Monthly Update - November 2018

After three months of correction, Indian markets got a much needed breather in the month of Nov. Recovery of rupee against the dollar, fall in oil prices and improvement in liquidity were the positives that helped the markets stage a recovery this month.

The decline in crude oil prices

Crude oil prices declined, and it came down below $60 per barrel. It fell by almost 28%, the steepest fall since Dec 2017. Lower oil prices reduce the pressure on inflation and the pressure on central bank to increase the interest rates. Further, low crude oil prices reduce the import bill for our country. This helped in taming the current account deficit that was going out of bounds since last year on account of high crude oil prices.

Recovery of Rupee

The rupee also recovered smartly, and it touched 70 per USD for the first time since last 3 months. The decline in crude oil prices and reduction in CAD helped to strengthen the rupee value. Moreover inflation data remained subdued further helping the recovery of rupee.

Increased inflows from Foreign Investors

The strengthening rupee and fall in crude oil prices helped to increase the foreign capital inflows. Foreign investors invested 6310 crores in the Indian market during Nov after a massive pullout in Oct.

Uncertain global cues

Despite the above mentioned positives, globally widespread uncertainty still remains as a negative factor for all emerging markets including India. This is due to the trade war tensions between the US and China. Further, volatility is expected to continue on account of the upcoming elections, movement in rupee and oil prices. OPEC is meeting this week for a proposed reduction in oil supply. This can again bring volatility to the crude oil prices.

Smart investment strategy in the current scenario

During the last one year, market valuations have become more reasonable. Some pockets like Small caps have become undervalued as compared to their historical averages. While, there is a possibility for the markets to go down further in the next 6 months, it is almost impossible to time the markets perfectly. Hence, in the current scenario, it is prudent for an intelligent investor to continue on the path of disciplined investing without getting panic. You should ensure that your asset allocation is maintained as per your risk profile. Kindly take help of your dedicated Financial Advisor to re-balance your portfolio during your reviews. This will help you to buy at current prevailing lower prices.

One should refrain from redeeming of the invested amount unless there is a planned goal. So, stay calm and focus on your long term goals.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

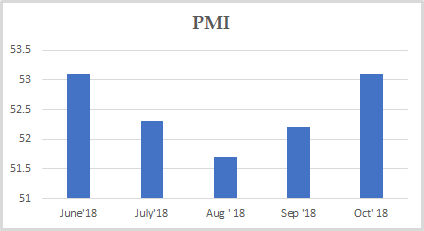

PMI

PMI India rose to a four-month high of 53.1 in October from 52.2 in September and beating market forecasts of 51.9.

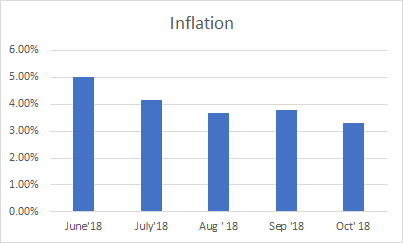

INFLATION

Inflation in India fell to 3.31% in October from 3.7% in the previous month and below the market expectations of 3.67%. It is the lowest inflation rate since September 2017.

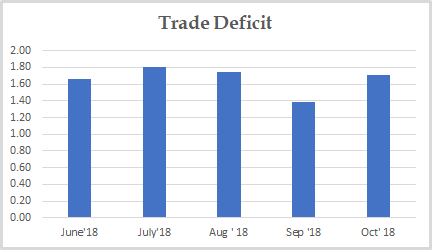

TRADE DEFICIT

India's trade deficit further widened to USD 17.13 billion in October from USD 14.16 billion a year earlier and higher than market expectations of USD 16.9 billion.

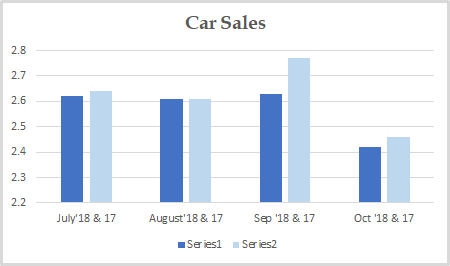

CAR SALES

Car Sales decreased to 2.42 in October from 2.63 in September. It also decreased on a year on year basis.

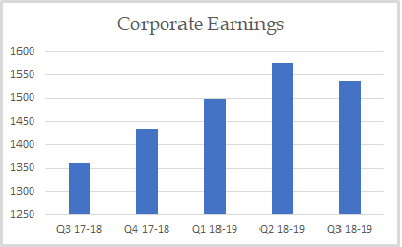

CORPORATE EARNINGS

Even though the corporate earnings were in an upward trend in the previous quarters, in this quarter it is slightly down. We need to wait for few more months to ascertain if there is a confirmed change in trend.

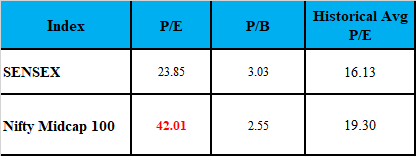

VALUATION

Markets are now looking fairly valued based on historical P/E and P/B basis.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment