Market Update - Dec 2017

With the 2018 budget season around the corner, many expect a populist budget tone from the government. The reason for a populist budget are two-folds: Government is on a back-foot after their relatively narrow margin of victory in Gujarat. There is a clear indication of rural unrest post demonetisation and multiple years of poor monsoons. Added to this is the 2019 election which is just 18 months away. This means that Govt has only this year to woo rural voters. This could mean that the government may be tempted to turn away from the path of fiscal prudence.

According to the latest data released, the government has already breached its fiscal deficit target for the current financial year till Nov end. The difference between govt. revenue and expenditure stood at ₹6.12 lakh crore as against ₹5.46 lakh crore planned. This was mainly because of lower than expected revenue collections at the back of higher govt. expenditure. If the fiscal deficit target is not met, it could add to financial volatility in the market in the time to come.

On the monetary policy stance, RBI has continued the status quo and has kept repo rate unchanged. It has listed upside risks to inflation and increased projection for the year. It now expects inflation to range between 4.3-4.7% in the 3rd and 4th quarters of the current fiscal year. With most major reforms already in place, the markets will focus on earnings growth in the year ahead. The economy and earnings will play a key role in deciding the markets trajectory going forward.

Market will also look towards global cues and US tax reforms. All eyes are on US tax bill related developments as well as on crude prices. Oil prices are heading higher and could lead to macro risks, increasing fiscal deficit and inflation.

Overall, there is a rising volume of money chasing a limited number of stocks. As a result, valuations look rich at the moment. The Earnings growth in the past six quarters amounts to just 6%. However, with the reforms stabilizing, earnings growth is expected to accelerate. We are keeping a close watch on crude oil prices, inflation data, fiscal deficit trajectory and the budget. Based on these parameters, we will take appropriate action in your portfolio during the coming months.

MACRO ECONOMIC TRENDS

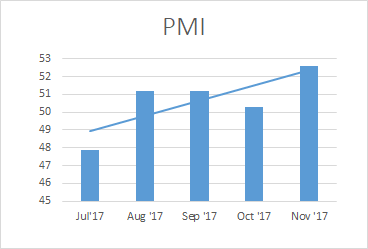

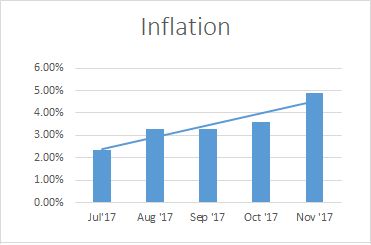

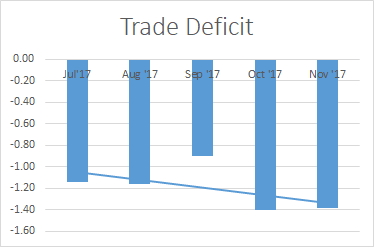

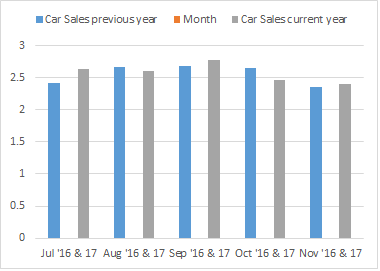

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trends:

PMI: PMI data is showing a upward trend as it has jumped in the month of Dec to 54.7 as compared to the 52.6 in Nov and is also higher than the market consensus. It is mainly because of increased output growth & employment.

INFLATION: Inflation is inching and is the highest since Aug 2016 and is mainly because of rise in the food and fuel prices. Consumer prices has increased by 4.88% y-o-y in Nov of 2017, higher than 3.58% in Oct and well above market expectations of 4.2%.

TRADE DEFICIT: Trade deficit is showing a upward trend and is the biggest deficit for a Nov month since 2014. It has increased to $13.83 billion from a $13 billion a year earlier.

CAR SALES: Car Sales increased by 2.55% year-on-year in Nov 2017. However the overall trend in the car sales is flat in the last few quarters.

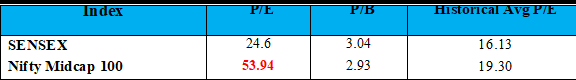

SENSEX VALUATION &

CORPORATE EARNING TREND

The markets are over-valued right now and are not supported by the fundamentals.

*As on 26th Dec 2017; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

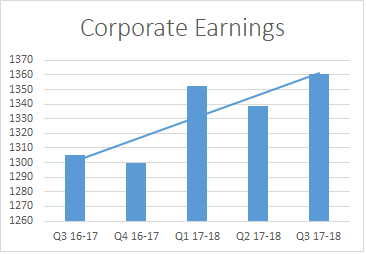

CORPORATE EARNINGS:

Overall the trend for corporate earnings looks to be upward from last few quarters. It is the highest since Q2 16-17