Why taking risk in long term investment makes sense?

Most of us want to keep our money safe while choosing to invest in our long-term goals like child education and our own retirement. This is done primarily because everyone has told us that investments in equity markets are risky, and we really don’t want to take the risk with our important goals like education and retirement. While it looks like a prudent choice, but unknowingly we are making the wrong choice of investment products, like FDs, NSCs, PPF etc. (Click here to know more why investing in FD for long-term goals is a wrong choice).

So, what should one do with his long-term goals? Well, for long-term goals, it makes perfect sense to take the risk. It may sound counter-intuitive, as we want to keep our money safe for important goals, but let’s see why this is our recommendation?

Firstly, one of the main reasons to consider risky investments, in the long run, is that ‘risky investments’ typically, takes care of inflation. One can expect around 12 – 15% returns in the long run from the risky equity investments.

Secondly, the longer you keep your investments in risky instrument higher is the chance to get positive returns. Let us illustrate this point by taking a specific example of Mr Ramesh who can tolerate a downside of 20% in his overall portfolio. Let us say he chooses to have 60% equity investments and 40% debt in his overall portfolio.

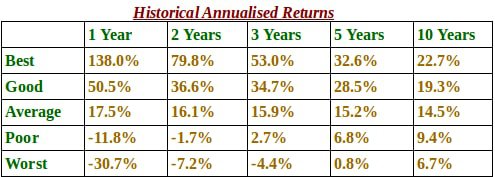

Now we simulate on the historical data of Sensex for the last 26yrs by varying the investment period. And let us assume we have invested for a period of 1yr starting from 2001, we will get 26 samples. We calculate the return percentage and then repeat the exercise with an investment period of 2yrs from 2001, we get 25 data points. We again calculate the percentage and tabulate the results. Below table shows the result obtained:-

You can observe that over the period of 1yr, Best returns are 138% with worst being -30.7%. However, for the investment period of 3yrs, the Best return are reduced by more than half to 53% and Worst is reduced by more than 1/5th to -4.4%. And the key data to note is for the 10 year holding period, where Best returns are 22% and worst returns are POSITIVE 6.7%, with the average returns of around 14.5% beats the returns from any safe instrument. And this now becomes obvious that risk of having a loss in the long term portfolio reduces significantly if we have investment horizon of more than 10yrs.

In general, the level of risk associated with a particular investment or asset class typically correlates with the level of return the investment might achieve. The rationale behind this relationship is that investors willing to take on risky investments and potentially lose money get rewarded for the risk taken. In the context of investing, a reward is the possibility of higher returns.

Thirdly, long-term equity investments offer a significant tax advantage: gains are taxed at just 12.5% if held for more than a year, and capital gains up to ₹1.25 lakh per year are exempt from capital gains tax. This makes long-term investing in equities a highly attractive option for maximizing your returns.

Hence investing for a long term has always proven to be more beneficial as it reduces the risk, is more tax-efficient and also beats inflation. So, choose your investment options wisely for your important life goals.

Happy Investing!

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment