Monthly Update - August, 2019

As we have been communicating during last few months, the Indian markets continued its downward trend in the month of Aug as well. Few economic indicators like Automotive sales and GDP growth numbers point to domestic slowdown in the Indian economy. Some of the global events like deepening of USA-China trade war did not help either. Logical question that would come to anyone's mind is that how deep is this economic slowdown? Is this as bad as the recession of 2008? How long will it take to come out of this slowdown?

It is not easy to provide a concrete answer to any of these questions. However, we can analyse some of the key economic indicators to get a sense where we are going:

First the Negatives

Consumer Demand

The consumer demand has reduced in India. When the demand drops, supply comes down, which in turn brings down the company's sales and revenue. This will affect the economic slowdown.

The decline in the automobile industry

The automobile industry has declined steeply. Compared to July 2018, the industry has declined by almost 31%. The last month was the fourth consecutive month of sales falling more than 20% and it was the worst slow down in ten months. The car sales trend is one of the important indicators of economic growth.

Banking Sector

The banking stocks also plunged significantly after Nirmala Sitharaman had announced the merger of 10 PSBs into four entities. But in the long term, these reforms will help the banking system definitely.

Employment Layoffs

To balance the decrease in demand companies may have to cut down on their cost. This may result in short-term employment lay off. Unemployment has already increased to 7.2% in 2019 from 5% in 2017. This can reduce spending and investments as well.

Low GDP Growth

The release of official GDP data which is reduced to 5% in the first quarter adversely affected the market sentiments. The GDP data, pointed out that India's economic growth has slowed down to 5 per cent, the weakest in six years in spite of the government's recent announcements to boost the economy.

Then the Positives

Measures by Indian Government to boost growth

On Aug 23rd Finance Minister Nirmala Sitharaman made several announcements to rejuvenate the economy. Some of the policies are:- Rs.70,000 crore capital into Public Sector Banks- Infusion of 70,000 crores into Public Sector Banks helps to improve the liquidity and lending.

- Rollback of enhanced surcharge on the rich and FPI's can induce more foreign investments in the coming future.

Cheaper Loans - Lower EMI burden

Banks have decided to pass on the RBI rate cut benefits to the borrowers. Hence launched repo rate linked loans which makes the home and auto loans cheaper. With interest rates going down globally, we expect even cheaper auto and home loans in the near future.

Rupee Depreciation - Positive for Exports

The Rupee fell sharply beyond 72. It depreciated almost 3.76% since the beginning of this year as a result of weak economic data, negative stock market sentiment and US-China trade war. This is a big positive for Indian Export sector.

Low Valuation - Good long term opportunity

The ongoing correction in stock markets have resulted into much reasonable valuations across several segments of the economy. Some of the segments like small & mid caps have corrected by more than 40% from their last year peaks. This provides a fantastic entry level for long term wealth creation.

FinAtoZ Take

The economic slow down/recession is a normal phenomenon and part of the economic cycle. Government has introduced many policies and taken measures to revive the economy. These policies may or may not work in the short run. However, in the medium to long run, markets will certainly come back and reward the patient investors.

As per Benjamin Graham, the intelligent investor should lookout for opportunities to buy low and sell high due to price-value discrepancies that arise from economic depressions and market crashes. We also believe in the same. The intelligent investor should not worry about the short term volatility. If possible, when the market goes down, he should invest more in equities which benefits him in the long term. Else, he should continue his periodic investments like SIPs etc and re-balance his portfolio to a slightly higher tilt towards equity with the help of his financial advisor.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

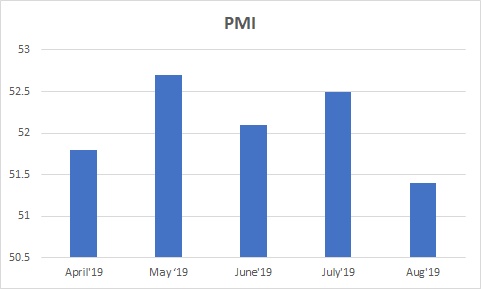

PMI

PMI India has dropped to 51.4 in August 2019 from 52.5 in the previous month and below market expectations of 52.2.

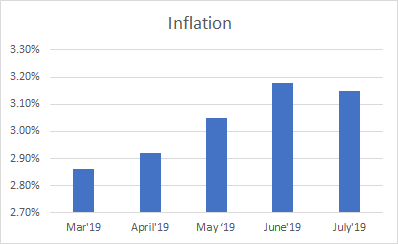

INFLATION

Inflation in India slightly reduced to 3.15% in July from 3.18% in the previous month and slightly below market expectations of 3.20%.

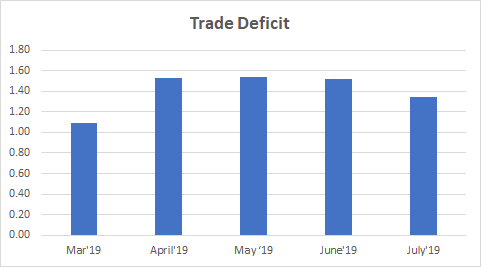

TRADE DEFICIT

India's trade gap narrowed to USD 13.43 billion in July 2019 from USD 18.63 billion a year earlier and below market expectations of USD 15.70 billion.

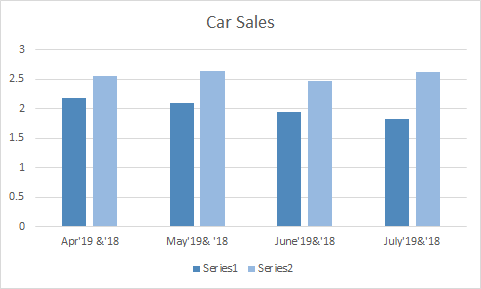

CAR SALES

Car Sales in plunged by 31% from on a year to year basis. July 2019 car sales were 1.95. It is the fourth consecutive month of sales falling more than 20%.

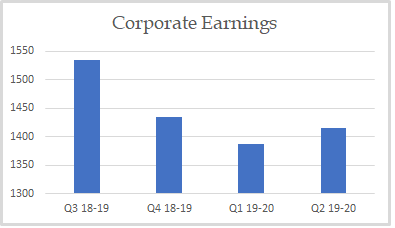

CORPORATE EARNINGS

The corporate earnings are showing a negative trend since last three quarters:

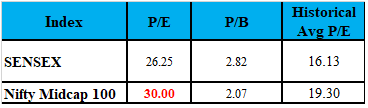

VALUATION

Markets are fairly valued on the basis of historical P/E basis. However, it is undervalued on historical P/B basis.