Monthly FTM Update -April,2017

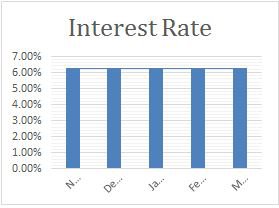

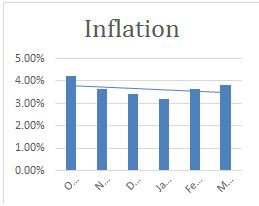

RBI Policy moves with the wide expectation keeping interest rates unchanged in its first bi-monetary policy review for FY18. However, it raised the reverse repo rate to 6% from 5.75% earlier. The committee is choosing to be conservative when it comes to Inflation. It has reiterated 4% inflation in the medium term as a core objective. Raising the reverse repo rate to 6% is a step towards ensuring that the liquidity management is in line with the neutral stance. However, the conditions for distortions in inflation are moving up and can push the figures by 1-1.5 per cent than the estimates of the RBI.

Possible upside risks are as follows:

1. Uncertainty surrounding the monsoon

2. Further rise in global commodities prices

3. Implementation of the HRA allowances of the 7th pay commission

4. One-off effects from the GST.

5. Increasing Debt-GDP ratio

Impact of GST: On the other hand, central government wants states to speed up the clearance of GST Bills. It is expected that 14 state legislatives will approve their respective state Goods & Services tax by mid-May. This will have a positive impact and brings a unified nationwide tax replacing a multi-layered set of taxes levied by central and state.

Geo-political risks: On the Global front, geo-political tensions have heightened with US attacking Syria, dropping massive air bomb in Afghanistan and conflict with North Korea. Included in these concerns is the potential that the unfolding situation could escalate into a nuclear conflict any time. Despite all these concerns, US markets are edging to its all-time highs. Analysts fear the situation is a tinderbox that could be set off by a small spark as they are at their highest level. And this can create a cascading effect on Indian markets as well.

Protectionist policy of US Government: Also the actions of Trump’s "Buy American, hire American and NEVER ever replace an American worker" is the new step to tighten the process of issuing H1B visas. Such a change will affect most of the Indian IT Industries. Also, the Indian rupee has appreciated considerably over the past two months. A continued trend of rupee appreciation could make Indian exports sector uncompetitive.

Despite the uncertain outlook in the GDP growth and other potential domestic and global geo-political risks, markets have soared and is hovering around its all-time high. Also RBI is remaining relatively hawkish on the inflation trajectory and is expected to stay on a longish pause. Overall, the markets are overvalued and this rising valuations lack support from fundamentals. Hence, we still continue to maintain 100% of your new investments into less-risky debt funds. We will patiently wait for the right time to move this money to equity.

MACRO ECONOMIC TRENDS

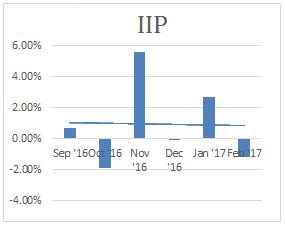

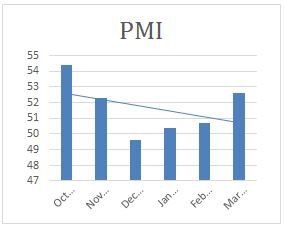

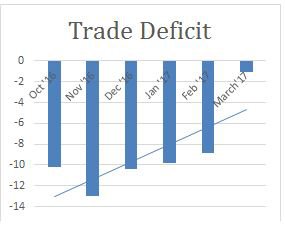

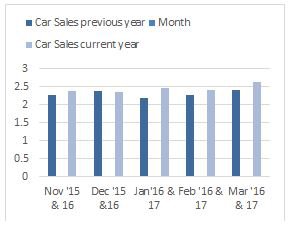

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trends:

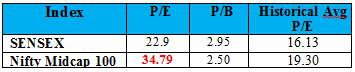

SENSEX VALUATION & CORPORATE EARNING TREND

The markets are over-valued right now and are not supported by the fundamentals.

*As on 24th Apr 2017; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

CORPORATE EARNINGS

MARKET OUTLOOK AND CURRENT DECISION AS PER FTM

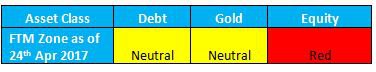

Most of the asset classes remained volatile in the month of Apr, 2017:

1. Debt/Bonds – Bond yield have increased by 6.78% in Apr.

2. Gold – Prices of Gold increased by 1.56% in the month of Apr.

3. Equity – Sensex increased by 1.731% in the month of Apr.

Current zones as per FTM:

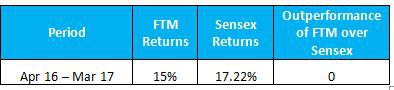

Returns comparison of FTM with Sensex over 1 year period

Changes made to your portfolio last month

We have made the following changes to your portfolio during the month of Mar & Apr:

Due to higher valuation in mid & small cap segment we continue to have zero exposure towards Mid Cap & Small Cap Funds in your portfolio. Also we continue to maintain 50% of equity exposure in your monthly SIP’s and remaining 50% will be in Debt funds with a zero exposure towards Gold.

Invest right, Invest consistently & Invest for long term horizon. Happy Investing!