Monthly FTM Update - May, 2016

‘Acche din’ for Indian markets seems to be around the corner. Market sentiment is bound to improve with expectations of a normal monsoon, revival in economic growth, rate cuts and the passing of the GST Bill in FY17. Global brokerages are becoming bullish about Indian markets. Citi and HSBC have upgraded India's rating and Sensex targets. Global financial major Morgan Stanley expects the Indian equity market to outperform the global markets over the next 12-18 months. It says that macros are now turning positive and has upgraded its outlook on India to ‘overweight’ from an ‘equal weight’ rating.

India is becoming a low-beta market within the emerging market basket. Its relative valuations and positioning amongst fund managers have come off from its record highs. A higher probability of Goods & Services Tax (GST) getting passed this year and expectations of normal monsoon are big catalysts for Indian equities. India is now one of the most attractive destinations in emerging market universe.

The overall economic growth is starting to show signs of a recovery, which should help earnings growth further. A good monsoon, ongoing recovery in capex and the push to consumption from the pay commission should add to economic growth."

MACRO-ECONOMIC TRENDS

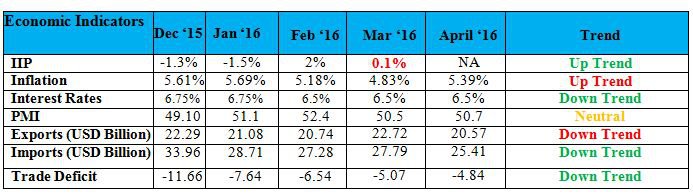

Inflation in India went up 5.39% y-o-y in April of 2016 which is higher than 4.83% in Mar 2016 and is above market expectations of 5%. Food Inflation has also reached a 3 month high.

Index of Industrial production (IIP) increased a meager 0.1% y-o-y in Mar 2016, slowing sharply from 2% rise in the previous month and is much lower than the market expectations of 2.5%. Exports declined 6.74% y-o-y in Apr 2016 and were valued at USD 20.57 billion as against USD 22.71 billion in Mar 2016. Imports reduced by 23.1% y-o-y and were valued at USD 25.41 billion as against USD 27.79 billion in Mar 2016.

Kindly refer to the below table for a summary of major macro-economic parameters and their respective trends:

Most of the economic parameters have shown gradual improvement during the last six to nine months. This shows that green shoots are coming up for the Indian economy.

SENSEX VALUATION & CORPORATE EARNING TREND

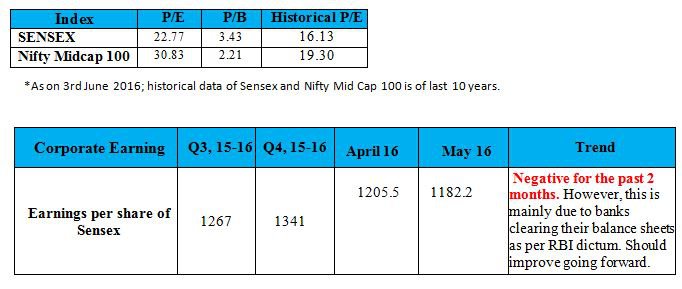

The markets are at reasonable value right now as the current P/E is close to the historical average P/E values.

Corporate

earnings have been rising for the last 6-9 months. However, it has

declined for the month of April & May. This is mainly because of

Banks reporting lower earnings to clean up their balance sheet (as per

RBI guidelines). However, ex-banks and ex-energy results have been

better. Most other sectors picked up subsequently and have registered

some profits as well.

Corporate

earnings have been rising for the last 6-9 months. However, it has

declined for the month of April & May. This is mainly because of

Banks reporting lower earnings to clean up their balance sheet (as per

RBI guidelines). However, ex-banks and ex-energy results have been

better. Most other sectors picked up subsequently and have registered

some profits as well.MARKET OUTLOOK AND CURRENT DECISION AS PER FTM

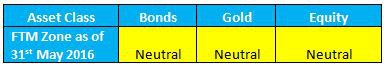

Most of the asset classes remained volatile in the month of Apr as well:

1. Bonds – Bond yield moved up by 4 basis points which resulted in a slight negative performance of G-Sec funds in the month.

2. Gold – Prices of Gold decreased by 5.7 % in the month of May.

3. Equity – Sensex gained by 4.3% in the month of May. Large Caps are trading at fair valuations but Midcaps look to be over-valued.

CURRENT ZONE AS PER FTM:

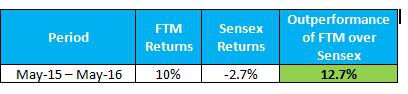

Returns comparison of FTM with Sensex over 1 year period

CHANGES MADE TO YOUR PORTFOLIO LAST MONTH :

There

was no change done to the existing funds during the month of May.

However, the strategy for deploying new investment has undergone the

following change:

1. Lumpsum Investment – 100% of the Lumpsum

investment is currently being invested in Liquid/Debt funds. We will

start moving this into equity when we get a buy signal on the FTM model.

2. SIP Investment - SIP investment continue to be 100% into equity

funds. This is invested in a combination of large caps, infrastructure

funds & mid / small cap funds.

At an overall level, we maintain 85% allocation to equities for the Growth-FTM portfolio. Going forward, we will wait for an opportune time to move this remaining 15% allocation to equities based on market movements and the signal from FTM.

1. Great Britain exiting from European Union

2. USA increasing the interest rate

3. Crude oil prices moving higher from here due to geo-political tensions.

We believe that these risks are short term in nature and do not pose a major risk to Indian growth story in the medium to long run. Hence, we are not looking to reduce exposure to equity at the moment. If markets correct, we will use the correction to further increase our exposure to equity from the current 85% to 100%.

Invest right, Invest consistently & Invest for long term horizon. Happy Investing!