Monthly FTM Update - Jan, 2017

Last three months saw unprecedented changes on the domestic front. On 9th Nov, an average Indian woke up to suddenly realize that the currency that he holds is no longer valid. Repercussions (both positive and negative) from this mammoth change are yet to be seen. It might take a substantially long time before we get close to the real impact of this move.

Meanwhile, the focus has shifted on the budget day which has been advanced to 1st Feb from the current year. With current uncertain environment, it will be a pretty tough task for the Finance Minister to come up with a balanced budget. Key consumption-driven sectors such as automobiles, telecom services and FMCG is on a slow growth pace despite a favorable monsoon and lower borrowing costs. Moreover, corporate earnings have started showing a downtrend with 4% decrease in Q3 results. This downward trend is likely continue into the fourth quarter as well. However, the pace of growth in the fourth quarter may recover to 5-7 per cent.

On the global front, Donald Trump has taken over the reins of the President of USA. His protectionist stance could have a major impact on Indian exporters such as IT and pharma, trade relations, as well as fund flows coming into India.

Given the muted growth outlook and global tensions of both trade and cash flow channels, the government is widely expected to provide a greater emphasis on growth in the upcoming Budget. The most likely course of action would be to keep fiscal deficit targets for FY18 unchanged from FY17, at 3.5% of GDP, compared to the consolidation road-map target of 3%.

Meanwhile, Indian stocks market have defied all logic and have moved up by 5% in the month of Jan. May be the market is expecting that our honorable Finance Minster can come up with a spectacular budget which may provide panacea to all the past ills. However, if the budget cannot satisfactorily balance the social and fiscal disciplines, there is a risk of the slowdown lasting longer than currently expected by the markets.

Therefore, we see volatile times ahead primarily due to populist budget, Trump policies and elections in UP and Punjab. Hence, we still continue to maintain 80%-100% of your new investments into less-risky debt funds. We will patiently wait for the right time to move this money to equity.

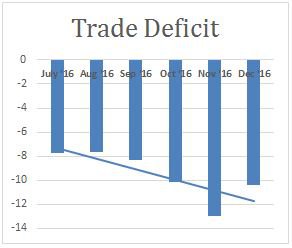

MACRO ECONOMIC TRENDS

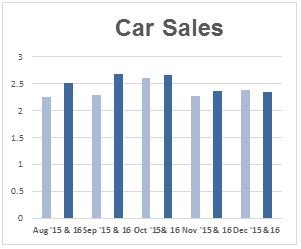

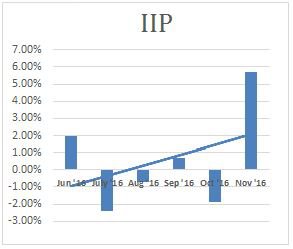

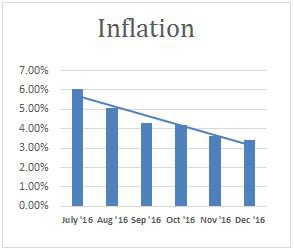

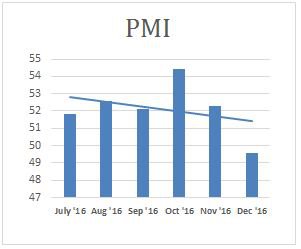

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trends:

SENSEX VALUATION TREND :

The markets are fairly valued right now post recent correction due to the demonetization.

*As on 25th Jan 2017; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

CORPORATE EARNINGS TREND :

Corporate earnings are likely to fall further because of the effect of demonetization.

MARKET OUTLOOK AND CURRENT DECISION AS PER FTM :

Most of the asset classes remained volatile in the month of Jan, 2017 :

1. Bonds – Bond yield have moved up by 0.7% in Jan.

2. Gold – Prices of Gold increased by 3.4% in the month of Jan.

3. Equity – Sensex increased by 4.2% in the month of Jan.

CURRENT ZONE AS PER FTM:

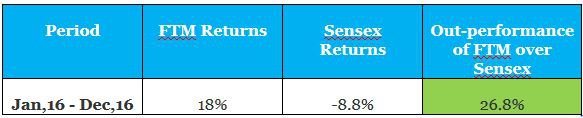

Returns comparison of FTM with Sensex over 1 year period :

This is a high outperformance as compared to Sensex. We were able to save most of your portfolio downside during last one year thus enabling a positive investment experience for you.

CHANGES MADE TO YOUR PORTFOLIO LAST MONTH :

We have not made any changes to your portfolio during the month of Dec & Jan:

Due to higher valuation in mid & small cap segment we continue to have nil exposure towards Mid Cap & Small Cap Funds in your portfolio. Also we continue to maintain 50% of equity exposure in your monthly SIP’s and remaining 50% will be in Debt funds with a zero exposure towards Gold.

Invest right, Invest consistently & Invest for long term horizon. Happy Investing!