Monthly Update - March 2019

After a 9 month downward journey, equity markets were quick to recoup all the lost ground. Markets rallied by more than 7% in March. The Sensex and the Nifty are at the record highs now. The main reasons for this rally were strong inflows from foreign investors, hopes of a stable government at the centre, a rise in rupee against the USD, and expectation of a rate cut policy in April.

Lets analyse the following factors in a bit more detail.

- FII's Foreign Institutional Investors (FIIs) poured in more than Rs.32000 crore into the domestic equity markets in March. These inflows led to a 7 per cent rally in the indices.

- Rise in rupee The value of rupee has risen due to the foreign fund inflows in the capital market, the announcement by the central bank regarding the dollar-rupee swap, optimism in the ongoing trade talks between Us and China.

- Rate Cut Due to the low inflation rate, the Reserve Bank of India lowered interest rate by 25bps to 6.25% in Feb to boost the slowing economy. The RBI may cut another 25bps in RBI monetary policy on 4th April. This is to boost economic activities and avoid the fears of global slowdown impacting domestic growth

- Small-cap & Mid-cap - Even if the Sensex and Nifty are at record highs, the small & midcap sectors are down over 15 per cent from their respective record highs. The current rally is extremely narrow led only by a few select index heavyweights mega-caps. The small-cap and mid-cap are down nearly over 15 per cent from their respective peaks.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

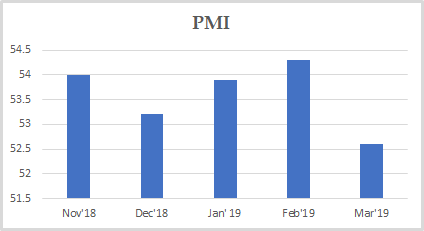

PMI

PMI India dropped to 52.6 in March from 54.3 in February and missing market expectations of 53.9.

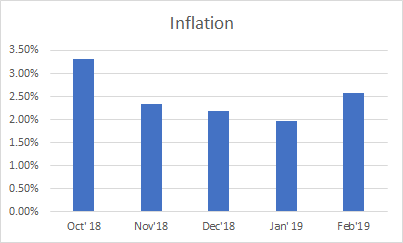

INFLATION

Inflation in India rose to 2.57% in February from 1.97% in the previous month and above the market expectations of 2.43%. It is the highest inflation rate in the last 4 months.

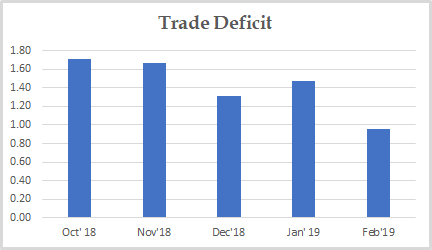

TRADE DEFICIT

India's trade gap narrowed to USD 9.6 billion in February 2019 from USD 12.3 billion a year earlier and below market expectations of USD 14.3 billion. It is the lowest trade deficit since September 2017.

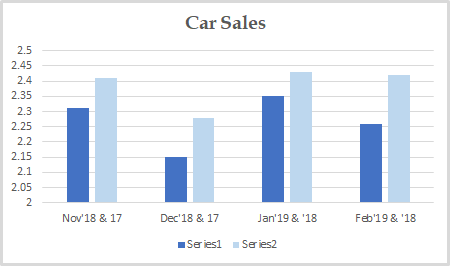

CAR SALES

Car Sales decreased to 2.26 in February from 2.35 in January.

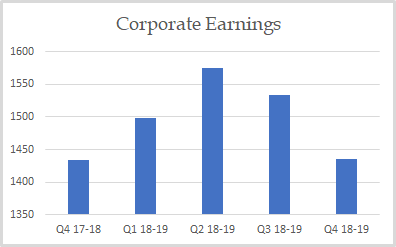

CORPORATE EARNINGS

The corporate earnings are slightly down this month compared to the previous quarter. We need to wait for few more months to ascertain if there is a confirmed change in trend.

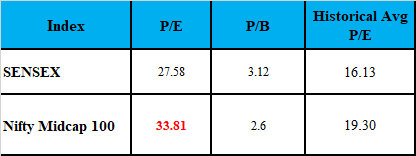

VALUATION

Markets are now looking fairly valued based on historical P/E and P/B basis.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment