Gold Investments: A Complete Guide to Options, Risks, and Taxes

Even before Mutual funds and Stocks, Gold has always been the trusted and preferred choice of investment in India. Although there are many reasons for people to invest in Gold, for many, Gold Investment is about Wealth Preservation and Protection. Gold also plays an important role in the Diversification of Portfolio. Gold prices are negatively correlated with Stock markets. In a volatile market, investors move away from riskier assets into safe assets like Gold. This shift also contributes to a further plummet in the stock market. So, Gold is traditionally described as a Safe Haven in times of market volatility.

While buying gold in physical form, like coins and jewellery has been the norm in India traditionally, we are not limited to that. There is a plethora of options available today. If you want to know more about the Pros, Cons, Charges, and Tax Implications of different options available in Gold Investments, you are at the right place. Here, we will discuss things that you need to know before investing in Gold.

Popular options available to Invest in Gold

- Physical Gold

- Gold Exchange Traded Funds

- Gold Mutual Funds

- Sovereign Gold Bonds

Physical Gold

Buying Physical gold in the form of Coins, Bars, and Jewellery is the traditional method of Investing in Gold.

Pros

- Tangible Ownership

- No hassle of Paperwork

- No Demat account is Required.

Cons

- Risk of Theft and Burglary

- Costs associated with safe storage.

Charges

- No additional charges are levied. (In the case of Bars and Coins)

Making charges, Wastage charges, Hallmark charges, etc come into the picture in case of Gold Jewellery.

Exchange Traded Funds

Gold ETFs are investment funds that track the price of gold by holding physical gold or gold futures as their underlying assets. These are kinds of mutual funds that are listed and traded on exchanges via BSE and NSE just like shares. It is like making a direct investment, but here the investor can buy proportionate ownership in a collective vault instead of buying gold in the physical form.

Pros

- Investing in gold ETFs offers the benefits of gold exposure without the hassle of physical possession. Hence, there is no risk of storage or theft.

- Pricing of ETFs is more transparent and closer to the actual market price of gold.

- ETF units can be easily bought and sold on stock exchanges.

- Gold ETFs are more liquid as they can be traded in the open market at the free will of the investor.

- Gold ETFs do not have any lock-in period. Thus, Gold ETFs can be used for short-term, medium-term, or long-term investment objectives.

- As SIP (Systematic Investment Plans) are not allowed, one can plan to purchase Gold ETFs at regular intervals to average out costs and mitigate market volatility. This makes investment in Gold ETFs more rewarding.

- In case of financial distress, Gold ETFs are known to be accepted as collaterals for loans as well.

Cons

- Investing in Gold ETFs might incur Asset Management and brokerage charges.

- Can be invested ONLY through a demat account, hence paperwork is involved for the Demat account opening.

- Differences in underlying gold prices and ETF performance might cause a tracking error, which in turn affects investor returns.

- ETFs require a minimum investment of one unit, equivalent to one gram of gold.

- Gold ETF has liquidity challenges. Selling large amounts quickly could impact your selling price in the exchange or take longer to find buyer at your desired price.

- Unlike Gold Mutual funds, SIP mode of investment is not available in Gold ETFs.

Charges

- ETFs have annual charges of 0.5–1%. This includes brokerage, expense ratio, etc.

- Brokerage charges are applicable at the time of entry and exit.

Gold Mutual Funds

Gold Mutual funds are another safe and easy way to invest in Gold. Gold MFs can invest in a combination of instruments such as gold futures, gold stocks, gold bullion, gold related companies like mining etc and other gold-associated instruments.

Gold Mutual funds are a good option for investors who want safe exposure to gold without going through the hassle of buying/storing the physical gold and without actively tracking the market.

Pros

- Investing into Gold Mutual funds does not have the obligation to open a Demat account.

- Unlike ETF, one can invest even Rs 500 in Gold Mutual funds. The investor gets units based on NAV.

- Gold Mutual funds allow investors to invest through a SIP.

- Gold funds are managed by Professional fund managers.

- Unlike Physical Gold, units in gold mutual funds do not involve making charges, goods and services tax, or any other kind of tax or surcharge.

- Gold Mutual fund units can be purchased and sold easily.

Cons

- The mistakes and biases of fund managers can affect the Fund's performance.

- Unlike Gold ETFs, Gold Mutual Funds invest in a variety of gold-related assets. As a result, there might be a mismatch between the performance of funds and actual gold prices.

- Investments into Gold Mutual funds come with several expenses like Fund manager costs, Exit Loads, fund operating expenses, etc.

