Monthly Update - September 2018

The Indian stock market continued to be volatile for the entire September month. There was a significant slide in the domestic equity benchmarks last month. The large-caps have corrected by nearly 7% and the mid/small caps have corrected by more than 10% in September month. The IL&FS default is one of the most significant event that drove the markets down.

Lets evaluate the key events and changes to the macro economic conditions in September month :

- IL&FS default - The IL&FS defaulted on a series of payments. The IL&FS was a AAA rated entity until August and directly got downgraded to junk category. The group has already defaulted on inter-corporate deposits, commercial papers etc. This, in turn, resulted into a big impact on mutual funds, insurance and pension funds that were holding IL&FS debt securities. Also, it led to a liquidity shortfall in the market.

- Rise in Crude oil price - Crude oil prices have increased further. The increase in crude oil also resulted into depreciation of the Rupee value to an all time low of 72.98 last month.

- Widening of CAD - Current Account Deficit widened further due to rising fuel bill and the weakening of Rupee against US Dollar.

- Increase is US Fed rates - Us Fed has increased the interest rate by 25 basis points and there is likely to be another hike in December. Fed rate hike will strengthen the Dollar and it will lead outflow of foreign money. This is another factor that has put pressure on the Rupee and might force RBI to hike interest rates further.

- Selling by FIIs - Overseas investors pulled out a huge amount from the Indian capital market last month. This was due to the widened current account deficit and sliding Rupee. This makes the outflow the steepest in four months.

- Inflation cooling down - Last month the inflation rate went down to 3.69% for the first time in 2018. When RBI increases the rates, it, in turn, increases the cost of borrowing money in the economy and reduces overall spending. This brings down demand and hence slows the rise in price or inflation.

Time to Increase allocation to Equity - From an Investor perceptive, the current market volatility provides a good opportunity to increase the allocation to equity in a phased manner. We, as your trusted advisers, are watching the market developments very closely. We would be using this volatility to increase your equity exposure over the next few months. This will enable you to gain from lower cost of acquisition of some good mutual funds. This is also the time to increase your SIPs in case you have any additional monthly surplus. SIPs work wonders to average the buying price in a market that is moving downwards. Your respective financial adviser will be in touch with you to guide you through the current market phase and make most of the current opportunity.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

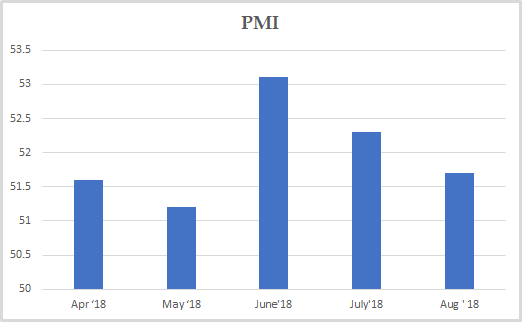

PMI

PMI India dropped to three months low of 51.7 in August from 52.3 in the previous month.

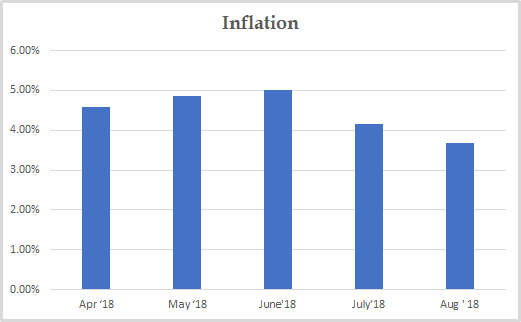

INFLATION

Inflation in India has declined to 3.69% in August from 4.17% in the previous month and below the market expectations of 3.86%. It is the lowest inflation rate since October 2017.

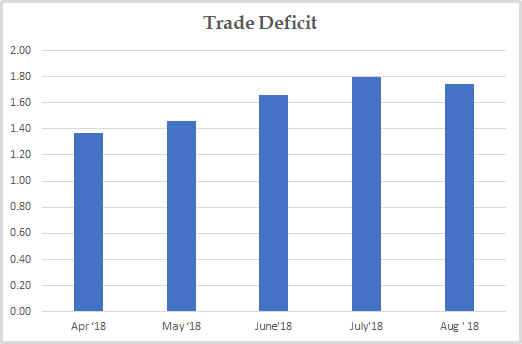

TRADE DEFICIT

India's trade deficit remained stable at around 17.4 Bn USD on a month-on-month basis. However, it widened if we compare with Aug, 2017.

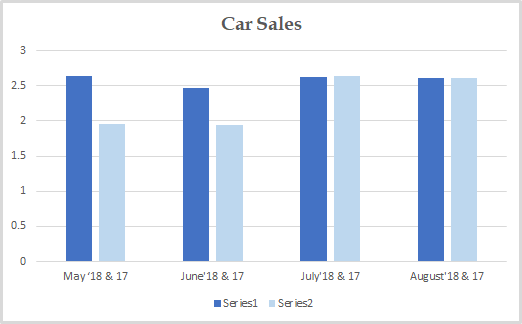

CAR SALES

Car Sales has decreased to 2.61 in August from 2.62 in July and less change on a year-on-year basis.

CORPORATE EARNINGS

Overall the trend for corporate earnings looks to be upward from last few quarters. It is the highest since Q2 16-17

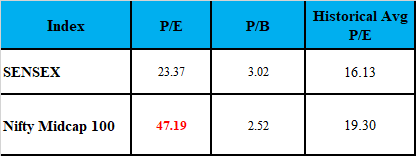

VALUATION

Markets are now looking fairly valued based on historical P/E and P/B basis.