Monthly Update - July, 2019

Union Budget that was presented on 5th of July, has triggered a steep decline in the domestic India markets. Sensex has tanked by 6.2% and Nifty

50 by 6.4%. Mid and small-cap categories declined to the lowest levels in 30 months.

Some of the main reasons for the market decline are unfavourable budget, poor corporate earnings and below-average monsoon.

Lets analyze the major events that occurred during the last month.

Union Budget

There were two major points of contention that spooked the markets:

1. First was increase in surcharge on the super-rich. As a result of this additional levy, majority of the Foreign Institutional Investors will also have to pay additional taxes. As a result they have started pulling out money from Indian markets.

2. Second is the proposal to increase the public shareholding in the listed companies to 35% from the present 25%. This will increase the supply of equity in the markets thereby putting pressure on the stock prices in the short to medium term.

Fiscal Deficit

The fiscal deficit of April-June is Rs.4.32 trillion which is 61.4% of the full-year budgeted estimate. This further enhanced the already subdued negative sentiments.

Sovereign Bonds

One positive factor in the overall gloomy environment was the proposal of foreign sovereign bonds. The Finance Minister Nirmala Sitharaman proposed to raise part of the Indian government borrowings in foreign markets through foreign sovereign bonds. It enables the inclusion of India’s government bonds in the global indices and leads to higher foreign inflows into India. The RBI plans to discuss this month the government’s plan of sovereign bonds and the risks associated with it.

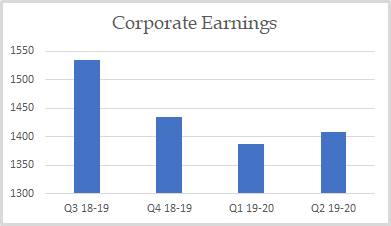

Weak Corporate Earnings

The corporate earnings were pretty weak for the Q1 of FY 19-20. Auto sector witnessed a clear slowdown with Maruti Suzuki reporting a 30% decline in sales for the moth of July.

Mid and Small Cap Indices

Mid and small-cap indices fell to their lowest level in the last 2.5 years. This could however, be an opportunity for long-term investor to accumulate mid and small caps at dirt cheap valuations. Historically broader markets outperformed after extreme corrections.

US Fed Rate Cuts

The Federal Reserve cut interest rates by 25 bps for the first time since 2008 on 31st July. But they said it was a mid-cycle adjustment to policy not the beginning of a long cutting cycle. The domestic indices and the currency dropped in reaction to the rate cuts. The Sensex and Nifty 50 closed at their lowest level in five months.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

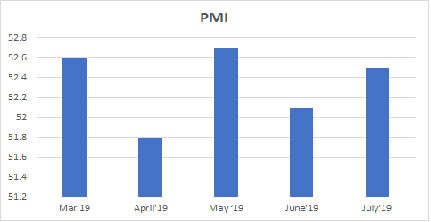

PMI

PMI India rose to a three month high of 52.5 in July from 52.1 in the previous month. in June.

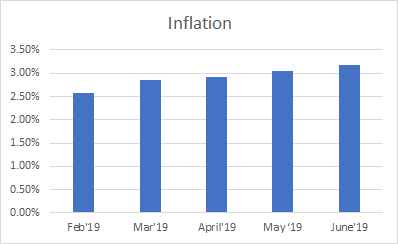

INFLATION

Inflation in India rose to 3.18% in June highest since the last October and slightly below market expectations of 3.20%.

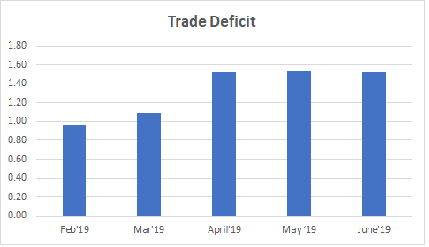

TRADE DEFICIT

India's trade gap narrowed to USD 15.28 billion in June 2019 from USD 16.60 billion a year earlier and below market expectations of USD 15.64 billion.

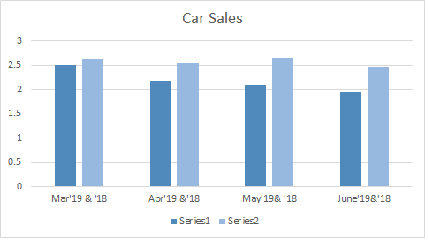

CAR SALES

Car Sales decreased to 1.95 in June from 2.10 in May and 21% decrease y-o -y basis.

CORPORATE EARNINGS

The corporate earnings are slightly down this quarter compared to the previous quarter.

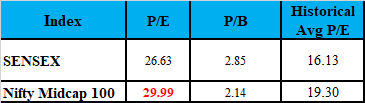

VALUATION

Markets are fairly valued on the basis of historical P/E basis. However, it is undervalued on historical P/B basis.