Quarterly Update - Facts don't care about your feelings!

“Facts don't care about your feelings.”

― Ben Shapiro

The unabated bull run in equity markets since last one year is making people nervous. Situation on the ground feels pretty grim with multiple lockdowns since the advent of Covid. 2nd wave has been devastating for majority of Indians both emotionally as well as financially. Though we seem to be out of 2nd wave now, the threat of future waves remains. So, one would wonder what is making equity markets climb newer highs day after day? How can the markets climb so high when the feeling is not so good? What is the basis of all this? Is someone playing games with the retail investors? Or is there some truth to this?

Only facts can help us to get answer to the above pertinent questions. Let’s try to analyse the following three important factors viz. Earnings Cycle Growth, Valuations and Liquidity. These three factors will help us to ascertain whether there is a concrete substance to what is happening in the equity markets currently.

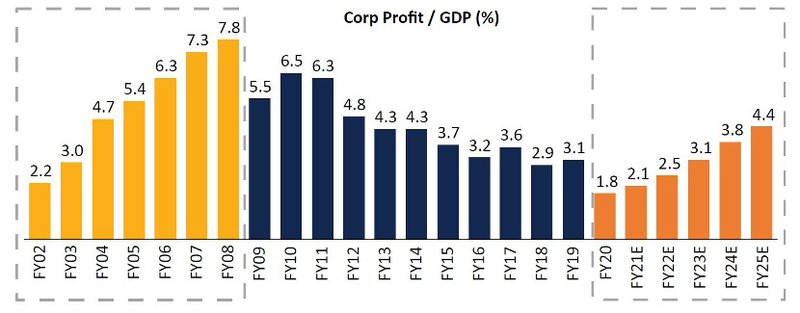

Earning Growth Cycle

Corporate earnings work in cycles. As depicted in the graph below, currently, we seem to be at the bottom of the earnings cycle. With hard lockdown no more an expectation irrespective of the Covid cases, earning cycle should see a rebound. This is likely to help the equity prices in the coming years.

Valuation

Although the markets are at all-time high, 1 year Forward PE is nowhere close to its highest level

(refer graph below). If we look at other parameters like Price to Book Value and Market Cap to GDP, we can ascertain that we are somewhere in the middle of the valuations cycle: i.e. neither undervalued, neither over-valued! As per our analysis, we are slightly above the fair valued zone at the moment.

NIFTY P/E (x) - 1 Year Forward

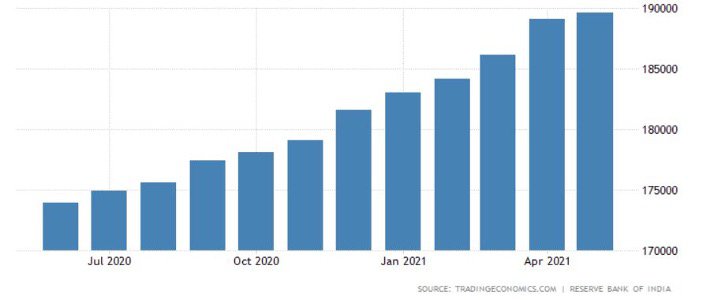

Liquidity

RBI in its latest annual report published in May, 2021 has highlighted the positive impact of liquidity on stock prices. The exact wordings from RBI annual report after statistical analysis on stock prices:

“The results suggest that the stock price index is mainly driven by money supply and FPI investments. Economic prospects also contribute to movement in the stock market, but the impact is relatively less compared to money supply”.

With repo rate being all time low and frequent government stimulus to industries, domestic markets are flushed with liquidity. US-Fed in its latest policy meet decided to continue with zero interest rate till 2022-23. Hence, one can expect high liquidity in coming one to two years in domestic as well as international market. This will support asset prices in the medium term.