Charges

The following charges are applicable in the case of Gold Mutual fund investments:

- Fund management charge – approx. 0.5% ~ 1% (Expense Ratio)

- Stamp Duty & other charges at the time of entry and exit from the fund

- Administrative charges for expenses involved in the fund

Sovereign Gold Bonds (SGBs)

RBI, in consensus with the Government of India, Launched Sovereign Gold Bonds in November 2015. These are government-issued bonds where the investment return is linked to the price of gold. SGBs will be sold through Scheduled Commercial banks (except Small Finance Banks, Payment Banks, and Regional Rural Banks), Stock Holding Corporation of India Limited (SHCIL), Clearing Corporation of India Limited (CCIL), designated post offices (as may be notified) and recognized stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange Limited, either directly or through agents.

Pros

- These bonds offer an assured interest rate of 2.5% disbursed half yearly in addition to capital appreciation of the underlying gold.

- Capital gains tax is exempted on the redemption amount on the bond at the end of 8 years at maturity.

- Anyone can invest in SGBs viz. Individuals, Trusts, HUF, charitable institutions, and universities. Both single-holding and joint-holding are allowed.

- In case of financial distress, SGBs can be used as collateral to take loans. RBI stipulated ‘loan to value’ ratio for gold loans is applicable here as well.

Cons

- The minimum investment that can be made is of 1 gram gold value and the maximum that an individual can invest is 4kgs.

- To avail the tax benefit, the bonds need to be held till maturity. Hence, liquidity will be a challenge if one wants to liquidate before maturity. One might need to rely on the Secondary market to liquidate before maturity.

Charges

Brokerage at the time of entry into and exit from the bond if executed through the secondary market.

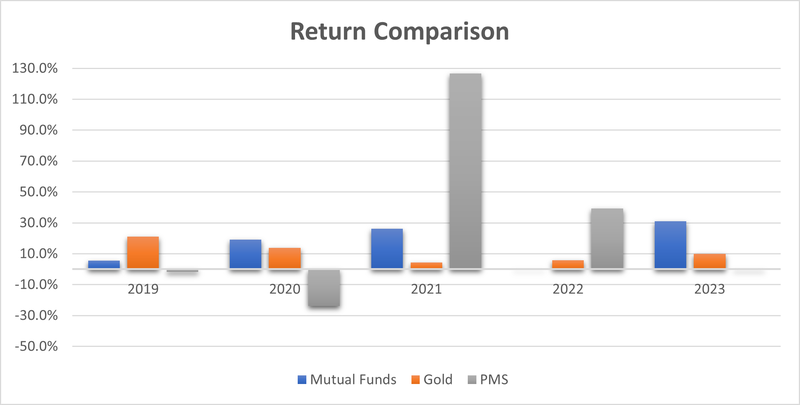

Comparison of Returns

Every financial instrument comes with a certain amount of risk. Usually, this risk is associated with the potential return on that investment. The two asset classes, Equity and Gold, have always been put in opposition when it comes to comparing returns, pros, and Cons. Though both asset classes are negatively correlated, past trends show that both asset classes have given fantastic returns to investors when we compare the returns over one-year, three-year, five-year, 10-year, and 20-year time horizons.

As an example, we can compare past returns of Gold, Mutual fund portfolio, and PMS.

The above comparison is for illustrative purposes.

De-dollarization

The US Dollar has been the dominant reserve currency in the world for over half a century. US dollar remains the currency of choice for international trade of major commodities like oil. This dominant role in the global economy grants US, a significant influence over other countries. US often weaponizes this dominance and uses sanctions as a foreign policy tool. As a result, some countries want to reduce their dependence on the dollar and challenge its dominance to insulate their central banks from geopolitical risks.

Understanding Central Banks' gold accumulation

Central banks across the world are actively diversifying their foreign exchange reserves by increasing their holdings of gold. This strategic shift aims to reduce dependency on traditional reserve currencies like US dollar and mitigate associated risks. The global uncertainty because of the financial conflicts among major global powers, high interest rates, and War is also pushing investors to invest in safe-haven assets like Gold.

Not only China, but many emerging economies have been aggressively accumulating gold reserves to diversify their forex reserves as well to reduce the dollar dependency.

What does this mean for Individual Investors

As a result of gold purchases by Central Banks, retail segments, and institutional investors, (Despite high prices) the demand for the metal has been on an increasing trend in the Global market. This demand might contribute to a rally in gold prices.

As an individual investor, one need to have at least 5% exposure of their overall portfolio towards Gold. This helps in the diversification of investments and also acts as a safe haven when equity markets are uncertain.

Conclusion

Gold investments provide different options for investors looking to diversify their portfolios. These options range from physical gold to ETFs and SGBs. Each investment option offers unique benefits and risks, catering to different investment strategies and preferences. Gold is often seen as a safe haven during economic uncertainty, but it also comes with challenges like storage costs, price volatility, and liquidity issues.

Allocating between 5 and 10% of your investment portfolio to gold can be beneficial. Prior to making an investment, it is important to ensure that your investment strategy is well aligned with your financial goals.

With the right strategy, gold can be a valuable part of a diversified portfolio, providing both security and potential for long-term growth.