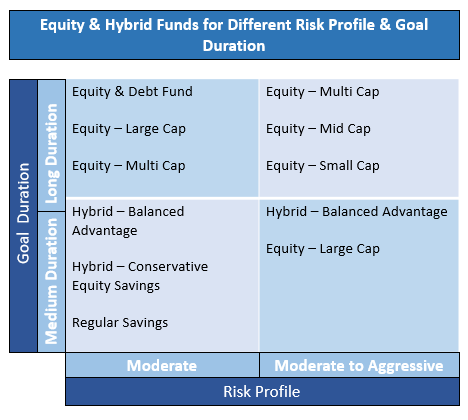

How to choose the right equity mutual fund based on your risk profile?

The scheme uniqueness helps the investor to choose the fund as per their return expectations and risk appetite. If the investment is for a long-term period and the investor’s risk profile is moderate, he can choose Equity Multi Cap or Equity Large Cap.

Similarly, if the investor needs the money within 4 years and his risk profile is mod-aggressive, he can invest in Hybrid Balanced Advantage or Equity- Large Cap

In the below table we have explained how to choose a fund from new categories of mutual funds as per your Risk profile and Goal duration.

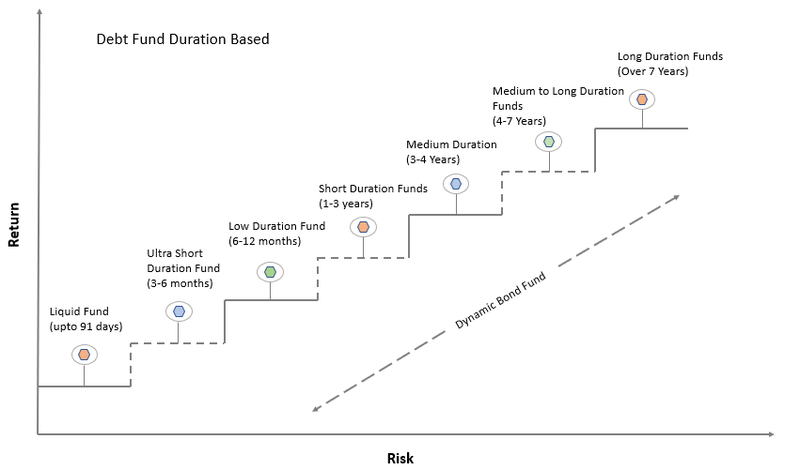

Debt Sub Categorisation

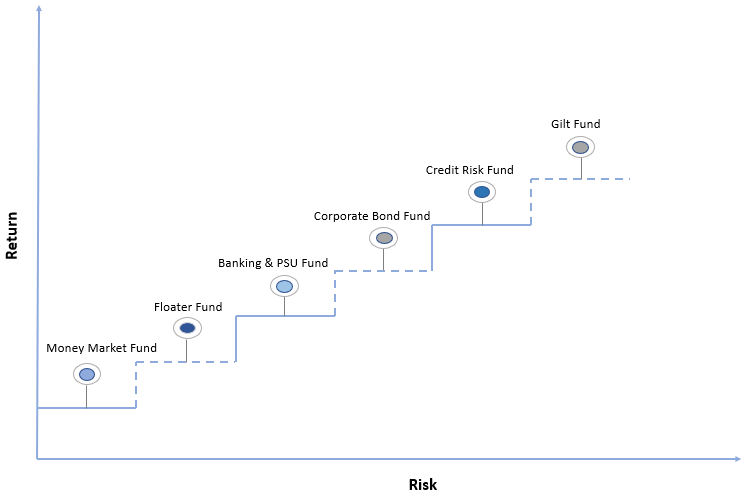

Similarly, Debt funds are further classified based on duration and instrument based. Based on duration debt funds are divided from Overnight fund to Long Duration Fund. And Instrument based funds are divided as Credit Risk Fund, Money Market Fund, Gilt Fund etc.

Below are the new Duration based debt funds as per new categories of mutual funds:

Following are the Instrument based debt funds as per the new categories of mutual funds.

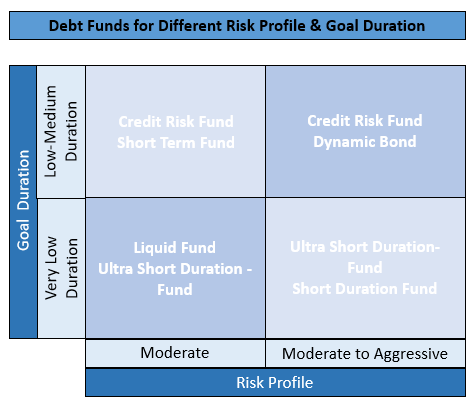

How to choose the right debt mutual fund based on your risk profile?

Debt Schemes are easier to choose after the re-categorization as the new categories of mutual funds are classified as per the duration. After the categorization, the maturity of the debt funds is defined, and it helps to track the fund’s relative performance. Also, it helps the investor to choose the fund based on their goal duration as the funds are aligned with the duration specified by the respective category.

If the investor’s risk profile is Moderate and his goal duration is low he can choose liquid fund or ultra-short fund. Similarly, an investor with mod-aggressive risk profile and medium duration, he can invest in Credit Risk Fund or Dynamic Fund. Here, we have explained how an investor can choose appropriate fund as per his Risk profile and Goal duration.

Also when the investor is nearing his goal, it is prudent for him to move the money from equity to debt. This is to safeguard the corpus. Even if the market crashes it doesn't affect the corpus as it will be safe in debt and earning a decent return but lower than equity. We will explain this in an example.

Example: Mr. Sharma needs 50 Lacs after 10 years for his son’s graduation. He can invest 25,000 monthly for this goal. After 7 years he should move the corpus to debt so that his money will be safe and still it will earn decent returns and he can achieve his goal.

To Conclude, SEBI’s re-categorisation and rationalisation was a bold move and to the investor it is much clearer, defined and easier to choose the fund as per their risk profile and goal duration.

Further Reads: Mutual Funds re-categorisation: Here's how to review your portfolio

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment