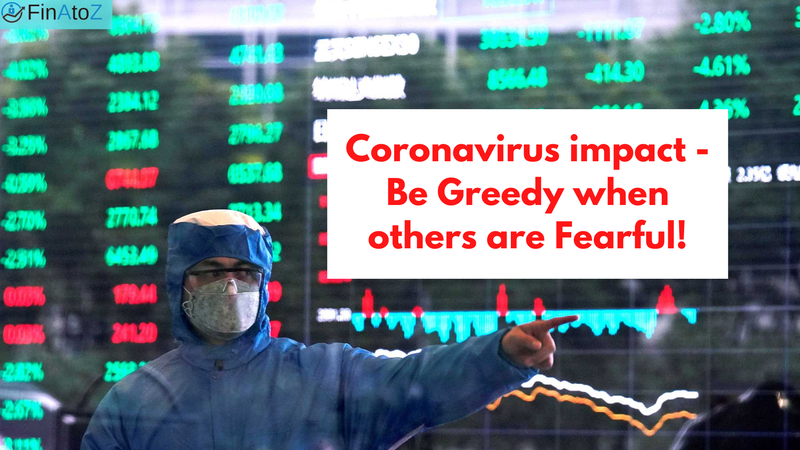

Coronavirus Impact - Be Greedy when others are Fearful!

Coronavirus or Covid-19 originated in Wuhan couple of months ago. However, it reached viral proportions this week on Wall Street — and literally throughout the world. Cases of the illness have stabilized in China, but its spread outside the country, to nearly 80 countries in total, is what may have truly injected uneasiness into the global stock markets.

Coronavirus outbreak is a black swan event for the markets. Black swan event is an event that cannot be predicted in advance. Talking about Indian markets, coronavirus has already hit BSE Sensex by more than 4000 points over the last few weeks. This is more than 10% fall in a very short span of time. To add fuel to fire, RBI put a moratorium on Yes bank in a desperate effort to save the ailing private bank. This again, was a very big dampener to the investor sentiments. It has put the entire Indian stock market in firm control of the bears.

Lets try to analyse the current situation in slightly more detail below.

How Coronavirus impacts the world?

1. Disruption to global supply chain - Biggest threat of Coronovirus is the disruption to the global supply chain. With world becoming more flat, the entire production supply-chain has numerous inter-linkages across multiple countries. For instance, a Pharmaceutical manufacturer in India might source its raw material from China and supply the finished medicine to USA and Europe. Any disruption in this supply chain in any country will have adverse impact on the functioning of such companies.

2. Inflationary pressures - Due to disruption in manufacturing of some essential goods, there is a possibility that the prices can rise in the short term. Also, there could be an increase in demand for few items related to the disease or its prevention. For instance, demand for Surgical mask, hand-sanitizers and face-tissues has increased drastically in recent times.

3. Lower crude oil price - Though prices of some essential goods can rise, there is also a chance of reduction of crude oil prices. This is because people will postpone their vacations and non essential travels for foreseeable future. Reduction of the prices of oil will have a positive effect on the import bill for a country like India which spends heavily on imports.

4. Negative investor sentiments - With the advent of social media, any negative (or positive) news travels across the world at a lightening speed. A global pandemic like Coronavirus starts getting reported everywhere - on WhatsApp, Facebook, Instagram, digital media, print media etc etc. Grim pictures of people wearing masks starts getting shared everywhere. The actual problem starts to get amplified to massive proportions. This is where panic starts getting set-up in financial markets!!

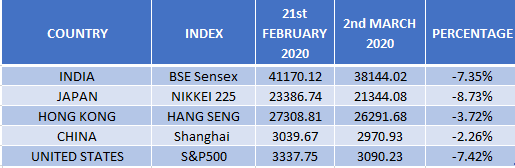

Impact of Coronavirus on Stock Markets

Coronavirus (Covid-19) has not only hit the Sensex but other world Index as well. A high-level analysis of major stock indices is provided below:

The S&P 500 posted its worst day since August 18, 2011. Stocks are on track for their worst week since the financial crisis of 2008. This is resulting in a significant loss of paper wealth. Crashes are driven as much by panic as they are by economic factors. Investors are worried about the spread of China’s Coronavirus and the implications for the global economy. (Read our article 5 Tips to ride Market Volatility for better Returns)

“The outbreak of coronavirus, through the direct and indirect linkages of trade and commerce and global supply chain, could impact Indian companies," said Arun Singh, Chief Economist Dun & Bradstreet India.(Click here to get a detailed CRISIL report of impact on India economy)

Impact of Past Epidemics on Stock Markets

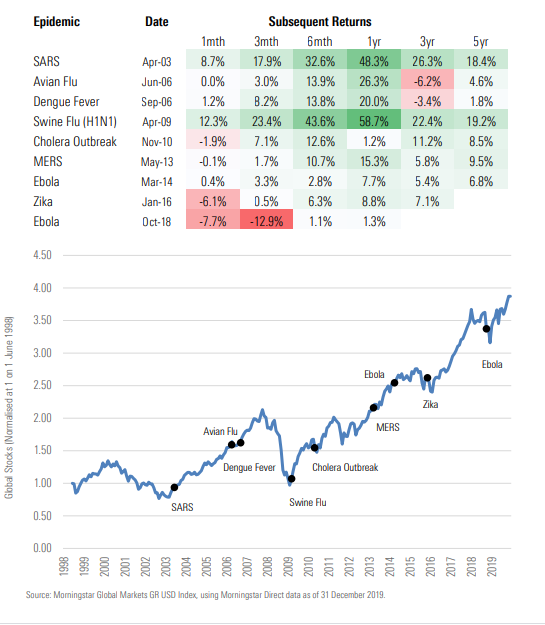

The key question that an investor is trying to seek is what lies ahead for them in the near future. What is the right thing to do under such bleak circumstances. Shall an investor go ahead and press the panic button. Or shall this be taken as a good long term opportunity? There doesn't seem to be an easy answer. However, lets try to see what happened in previous such instances over the last 20 years. We look to provide a sense of base rates—market returns following major epidemics in recent history.

Source: Morningstar Global market GR USD Index

If we look at above charts, whenever market has got to such an uncertainty in the past, it always tend to recover within a max. of 6 months. While there is always a chance that this time things can be different, we believe that world has enough resources to come up with a solution in due course of time. Hence, we still believe that 6 months is a good time for things to start returning to normal. The collective impact of the outbreak (fewer flights, less trade, loss of productivity, etc.) will affect a few businesses, a few industries and for few weeks it might impact the markets.

What you should do if you are a long term investor?

Lets come to the million dollar question: How to play the current markets? What is the right thing to do keeping in mind a long term investment horizon? We believe that the answer lies in the following famous Warren Buffet quote: "Be Fearful When Others Are Greedy, Be Greedy When Others Are Fearful" . From our past 25 years of investing experience, we have seen numerous instances of greed and fear. Every time there's a panic, markets valuations become extremely cheep. Anyone who invests in such times, gets an amazing investing experience over the next few years. This is a time when panic has got set-up in the stock markets around the world. With each fall, valuations look more and more compelling than ever before. This is certainly not a time to press the panic button. In other words, a prudent investor should not think of reducing equity allocation under current circumstances. On the contrary, this is a time to increase allocation to equity in a phased manner. Probably over the next 2-6 months. Talk to your financial advisor and get this going. Such investment opportunities don't come too often.

Disclaimer and Key Assumptions - The opinion expressed above is only for an investor who has a long term investment horizon. Investors should talk to their financial advisor before taking any investment decision.