Liquidity (INR Billion) Vs Time

To summarize it, two of the above three parameters look positive and one looks neutral at the moment:

Update on existing FinAtoZ products:

1. PPFAS Flexi Cap Fund: The fund which is already known for its unique flexibility of investing both in domestic and international equities has added one more feature to its portfolio. It has become the first fund in India to include “Covered call” in its mandate. In simple terms, it is one of the option strategy to limit the downside of the portfolio in case of adverse market movement. This feature makes it a good inclusion to reduce the risk of overall portfolio.

2. ICICI Balanced Advantage Fund: The fund which is known for its dynamic equity allocation as per market conditions has helped the portfolio to limit the downside in bear market and take the reasonable upside in bull market. Now in order to diversify further, fund has changed its allocation rule to include REIT in its portfolio up to a maximum limit of 10%.

3. PGIM Global Equity Fund: It is one of its kind of fund with maximum diversification into developed international markets. This is evident by their investments in Europe, Japan, Korea, China, Singapore apart from US. However, the fund is facing some headwind in this year due to correction in its top holdings like Tesla & Shopify. This makes it a good time to accumulate these world leaders at a reasonable price.

New additions to list of FinAtoZ approved products:

1. Motilal Oswal Multi Asset Fund: It is a unique offering which invests in a combination of Domestic equities, International equities, debt and gold. As we know that equities and gold have negative correlation, the fund is expected to give reasonable returns with lower risk in different market cycles. The risk-return profile lies close to debt as compared to equity. As per back testing results for last 20 years, the minimum annualised returns given by the fund for any 3-year period is 4.03%. At the same time, the max. annualised return in a 3-year period has been 16.42%. So this fund can be considered as an all-weather fund.

2. Kotak REIT FOF: It’s a fund of fund investing in SMAM Asia REIT Sub Trust Fund. REIT stands for Real Estate Investment Trusts. REIT funds basically invests in finished real estate buildings that typically offer a good rental yield. This fund is the first one to introduce 100% REIT in its portfolio. The parent SMAM Asia REIT fund invests primarily in Singapore & Australia’s REIT markets. Apart from rental yield, real estate appreciation and currency depreciation add the extras legs to returns. The risk-return profile is in between equity and debt.

3. Edelweiss US Tech FOF: One more Fund of fund which invests in JP Morgan US Technology Fund. This fund primarily invests in US tech markets. With a track record of more than 10 years in US, it has successfully beaten the NASDAQ index most of the times in last 10 years. Needless to say, the fund has higher beta and hence a higher risk.

Kindly note that we may or may not have invested in these products depending on your risk profile and overall asset allocation.

Some other significant changes worth discussing:

1. EPF Rule: The Government has finally placed an end to unlimited tax benefit for investing in EPF. As per the new rule applicable from 1st April, 2021, any investment of more than 2.5 lacs in a year will attract tax on interest earned over and above 2.5 lacs investment. This 2.5 lacs will include employee side contribution, employer side contribution and VPF. PPF is not included in this calculation of 2.5 lacs. For simplicity, consider any investment beyond 2.5 lacs as FD which will be taxed as per tax slab. This has made VPF less attractive as post tax returns will be in the range of only 6% going forward.

2. ULIP Rule: To bring in parity between mutual funds and ULIPs, the Budget 2021 amended the Income Tax Act, 1961 and accordingly any gains from a ULIP policy shall be treated as capital gains in case the premium paid for any year exceeds Rs 2.5 lakhs. Such policies will now be taxed at 10 percent at maturity.

Summary:

To summarize, last few months have been full of activity for us. Some of the above products researched and approved by our investment committee are pretty interesting and all-weather products. It is our endeavour to continuously research and find out newer ideas that will help our investors in their long-term investment journey. Also, let us not forget the learnings from last 1 year post the advent of Covid. We urge you to maintain fiscal prudence: i.e. maintain sufficient emergency fund, have health and life insurance in addition to the corporate cover, share your asset details with your spouse and most importantly get vaccinated 😊 Stay safe, stay healthy, stay happy!