2018 - The year gone by!

2018 was an year of consolidation. On one hand the large cap index touched record highs. On the other, mid and small cap corrected significantly. It was an year when the rupee depreciated to its lowest value. We saw crude prices rising substantially throughout the year before crashing in the last two months. 2018 was also an year of regulatory changes. The substantial changes in the mutual fund industry were the re-categorization of the mutual funds and the introduction of 10% tax on long term capital gains. This resulted in a deep correction in the mid and small cap space.

- Re-categorization and Rationalization of Mutual Funds

SEBI recategorized and rationalized the mutual fund industry in 2018. Re-categorization of mutual funds brought a short-term churn in the mutual fund industry during the mid of 2018. However, in the long-term the impact is likely to get adjusted and averaged out. Categorization was a positive move as it simplified the mutual fund categories and helped the investors to choose the right mutual fund as per their needs.

- 10% tax on long-term capital gains.

Another significant change in the mutual fund industry was the introduction of taxation on long-term capital gains on equity mutual fund. Earlier there was no tax if equity funds were held for more than an year. Now, investors will have to pay 10% tax on the profits booked even after holding for more than one year. There is however an exception to this rule. Upto 1 lac gain will be exempted from LTCG. 10% taxation will be there on the LTCG from mutual funds over and above 1 Lac gain.

- Indian Markets in 2018

Indian markets were very volatile in 2018. This was due to the fluctuations in the crude oil prices, rupee depreciation, elections etc. The domestic indices touched record highs. But after touching record highs, there was a significant slide in the domestic equity. From the peak market corrected by 14%. If we look at the opening and closing values of Sensex last year, was almost flat. But in between, the market went up by 16% and corrected by almost the same value.

- Crude Oil Prices

The crude oil prices were high till the end of the year and it affected the rupee value, current account deficit and decreased the capital inflows also. But by the end of the year, crude oil prices declined, and it came down below $60 per barrel. It helped to reduce the current account deficit and strengthened the rupee value during last two months of the year.

- Rupee Depreciation

Indian Rupee depreciated to its lowest value in 2018. The fall in the rupee was due to the fluctuations in crude oil prices, and trade war tensions between the US and China. Current account deficit and the decrease in capital inflows also affected the rupee value. The significant advantage of the rupee depreciation was the rebound of IT and the pharmaceuticals during the month of September. However, this boom was only for a while.

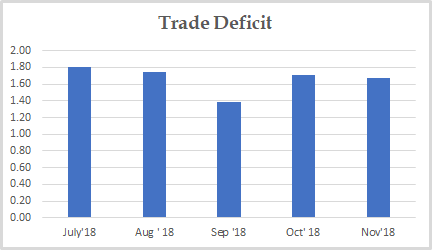

- Trade Deficit

The trade deficit widened to a 5 year high of USD 18.02 billion in July 2018. The stagnant exports, increased imports and fluctuations in oil prices affected the balance of trade. The widened trade deficits resulted in weakening of rupee as we needed more foreign currencies to meet the increasing imports.

- RBI Interest Rates

In 2018 RBI increased the interest rates twice. This is because of the increased inflation and depreciation of rupee value. RBI increased the interest rates from 6% to 6.25% and from 6.25% to 6.50%.

- Small & Mid Cap category

Even though the market was rallying last year, small-cap corrected by 33% and midcap corrected by 28% last year. This correction was a good opportunity to increase the exposure towards this segment for the long-term investors.

- The IL&FS default

The IL&FS defaulted on a series of payments. The IL&FS was AAA rated until August, but they defaulted on inter-corporate deposits, commercial papers etc. and got downgraded to junk category. This, in turn, resulted in a big impact on mutual funds, pension funds and insurance funds which were holding IL&FS securities. It also led to a liquidity shortfall in the market.

- Upcoming elections in 2019

Elections can bring volatility in the market in short term. It is harder to predict the markets in short term. But if we analyse previous elections, they did not affect the market beyond initial 3 to 6 months.

Overall 2018 was a good opportunity for long-term investors. The market volatility gave a good opportunity to increase equity exposure. It helped the investors to buy more units at a lesser NAV. This will enable them to get higher benefit when the market does recover. Re-categorization of mutual funds by SEBI was also a positive change in the industry as it de-cluttered the mutual funds and eanbled more clarity and transparency.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

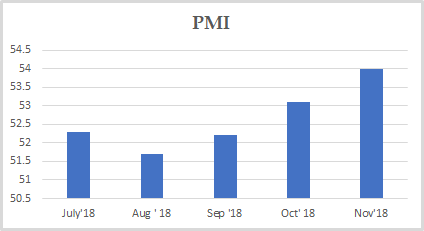

PMI

PMI India rose to 54 in November from 53.1 in October.

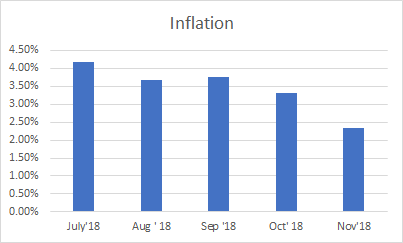

INFLATION

Inflation in India fell to 2.33% in November from 3.31% in the previous month and below the market expectations of 2.8%. It is the lowest inflation rate since June 2017.

TRADE DEFICIT

India's trade deficit widened to USD 16.67 billion in November from USD 15.1 billion a year earlier and slightly higher than market expectations of USD 16.08 billion.

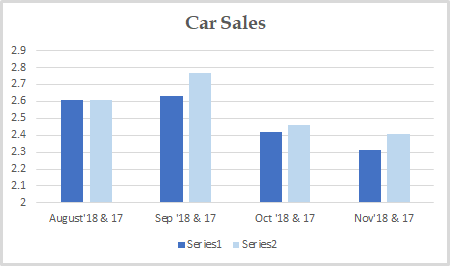

CAR SALES

Car Sales decreased to 2.31 in November from 2.42 in October. It also decreased on a year on year basis.

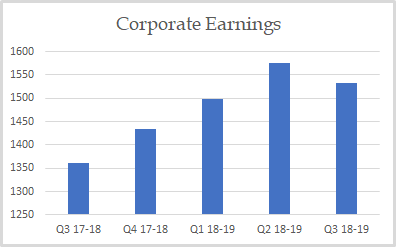

CORPORATE EARNINGS

Even though the corporate earnings were in an upward trend in the previous quarters, in this quarter it went down slightly. We need to wait for few more months to ascertain if there is a confirmed change in trend.

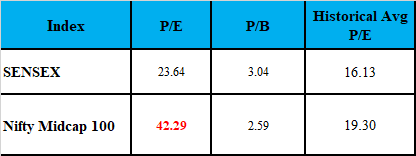

VALUATION

Markets are now looking fairly valued based on historical P/E and P/B basis.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment