Monthly FTM Update - Nov, 2016

Nov, 2016 will go down in the history of Indian financial markets as a month of induced financial shock. Narendra Modi’s bold and painful shock therapy has cut a deep wound in the psyche of one and all. It will surely have a much higher impact on people / institutions that used to deal in transactions that were unaccounted for. Whether this move will clean our country of black money is not certain, but what is almost certain is that this move will have huge impact on the behavior of the people of our country.

With all these environmental changes and so much chaos around, FIIs have been busy withdrawing cash from the Indian stock markets since the last 20 days. So far, they have already offloaded more than 15,500 Crore of equity this month. As a result, Sensex saw a sharp correction of 9% during this month. While the markets went down sharply, we are glad to communicate to you that your portfolio registered a positive return of 0.25% to 1% depending on your risk profile. Events of these magnitude test investment models thoroughly. So, it will not be wrong to say that this was an acid test for FTM as a dynamic asset allocation model. We are happy to note that FTM helped us do the right thing at the right time. As a result our investors were able to sleep peacefully in these very turbulent times!!

In our investment experience of several years, we have seen that bad times provide fantastic opportunity to long term investors. As Warren Buffet says, “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”. We believe that the current volatile conditions provide a good opportunity to accumulate equities for our long term investors. At the same time, we understand that bad times are not yet over and there could be more downside in the offing. To capitalize on this opportunity, we have decided to move around 20% of your Growth-FTM investments into equity over a period of one month starting 17-Nov-16. This strategy will ensure that we are using cost averaging to reduce market volatility risk and buying at an average price of one month in a falling market. We have preserved the remaining 70% - 80% of your Growth-FTM investments in non-risky debt funds for the moment. We will be using this portion to move it to equity when we get further buy signals on FTM in days/months to come.

MACRO ECONOMIC TRENDS

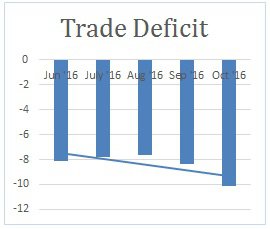

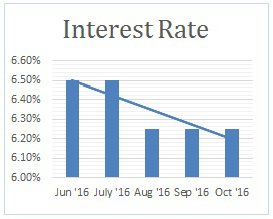

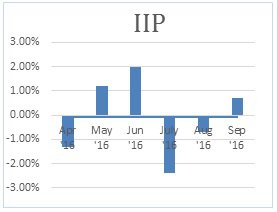

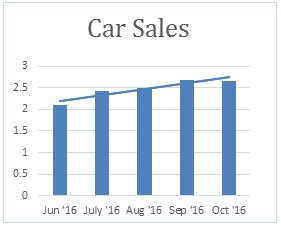

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trends:

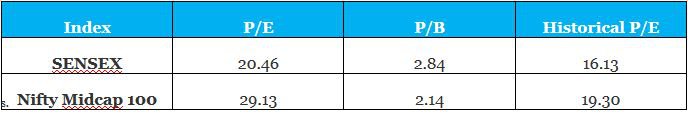

SENSEX VALUATION TREND :

The markets are fairly valued right now post recent correction due to the demonetization.

*As on 29th Nov 2016; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

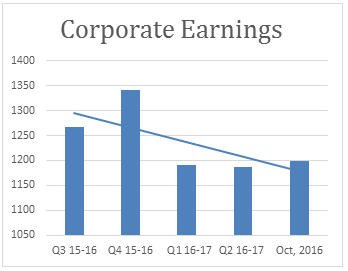

CORPORATE EARNINGS TREND :

Chart above shows that Corporate Earnings are likely to fall further because of the effect of demonetisation.

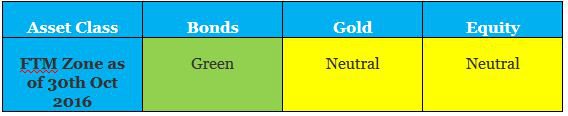

MARKET OUTLOOK AND CURRENT DECISION AS PER FTM :

Most of the asset classes remained volatile in the month of Nov, 2016 :

1. Bonds – Bond yield have moved down sharply in Nov. As a result long term bond funds gave fantastic returns in Nov.

2. Gold – Prices of Gold decreased by 4.5% in the month of Nov.

3. Equity – Sensex dropped by 9% in the month of Nov.

CURRENT ZONE AS PER FTM:

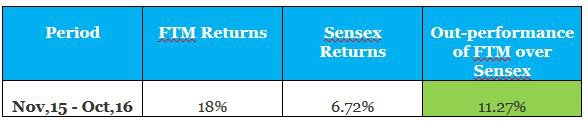

Returns comparison of FTM with Sensex over 1 year period :

This is a high outperformance as compared to Sensex. We were able to save most of your portfolio downside during last one year thus enabling a positive investment experience for you.

CHANGES MADE TO YOUR PORTFOLIO LAST MONTH :

We made the following changes to your portfolio during the month of Oct & Nov:

1. Existing Growth-FTM Investment – Due to Demonetisation markets has seen 9% of correction in the month of Nov and are now trading at a reasonable valuation. We got a partial buy signal in Equity as per FTM. Hence, we decided to move around 20% of your Growth-FTM investments into equity over a period of one month starting 17-Nov-16. This strategy will ensure that we are using cost averaging to reduce market volatility risk and buying at an average price of one month in a falling market.

2. Exposure to Sectors –

Due to higher valuation in mid & small cap segment we continue to

have zero exposure towards Mid Cap & Small Cap Funds in your

portfolio. Also, as of now we have a very limited exposure to any sector

as such.

3. SIP Investment – As the valuation of

equity as an asset class has improved, we have increased the exposure of

equity from 10% to 50% in your monthly SIP’s starting Dec 2016.

Remaining 50% will be in Debt funds. We have reduced SIP in Gold from

current 20% to 0%.

4. Lump sum Investment – We are taking 80% of the new money into Debt and the rest 20% in Equity funds through STP.

Invest right, Invest consistently & Invest for long term horizon. Happy Investing!

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment