Budget Update - Jan_Feb 2018

FinAtoZ View on Budget 2018 and The Road Ahead

As expected, the Union Budget 2018 had a clear focus on the rural theme. Government announced significant steps to put more money in the rural economy. There were many announcements on infra projects for rural India. Moreover, the move to increase MSP is likely to put more money in the hands of rural consumers. However, the budget had almost nothing for Indian middle class. Also, there were other negatives like re-introduction of Long Term Capital Gains tax on equities and mutual funds.

The Road Ahead

- Markets to remain volatile: The stock markets are likely to be volatile in the short term. This may provide an opportunity to increase allocation to equities at the right time. However, we have to wait patiently till the time that opportunity presents itself.

- Positive for rural, infrastructure and export oriented sectors: We are closely tracking these sectors and may want to increase allocation to one or more of them in the near future.

- Interest rates may have bottomed out: The chances of home loan rates decreasing further looks very remote now. So, if you are planning to take home loan, you can look at taking the fixed rate scheme if the interest rate differential is not high between flexible and fixed.

- Mid & Small Caps more risky: The smaller companies will be more risky since they are prone to larger correction if the markers go down. We have zero exposure currently to small and mid caps. Any major movement downward will provide us a good opportunity to shift some allocation to this segment.

- No major impact due to 10% LTCG: We don't see any major impact due to re-introduction of LTCG on the stock markets in the long run. Since all the other financial instruments are taxed, it is not unfair to tax returns from equities as well. Moreover, the Government has given an exemption of Rs. 1 Lac per annum for this tax. Most of the retail investors will fall under 1 Lac of redemption. So, there may not be a significant material impact for a retail investor. Read our blog on "How to reduce the impact on LTCG".

You have nothing to worry: As far as your investment portfolio is concerned, there is a significant portion that is currently invested into low risk debt. These funds should continue to rise even in a falling market scenario. Moreover, your investment portion that is invested in equity is mostly into large cap and high quality companies. There is almost nil exposure to high risk mid and small cap segment. So, your current portfolio is in a great position to withstand any market volatility that may occur in the short term. In-fact, we may be making use of such short-term volatility to increase exposure to equity based on your risk profile and goals duration.

MACRO ECONOMIC TRENDS

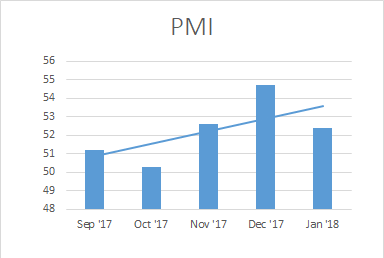

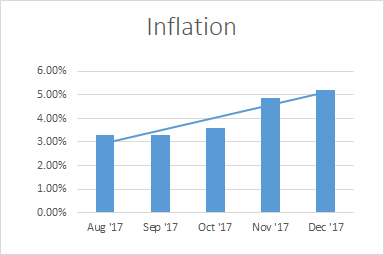

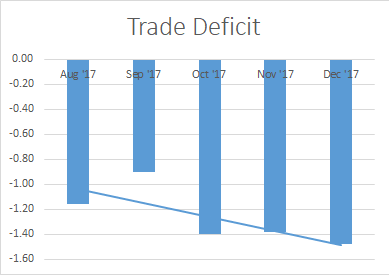

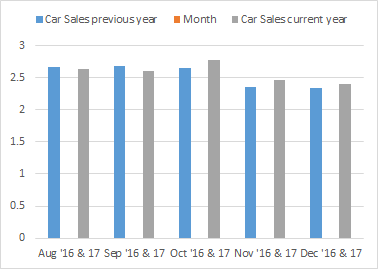

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trends:

PMI : PMI India fell to 52.4 in Jan from 54.7 in Dec. It is pointing to a weakest expansion in the manufacturing sector since Oct 2017. However, it showed a highest reading in the month of Dec 2017 since Oct 2012 and is the highest since Dec, 2012 as the output hits a five year high.

INFLATION :

Inflation in India has increased 5.21% y-o-y in Dec of 2017 and is above the market expectations of 5.1%. It is the highest inflation rate since Jul '16 and is mainly because of rise in the food and fuel prices. However, Central bank expects inflation to be in between 4.4-4.7 percent during the 2nd half of current fiscal year that ends in Mar '18.

TRADE DEFICIT : Trade deficit is showing a upward trend and has widened to $14.88 billion in Dec'17 as compared to $10.55 billion a year earlier. It is also above the market expectations of 12.37 billion.

CAR SALES : Car Sales has decreased by 2.56% year-on-year in Dec 2017. The overall trend in the car sales seems to be downward in the last quarter from Oct - Dec 2017.

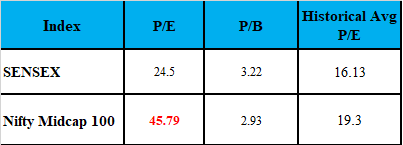

SENSEX VALUATION &

CORPORATE EARNING TREND

Mid Caps and Small Caps has seen a correction of around 6-7% in last two days after the Budget.

*As on 5th Feb 2018; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

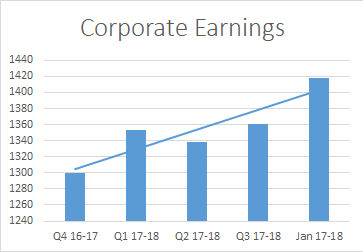

CORPORATE EARNINGS:

Overall the trend for corporate earnings looks to be upward from last few quarters. It is the highest since Q2 16-17