Monthly FTM Update - Dec, 2016

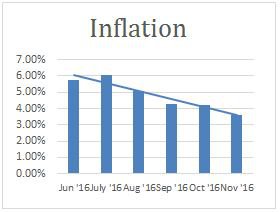

To everyone’s surprise, RBI’s new monetary policy committee kept interest rates unchanged at 6.25% despite wide expectations of rate cut. It also lowered the GDP growth estimate to 7.1% from the earlier projection of 7.6%. This move is to keep inflation in check. The RBI cited the dollar’s surge and the increase in the prices of oil and commodities as two factors that could increase global volatility.

While on the other side, The Federal Reserve raised its benchmark interest rate by quarter points for the first time in a year. It also signaled that rates could continue to rise next year more quickly than officials had expected. It reflects Fed officials' confidence in the strengthening of the U.S. economy and what officials see as budding signs of higher inflation.

Potential risks and its impact on India:

1. Accelerated slowdown in earnings from corporate in Jan – 2017 quarter, due to demonetization.

2. Rise of Interest Rate in the US - Impacts rupee & FII outflows

which already exceeds 26,000 crore in December quarter can increase

further.

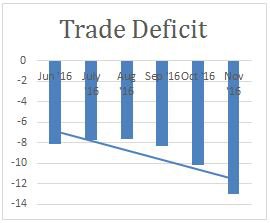

3. Rise in the crude oil & commodity prices increases trade deficit.

Though India will be affected and the rupee may weaken, comforting levels of foreign exchange reserves will likely soften the blow. Also there is a possibility of decrease in corporate earnings in the next quarter due to demonetization which may negatively impact GDP. There is more of uncertainty and volatility in the short term and this will remain until we have actual numbers coming out.

Hence, we continue to maintain 80% of your new investments into debt. And we still preserve 70% - 80% of your Growth-FTM investments in non-risky debt funds for the moment to reduce market volatility risk. We will patiently wait for the right time to move this money to equity.

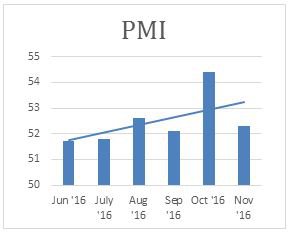

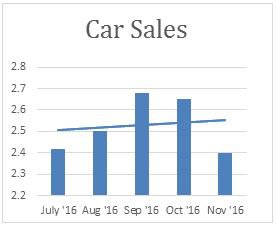

MACRO ECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trend.

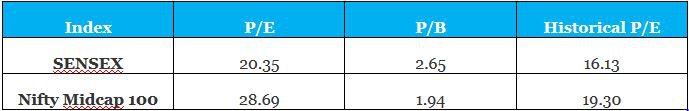

SENSEX VALUATION TREND :

The markets are fairly valued right now post recent correction due to the demonetization.

*As on 23rd Dec 2016; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

CORPORATE EARNINGS TREND :

Chart above shows that Corporate Earnings are likely to fall further because of the effect of demonetisation.

MARKET OUTLOOK AND CURRENT DECISION AS PER FTM :

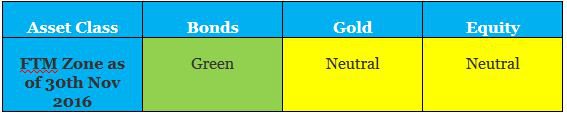

Most of the asset classes remained volatile in the month of Dec, 2016 :

1. Bonds – Bond yield have moved up by 5.4% in Dec.

2. Gold – Prices of Gold decreased by 6.8% in the month of Dec.

3. Equity – Sensex dropped by 2% in the month of Dec.

CURRENT ZONE AS PER FTM:

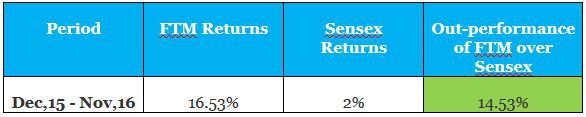

Returns comparison of FTM with Sensex over 1 year period :

This is a high outperformance as compared to Sensex. We were able to save most of your portfolio downside during last one year thus enabling a positive investment experience for you.

CHANGES MADE TO YOUR PORTFOLIO LAST MONTH :

We made the following changes to your portfolio during the month of Nov & Dec:

1. Exposure to Sectors – We continue to have zero exposure towards Mid Cap & Small Cap Funds in your portfolio due to higher valuation in mid & small cap segment.

2. SIP Investment – As the valuation of

equity as an asset class has improved, we continue to maintain 50% of

equity exposure in your monthly SIP’s. Remaining 50% will be in Debt

funds with a zero exposure towards Gold.

3. Lump sum Investment – We are taking 80% of the new money into Debt and the rest 20% in Equity funds through STP.

Invest right, Invest consistently & Invest for long term horizon. Happy Investing!