How to create your personalized financial plan?

Financial Planning once upon a time was considered a prerogative of the rich and the elite, but in today’s time it has become more of a necessity for most of us. Consider this, while most of us can figure out how much we can save (based on our monthly expenses and income), it is difficult is to figure out whether that is enough for all our future financial goals. These goals could be as simple as a family holiday abroad or kids’ education, their marriage, our own retirement etc. To get this clarity one needs to create a Goal based financial plan.

A personalized financial plan broadly requires the following steps to be followed:

First step: Classify the goals based on their respective tenure

The reason to classify the goals is to choose an appropriate asset class for our investment. It is advised to classify all goals which one needs to achieve in the next 3 years as “short term” goals and the ones which can be realized after 5 years as “long term”. For short term goals the choice of investments can be Debt Mutual Fund or even fixed deposits. For long term investments, equity mutual funds and Portfolio Management Services, are more appropriate investment options.

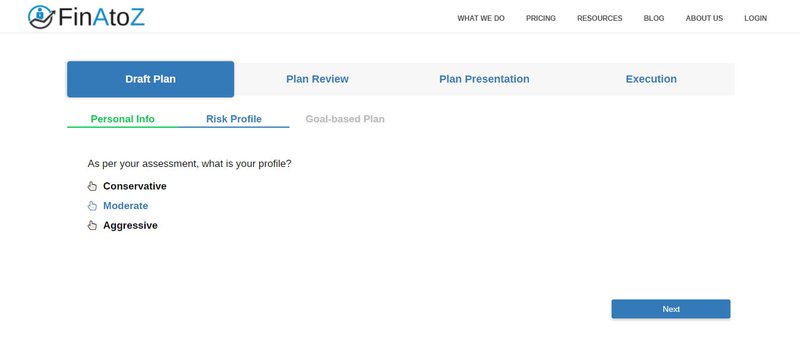

Generally, it is seen that people are not comfortable with equity investments because there is a risk of losing even the initial investment. However, it is statistically proven, (refer to our next article) that equities give good long term returns. One needs to consider, how much risk he is comfortable to take in his portfolio.

For example, if you have invested 1 Lakh rupees in equity markets, how much downside will make you uncomfortable? This down side comfort is part of assessing risk tolerance, what we call in the financial planning domain as “risk profiling”. Based on the risk profiling score, we ascertain how much equity will be there in your overall portfolio.

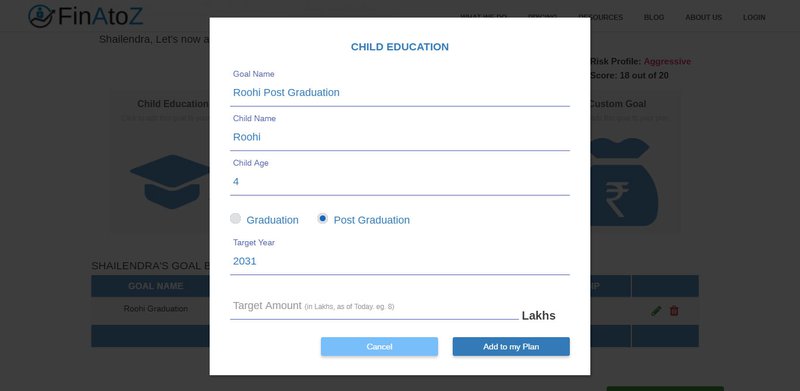

Second Step: Plan for the long term goals based on the current value of the goal.

The reason to classify the goals is to choose an appropriate asset class for our investment. It is advised to classify all goals which one needs to achieve in the next 3 years as “short term” goals and the ones which can be realized after 5 years as “long term”. For short term goals the choice of investments can be Debt Mutual Fund or even fixed deposits. For long term investments, equity mutual funds and Portfolio Management Services, are more appropriate investment options.

Third step: Compound this amount for the number of years left as per the inflation

For example, in education, inflation is around 10% if you want your child to study in India. But if you have plans to get her educated in the US or some other country, you need to consider the appropriate education inflation there. Generally, in US inflation in education is around 2 to 3%.

Fourth step: To calculate the monthly savings required to achieve for that goal.

This is calculated based on the equity products, their return expectation (generally assumed around 12%). You can also, find the monthly savings requirement by clicking here.

The above mentioned steps, provide a good starting point to plan for your goals, but we need to maintain a record for keeping track of the progress. The following parameters should be measured and monitored:

- Half-yearly progress of the goals to see if everything is going on as per plan or we need to take some corrective action in the portfolio (example: change a non-performing fund to a better one).

- Take corrective actions based on the current personal life situation (example: Good salary increment due to job change can enable early retirement).

More often than not, tracking finances get tedious because it requires a fair amount of your precious time and a lot of discipline. And one may rather wish to spend that time in a more relaxed way with the family than on complicated spreadsheets. FinAtoZ provides you exactly this option by assigning you a certified financial advisor who can not only help you to track your financial journey but also help you manage the funds better. A certified advisor provides you with all the relevant information from our in house research and literally hand-pick best investment products made just for you. ( 5 signs you need a financial advisor).