Monthly Update - May, 2019

The Indian equity markets went up in euphoria on account of the return of Narendra Modi as prime minister. For the first time in its history, Sensex and Nifty crossed new milestones of 40,000 mark and 12,000 marks respectively. However the euphoria is likely to be short lived, as macroeconomic factors will catch up eventually. The new government faces a lot of challenges in reviving the economy ranging from consumption slow down, liquidity crisis, unemployment, stagnant private sector investment etc. On top of this, the global factors are not supporting either. There is an ongoing China-USA trade war that is impacting the entire world.

The positive impacts of a stable Government led by Narendra Modi are:

- It ensures continuity in economic policies.

- It ensures political stability and predictability of economic policies. This helps investors to build a strong portfolio for the next five years.

- Continuity in economic policies are a significant positive for attracting global investors as well.

- It is expected that the Modi government make policies to boost the infrastructure, railways, roads & constructions, real estate, rural sector consumption etc. This can bring a positive sentiment towards infra, housing, banking sector.

- It helps progress on the foundation built up in the first term of Modi.

The global and domestic factors which can weaken the market rally in the short term are:

- Slowing GDP growth - India’s economic growth fell to 5.8% in the last quarter which is the lowest in 5 years.

- Liquidity crisis fueled by Indian Non Banking Finance Companies.

- Weakened global and domestic demand.

- Sluggish exports.

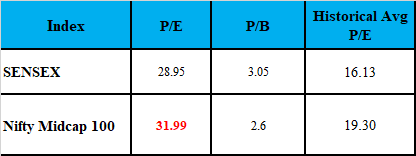

- High valuations of the Sensex - Current Sensex PE ratio is higher than its historical averages.

- Continued US-China trade war.

- US -Iran tension.

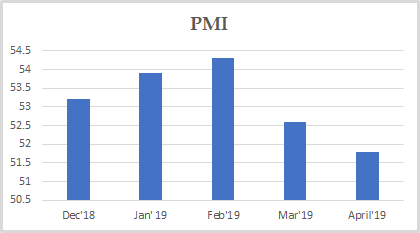

- Economic indicators like IIP, PMI, automobile sales are trending down.

- Moreover, the market is expected to follow global market sentiments. MSCI India’s weight is likely to fall 20-50 bps by the end of this year due to the increase in China’s index exposure and inclusion of Saudi Arabia. This can lead to temporary outflows from India further putting pressure on Indian markets.

Though Sensex and Nifty have recently touched new highs, the mid cap and small cap haven't performed well in the last 1.5 years. The highs are driven by only select few stocks. Hence don't lose faith by seeing your mutual funds not giving you the same return as the market highs. As per the previous history of elections, markets were inconsistent for short term and produced good results in the long term of 3-5 years. This helps investors to build a strong portfolio for the next three years. Investors can include economy-linked sectors such as infra, cement, housing and banking in their portfolio. Moreover, investors may focus on quality mid-caps and small-caps. As the market is overvalued now, don't invest lump sums directly into the equity. Invest only through the STP /VTP to the equity. Proper asset allocation and staying invested can give good compounded returns in the next 3 to 5 years.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

PMI

PMI India dropped to a six month low of 51.8 in April from 52.6 in March and below market expectations of 52.5.

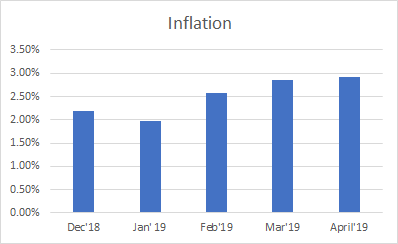

INFLATION

Inflation in India rose to 2.92% in April from 2.86% in the previous month and below the market expectations of 2.97%.

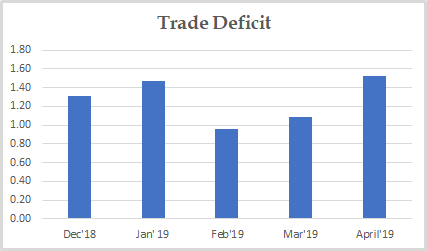

TRADE DEFICIT

India's trade gap widened to USD 15.33 billion in April 2019 from USD 13.72 billion a year earlier and above market expectations of USD 13.91 billion.

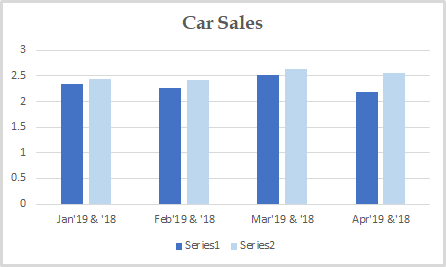

CAR SALES

Car Sales decreased to 2.19 in April from 2.51 in March and 14% y-o -y basis.

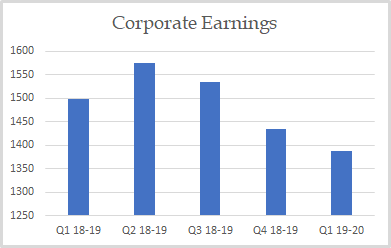

CORPORATE EARNINGS

The corporate earnings are slightly down this quarter compared to the previous quarter. We need to wait for few more months to ascertain if there is a confirmed change in trend.

VALUATION

Markets are over-valued based on historical P/E and P/B basis.