Monthly FTM Update - Feb, 2017

No bad news is good news. This Budget can be described as neutral to being mildly positive. It has largely focused on increased public expenditure, especially in the rural areas and on infrastructure. At the same time, the Budget projects to limit the fiscal deficit at 3.2% of GDP. Though, markets gave a thumbs up to the Finance Minister for sticking to fiscal discipline, economist are of the view that the projections of 3.2% look unrealistic. Moreover, the impact of GST and the effect of Demonetization are not factored in the budget.

On tax reforms, the reduction of the corporate tax for SMEs with a turnover under Rs 50 crore to 25% is a welcome move. However, no progress has been made for reducing corporate tax for large companies. This is a deviation from the earlier laid roadmap to reduce corporate tax to 25% and make Indian companies globally competitive. Relief for individual tax payers with income between Rs2.5 and Rs5 lakh per annum are additional feel-good factors in the budget. Keeping long term capital gains tax unchanged is another good news which would have otherwise resulted in a negative impact. Sector-wise, the budget is positive for Real Estate, FMCG and Auto.

Meanwhile, RBI has held the repo rate unchanged at 6.25% as it appears to be quite worried about the possible inflationary pressures going forward. It has shifted the policy stance from “accommodative” to “neutral”. This change in stance signals that it is unlikely to cut rates anytime soon. Hence, this could likely be the end of rate cut cycle. This change has an impact on our choice of debt funds going forward. Long term debt funds have now become unattractive. Hence, we have stopped taking any fresh investments in long term debt funds.

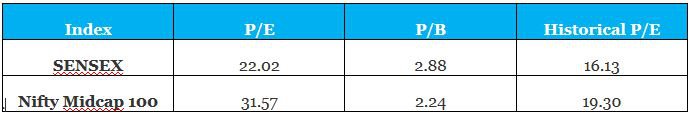

Overall, markets are looking unattractive and are commanding high valuations. Current upsurge in the market is not supported by the fundamentals and the economic parameters and the upside from this level can be limited but the downside would be steep. Historically, investments made at this level have not usually started paying off until 5 years or more. Statistically, averaged returns for Nifty investments made at a PE of 23 have been negative for 3 years. The five year returns are positive but have averaged at 6.9% which are not attractive.

Meanwhile, Indian stocks market have defied all logic and have moved up by 5% in the month of Jan. May be the market is expecting that our honorable Finance Minster can come up with a spectacular budget which may provide panacea to all the past ills. However, if the budget cannot satisfactorily balance the social and fiscal disciplines, there is a risk of the slowdown lasting longer than currently expected by the markets.

Potential risks on the markets are as follows:

1. Outcome of UP elections could be a trigger for correction in the market.

2.

Protectionist stance of Donald Trump, restrictions on H-1B visas can

adversely hit the lifeline of Indian tech firms and professionals in US.

3. Decision of US Fed on rate hike in its next meet to be held in the 3rd week of March.

Hence, we still continue to maintain 100% of your new investments into less-risky debt funds. We will patiently wait for the right time to move this money to equity.

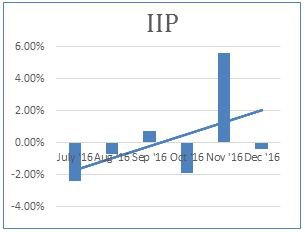

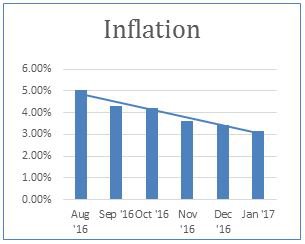

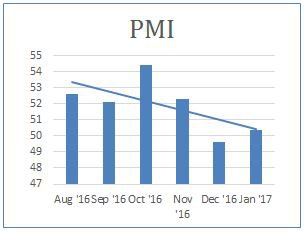

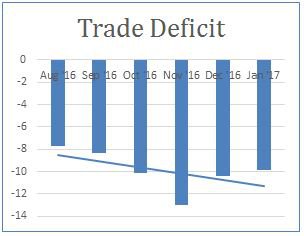

MACRO ECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macro-economic parameters and their respective trends:

SENSEX VALUATION TREND :

The markets are fairly valued right now post recent correction due to the demonetization.

*As on 25th Jan 2017; historical data of Sensex and Nifty Mid Cap 100 is of last 10 years.

CORPORATE EARNINGS TREND :

Corporate earnings are likely to fall further because of the effect of demonetization.

MARKET OUTLOOK AND CURRENT DECISION AS PER FTM :

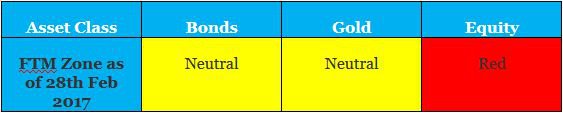

Most of the asset classes remained volatile in the month of Feb, 2017:

1. Bonds – Bond yield have moved up by 7.33% in Feb.

2. Gold – Prices of Gold increased by 2.88% in the month of Feb.

3. Equity – Sensex increased by 2.39% in the month of Feb.

CURRENT ZONE AS PER FTM:

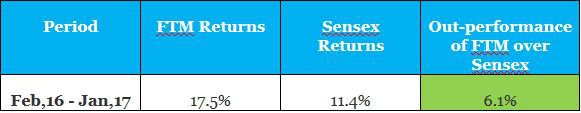

Returns comparison of FTM with Sensex over 1 year period :

This is a high outperformance as compared to Sensex. We were able to save most of your portfolio downside during last one year thus enabling a positive investment experience for you.

CHANGES MADE TO YOUR PORTFOLIO LAST MONTH :

We have not made any changes to your portfolio during the month of Jan & Feb:

Due to higher valuation in mid & small cap segment we continue to have zero exposure towards Mid Cap & Small Cap Funds in your portfolio. Also we continue to maintain 50% of equity exposure in your monthly SIP’s and remaining 50% will be in Debt funds with a zero exposure towards Gold.

Invest right, Invest consistently & Invest for long term horizon. Happy Investing!