Monthly Update - June 2018

Markets are suggesting mixed signals at the moment. On one hand, macros continued to weaken due to sharp rise in oil prices, pressure on current account deficit and its impact on inflation. On the other hand, corporate earnings have shown a steady increase. In-fact corporate earnings have been highest since demonetisation time.

Indian Rupee has fallen to its lowest ever against the US dollar last month. The fall in the rupee was led by higher oil prices and rising trade war tensions between US and China. Higher current account deficit and lower capital inflows is also affecting the value of the Indian Rupee. The pressure on the Rupee and capital outflows from emerging economies may continue in the near term. The slowdown of capital inflows in the economy due to the strength of the US dollar and hike in US Fed rates has amplified the situation. Elevated crude oil prices and a weak rupee has given rise to jitters in the Indian economy. The upcoming elections may also intensify the situation further; if there is no clear majority at the centre, foreign investors may wait for clarity which in turn affects the inflows.

The recovery in Micro-environment will continue. The significant advantages are the depreciation in rupee lifts a large number of exporting sectors like IT and Pharmaceuticals. The rebound of IT and Pharma accelerates the recovery of earnings. The Indian Pharmaceutical market returned to double-digit growth. The sector has come out from its worst phase and likely to witness up-trending earnings in the next 1-3 years.

Other factors: The churn in mutual fund industry continued due to the SEBI’s mandate on categorization of mutual fund schemes. Fund houses had to adjust their portfolios to comply with the SEBI's norms. For eg: Large-cap funds which had taken high mid-cap exposure to boost returns sold these stocks to comply with SEBI’s new norms.

We are keeping a close watch on rising oil prices, inflation and fiscal deficit. Based on these parameters we will take appropriate action in your portfolio.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

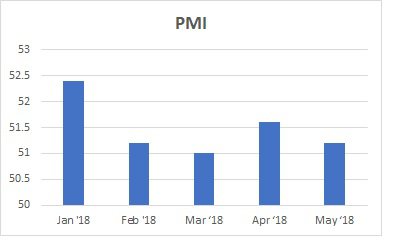

PMI

PMI India fell to 51.2 this month from 51.6 last month and below market consensus of 51.5.

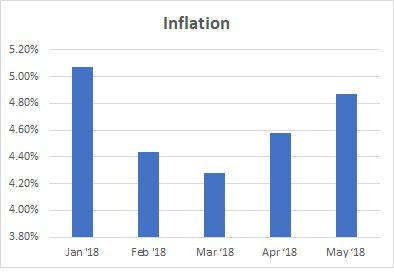

INFLATION

Inflation in India has further increased to 4.87% than 4.58% in the previous month and slightly above the market expectations of 4.83%. It is the highest reading in 4 months.

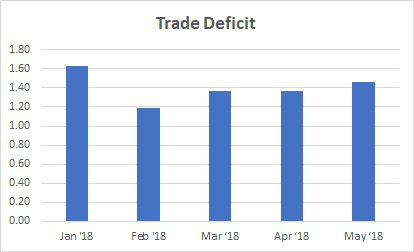

TRADE DEFICIT

The trade deficit has widened to $14.62 billion in May'18 as compared to $13.84 billion a year earlier due to the rising crude oil prices. It is above the market expectations of $14.23 billion gap.

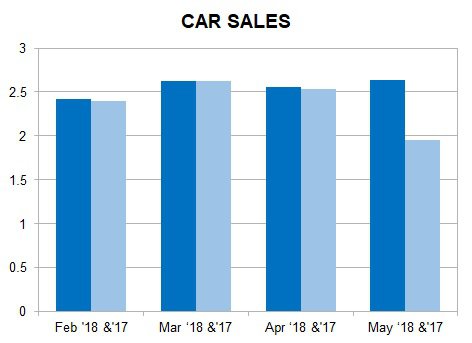

CAR SALES

Car Sales has Increased by a phenomenal rate of 35% year-on-year in the month of May. It has increased to 2.64 in May from 2.56 in April.

CORPORATE EARNINGS

Overall the trend for corporate earnings looks to be upward from last few quarters. It is the highest since Q2 16-17

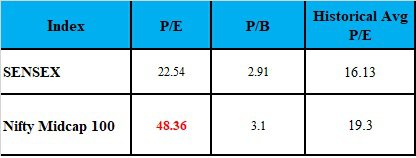

VALUATION

Mid Caps and Small Caps continue to be over-valued as per historical averages. Large caps are comparatively better valued at the moment.